Which structure is best?

For our clients, there are predominantly four ways they hold their personal wealth. They are:

For our clients, there are predominantly four ways they hold their personal wealth. They are:

- Directly, either as an individual or jointly;

- In a private investment company;

- Through their family trust; and / or

- Via a self managed or public superannuation fund.

Which structure is best? It depends. But given our emphasis on focusing on the things you can control, the structure choice is one that needs serious consideration. There are a number of often competing factors to take into account, with taxation, asset protection and succession / estate planning usually most prominent. This article considers some of the issues.

After-tax, super looks the winner …

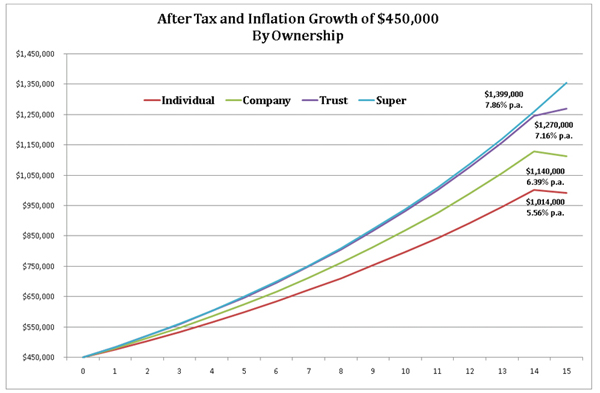

Superannuation is, generally, the most tax advantageous structure. To obtain a feel for this, we examined how much an initial $450,000[1] investment would grow over a 15 year period, assuming a 4% p.a. fully franked dividend, 6% p.a. growth and 3% p.a. inflation, for each ownership structure.

The following chart compares the growth paths, end investment values and after tax returns, all after inflation. Below the chart, we have outlined some key assumptions of the analysis.

Key assumptions:

- The individual is a top marginal rate taxpayer, currently 46.5% for ordinary income and 24.25% for long term capital gains

- The company pays tax at 30% on both income and capital gains

- It is assumed the family trust can distribute dividends to taxpayers with a marginal rate of 16.5% p.a., with a blended capital gains tax rate of 21.5%. Actual rates will depend on the tax status of beneficiaries, but the trust should be structured so a worst case outcome is the same as that for a company.

- The capital gain in the superannuation scenario is taken in the pension phase, with 0% tax applying.

- Dividends are re-invested on the same basis as the original investment.

After tax and inflation, the superannuation end period value is almost 38% more than had the investment been owned by an individual! The individual’s investment would have had to grow by 8.6% p.a., rather than 6%, to achieve the same end value.

Given the analysis, why wouldn’t you put everything into super? For a start, because it is so tax effective there are some fairly severe restrictions on how much can be accumulated in this environment.

And for anybody born since 30 June 1964, they cannot get their hands on their super until after age 60. A successful 40 year old, looking to retire at 50 and live off investment income, would need to ensure there was sufficient wealth accumulated outside super to at least bridge the 10 year gap.

Super also has a potential estate planning sting. If your super goes to non dependents on your death, a tax of 16.5% applies!

Tax wise, the family trust also looks an attractive wealth holding structure provided income is distributed to relatively low tax paying beneficiaries. In addition, it has asset protection and estate planning advantages.

The usual family trust structure allows wealth to be owned for the benefit of all family members rather than just the primary wealth generators, even though they may retain significant influence as to how wealth is distributed. This separation of ownership and control to some extent protects the family’s wealth from legal actions against individual beneficiaries.

More importantly for many clients, family trusts have significant estate planning and succession advantages. Unlike super, nothing necessarily needs to happen to trust assets in the event of the death of either or both parents.

As ownership is unaffected by death, there are no forced asset transfers with their potential adverse tax consequences. Trusts therefore provide a mechanism both for tax effective intergenerational transfer of family wealth and for ensuring wealth is retained within the family bloodline on the death of parents.

A company is rarely likely to be a desired structure for holding long term passive wealth. Its limited liability characteristic is more relevant to owning a business, as it restricts the potential loss of owners to the capital they contribute to the company. However, for a family with a very long term view of wealth accumulation and transfer, the unlimited life of a company may hold more appeal than the 80 year limit placed on trusts.

Finally, tax efficiency would appear to rule out direct ownership of long term wealth. But this is not necessarily the case if, for example, tax deductible debt is used to finance wealth accumulation.

Negative gearing by top marginal tax rate paying individuals can be a tax advantageous way to accumulate wealth. And in specific circumstances, negative gearing may provide the opportunity to transfer income from a high tax paying, investment owning individual to a low tax paying entity (e.g. non-working spouse, family trust) without incurring the additional risk normally associated with borrowing.

There is no one size fits all …

Although we have just skimmed the surface here, it should be clear that choice of wealth holding structure is not a straightforward decision.

You need to be very clear about what you are trying to achieve, long term. What is most important to you – tax effectiveness, asset protection, estate planning, flexibility, administrative ease and/or cost? Usually, a blend of structures is appropriate to balance these competing objectives.

Although the structure choice may be complex, the decision to obtain appropriate advice should be easy. If you are likely to accumulate meaningful wealth over your lifetime, comprehensive professional advice obtained as early as possible will, almost certainly, pay for itself many times over.

[1] $450,000 is the largest once-off after-tax amount that can be contributed to a superannuation fund by an individual over a three year period.

2 Comments. Leave new

[…] discussed in “Ownership of family wealth”, the amount of tax payable will be driven by who owns the investment. We look at four […]

[…] discussed in “Ownership of family wealth”, the amount of tax payable will be driven by who owns the investment. We look at four […]