Retirement readiness is low, both in Australia and internationally

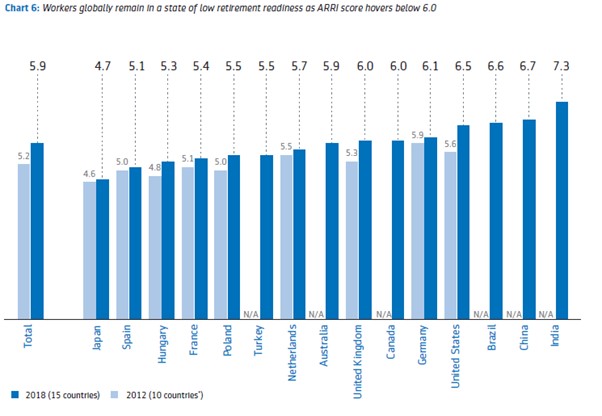

Recently, the Aegon Center for Longevity and Retirement released its 2018 international Retirement Readiness Survey, a survey it has conducted annually since 2012. For each of the 15 nations surveyed, an Aegon Retirement Readiness Index (ARRI”) is calculated, ranking retirement readiness on a scale from 0 to 10.

A high index score is between 8-10, a medium score between 6 and 7.9, and, a low score being less than six. The results for workers in the fifteen surveyed nations (with a comparison with 2012 results, where available) are shown below:

In summary, internationally, the retirement readiness of those surveyed is regarded as at the low end of the scale, with Australia scoring a mid-range 5.9 despite our often-lauded “three-legged” approach to retirement (i.e. social security, employee/self-funded superannuation and other personal savings).

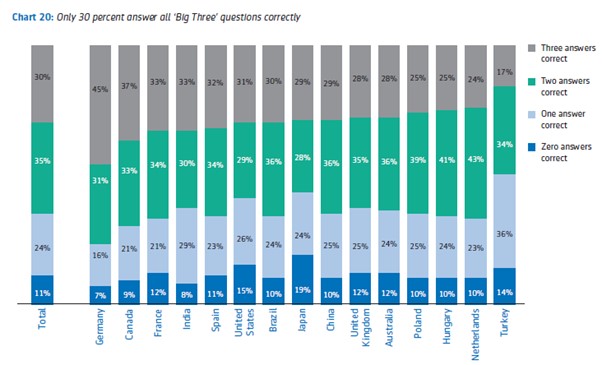

Inadequate financial literacy is identified as a significant factor contributing to this low level of retirement readiness. The survey report notes that:

To assess financial literacy internationally, the survey uses the “Big Three” financial literacy questions developed by Drs Annamaria Lusardi and Olivia Mitchell. The remainder of this article examines both these “Big Three” questions and some research findings based on the assumption that the responses to the questions serve as a reasonable proxy measure of financial literacy.

The “Big Three” financial literacy questions

The responses to the following three questions are often used as a basic, but well validated, guide to financial literacy:

- Suppose you had $100 in a savings account and the interest rate was 2% per year. After 5 years, how much do you think you would have in the account if you left the money to grow:

- more than $102;

- exactly $102;

- less than $102;

- do not know;

- refuse to answer.

- Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, would you be able to buy with the money in this account:

- more than today;

- exactly the same as today;

- less than today;

- do not know;

- refuse to answer.

- Do you think that the following statement is true or false? Buying a single company share usually provides a safer return than a managed share fund:

- true

- false

- do not know;

- refuse to answer[1].

The three questions test for a rudimentary understanding of some key financial concepts i.e.:

- investment return compounding, for Question 1;

- maintaining real purchasing power, for Question 2; and

- investment risk reduction through diversification, for Question 3.

Question 3 also indirectly tests whether respondents know what a company share (or company stock in the USA) and a managed share fund (or stock mutual fund in the USA) are. If you can’t confidently and correctly answer the three questions, you have almost no chance of adequately planning for a financially secure retirement or even be in a position to assess the veracity of any financial advice received.

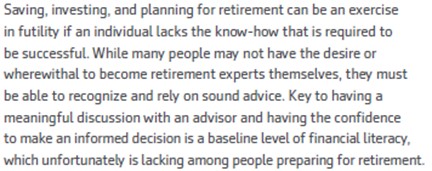

But as revealed in the chart below, the Retirement Readiness survey indicated that only about 30% of respondents answered all “Big Three” questions correctly:

For Australia, 28% answered all three correctly.

The chart below shows that the investment risk diversification question (i.e. Question 3) posed the greatest difficulty for respondents, in all countries:

Using the “Three Questions” responses as a measure of financial literacy, interesting research findings show, among other things, that:

- financial literacy varies with age, being low for young adults, rising through to about age 50 and then declining again with age. Unfortunately, peoples’ confidence in their financial decision making tends to increase with age, resulting in a potential gap between perceived and actual decision-making ability, leaving older people more exposed to unscrupulous practices;

- men tend to have higher levels of financial literacy than women. However, women show a greater awareness of their inadequacies when it comes to financial decision-making than do men;

- financial literacy is positively related to education. However, there remains wide variations in financial literacy among the more highly educated i.e. high cognitive ability does not imply high financial literacy; and

- those who are more financially literate are more likely to undertake financial planning and those who plan accumulate higher wealth than those who don’t. To date, there is no robust research to indicate that financially literate retirees are more successful in managing their financial resources in retirement although it would be surprising if they aren’t.

We all stand to bear the cost of low financial literacy

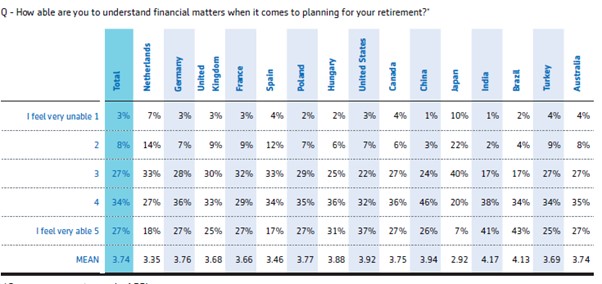

Unfortunately, there appears to be a vast gap between most people’s financial literacy (as measured by the “three questions”) and perception of their ability to make sound financial decisions. Although not measured directly, the Retirement Readiness Survey revealed that while only 30% of respondents could be regarded as having at least rudimentary financial literacy (i.e. answered all three questions correctly), 61% considered they were able to “understand financial matters when it comes to planning for your retirement” (i.e. rated themselves a 4 or 5, on a 5 point scale), as shown in the table below:

Low financial literacy, coupled with a lack of awareness, not only contributes to the revealed low level of retirement readiness but also to a high reluctance to seek financial advice and unwittingly imprudent investment risk taking, typified by the borrowing binge that fuelled the recent Melbourne and Sydney residential property booms.

Unfortunately, at some stage, the high cost of low financial literacy will almost certainly hurt us all.

[1] Correct answers: Question 1 – More than $102; Question 2 – Less than today; Question 3 – False.