Gold as a safe haven

The allure of Gold, as a viable long term investment option, has shot to new heights in the past five years. While this is perhaps understandable given its status as a safe haven, should it be a fundamental component of an investment portfolio?

There is a lot of misunderstanding about gold, its role in the financial system and use within an investment portfolio. We aim to address some of these misunderstandings.

A Brief History of Gold

Gold first became a transferable form of money around 560 B.C. when gold coins (stamped with a seal) were used by merchants to simplify trade. The coins were valued according to their inherent gold content. In 1066, Great Britain developed the British pound (symbolising a pound of sterling silver) and other units of currency based on their inherent metal value. During this period, gold (and silver) represented the main means of exchange (i.e. money).

In 1792, the US established a bimetallic standard which required that every monetary unit in the United States was backed by either gold or silver. In 1913, the US Federal Reserve was created and issued promissory notes (the present day version of money) that guaranteed the notes would be redeemed for gold on demand. Under these arrangements, the money used in circulation simply represented the gold (and silver) held at the bank.

Gold coins were still in circulation in 1934 when the US government ceased their minting (under the Gold Reserve Act) and began to take them out of circulation. Currency notes were still backed by gold until 1971, when the US abandoned the gold standard and ceased to directly back the currency with gold reserves.

The fact is there probably isn’t enough gold in the world to cater for the monetary requirements of today. As the world’s population has grown, it has outstripped the rate of growth of gold deposits. So, whether we like it or not we have had to accept a monetary system that is no longer backed directly by gold. Each unit of currency is now backed by the issuing central banks, which continue to hold some gold as part of their reserves.

Gold as an investment

Some arguments for buying gold include:

- Its price is well below it’s all time inflation adjusted high;

- Anyone holding US dollars will be at the victim’s end of a grand Ponzi scheme;

- I want to hold gold in case society falls apart and paper money no longer has any value;

- Paper money/fiat currency is losing value as we speak while gold and silver are holding value;

- Gold has many uses and does not oxidize or form compounds. It is forever;

- Gold is the safest thing I can purchase because it’s a physical metal I can actually store;

- I’ve lost faith in the financial system, so I’m going back to gold;

- Precious metals have no counter party risk. You don’t have to depend on the assurances of others that they have value. They have intrinsic value whereas paper does not;

- Physical gold has a limited supply. It has only one way to go. Up.

Is the price of gold determined by its value as a raw material? Is it determined by its value as a hedge against inflation? Is it determined by its value as a hedge against the implosion of the monetary system?

There are so many different reasons for buying gold. Those buying it as a raw material may be prepared to pay a very different price to those buying it to protect against the implosion of the financial system. It seems that anyone that holds gold uses multiple arguments to justify its value and their prognostications about its future value.

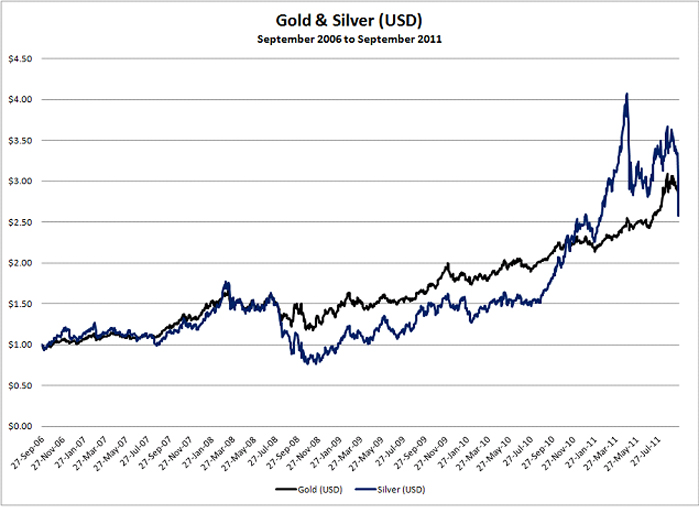

The chart below shows the movement in the (USD) price of gold and silver over the past 5 years. With the benefit of hindsight, the time to buy gold was five years ago, but few had the foresight (or luck) to get this right.

Regardless of gold’s recent price performance, an investor’s aim should be to build a diversified portfolio of assets that have a reliable method for generating an expected return. For example, you buy shares because you expect to be rewarded as a result of the profit growth of the underlying businesses over the long term.

By way of contrast, including an allocation to currency (say US dollars) in an investment portfolio adds a risk exposure that has no long term expected (real) return. While its price will fluctuate (often with extreme volatility), it does not meet the requirements of a true investment.

Gold is an asset that behaves more like a currency i.e. it too has no expected (real) return. It does not produce an income stream that can be valued. As Warren Buffett explains:

“You could take all the gold that’s ever been mined, and it would fill a cube 67 feet in each direction. For what that’s worth at current gold prices, you could buy all – not some – all of the farmland in the United States. Plus, you could buy 10 Exxon Mobils, plus have $1 trillion of walking-around money. Or you could have a big cube of metal. Which would you take? Which is going to produce more value?”

It’s important to note that most investors with a diversified portfolio already have an indirect exposure to gold (and other commodities) via exposure to the companies that mine and market the commodity. The share price of these companies will be affected by commodity prices.

For those justifying the addition of gold to a portfolio as a safe haven investment, you need to be mindful that gold behaves in a far more erratic fashion than traditional safe haven investments such as cash and bonds. Because it’s so difficult to value (having no expected return), its price behaviour can be quite volatile (as seen below).

Investing is about value, speculating is about price

Gold has proved to be a bright light amongst the gloom of the past 4 years. It has certainly attracted a lot of attention and there are many passionate supporters of the shining metal. Yet “investing” in gold is far from the safe haven investment many purport it to be. At a fundamental level, you need to decide if you’re an investor or a speculator before you jump on the gold bandwagon. You can make money trading gold, but be clear – it’s a speculators’ game.