When it comes to investing, there is an inordinate amount of information and opinion that is freely available. Most people have an opinion about the direction of the economy, markets, which asset classes or sectors will do best, and which specific securities will out perform. And most of these opinions are supported by valid reasoning and sometimes by informational “evidence”.

When it comes to investing, there is an inordinate amount of information and opinion that is freely available. Most people have an opinion about the direction of the economy, markets, which asset classes or sectors will do best, and which specific securities will out perform. And most of these opinions are supported by valid reasoning and sometimes by informational “evidence”.

But how helpful is this when investing?

To be a good investor over the long term you need to abide by some intelligent investment rules. Unfortunately, devising the rules is a much tougher act than coming up with forecasts and opinions. Following the rules is even tougher, especially when they may conflict with your forecasts and opinions.

The three golden rules:

- Never invest until you have an articulated, long term strategy with a clear set of rules for investing;

- Never disobey the rules;

- Never ignore the rules. To do so makes them obsolete. Replace them with revised and improved rules, but never ignore them.

While this advice may appear a little trite, it is amazing how many people invest without any long term strategy or rules. We think it’s because:

- It takes time and effort to devise a strategy and rules. Many people just couldn’t be bothered, don’t know where to start or don’t comprehend the lifetime cost of missing this step;

- They are used to things changing so quickly in their life and careers that committing to something long term is seen to have little value;

- Immediate opportunities are given much higher priority than long term strategic decisions. This is driven by the tendency to be distracted by issues that are urgent ahead of those that are important;

- A need to be in control and to control one’s own destiny. This drives a preference for decisions that offer more immediate evidence of success. Opportunism generally wins out over prudence in this battle.

A practical example

Common logic given for the shift from shares to cash throughout 2008 was that share values were falling and cash rates were better. This apparently rational reasoning was given more strength because it was strongly correlated with investors’ emotions at the time.

But how useful is this reactive reasoning in a strategic sense? Could you rely on it for managing your wealth over the long term?

Let’s have a look at the rules that flow from this reasoning:

- Follow the most recent trend.

- Sell assets that show poor recent past performance; and

- Buy assets that show good recent past performance.

That seems relatively clear but it’s not really specific enough. To be a practical set of rules, you need to specify the period that will be used to measure recent past performance. So, for the sake of adding clarity, let’s add a fourth rule:

- Recent past performance is determined by the return over the past 12 months.

You also need to consider how often you want to trade. If the past 12 month performance of cash and shares fluctuates month by month, then you’d be up for some sizeable trading costs. So, to avoid excessive trading, we’ll add two final rules:

- Hold each position for a minimum of 3 months; and

- Only implement decisions after 3 months of confirming past performance.

So, now you have some practical investing rules derived from some commonly accepted reasoning.

Intelligent investment rules

It’s not just a matter of following the rules, you also need an intelligent set of rules.

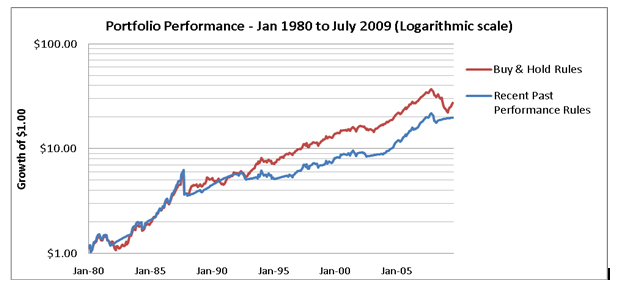

We tested the above rules, using the two asset classes of cash and Australian shares (S&P/ASX 300 Accum. Index), over a 29 year period. We compared this approach to a more traditional buy and hold approach. We constructed the comparison so that both exposures exhibited the the same level of risk for the tested period, (as determined by the level of volatility).

The results are shown in the graph and table below:

| Annualised Return | Growth of Wealth | Annualised Standard Deviation (Volatility) | |

| Recent Past Performance Rules | 10.6% | $19.73 | 14.76% |

| Buy & Hold Rules | 11.9% | $27.69 | 14.76% |

| Cost over 29 year period | -1.3% | -$7.97 | 0.00% |

The lifetime cost …

Over the 29 year period, you would have been 40% worse off by implementing the rules based on recent past performance. This loss of wealth has nothing to do with taking more or less risk; it comes down to the application of poor investment rules over a long period of time.

While reasoning and opinion are powerful and emotive drivers, they often lead to investment results that are far from optimal. Actions are generally driven by popularism and emotion.

It’s important not to let the plethora of information and opinion take precedence over the disciplined application of an intelligent investment strategy. Seasoned investors rarely credit their investment success to opportunism or striking it lucky. Rather, it’s about having a smart, long term strategy and sticking to it.

A good adviser can help you build a sound strategy that suits you. They will provide you with an intelligent set of rules (based on rigorous research) and they will help you to implement those rules over time.

The lifetime cost of ignoring the three golden rules can be substantial.