A picture paints a thousand words…

Our recent article, “What is “The Value of Financial Planning”?”, introduced a number of key metrics that we monitor to assess clients’ progress toward meeting their financial objectives. Together with some additional important measures, a “Personal Financial Scorecard” can be created for each client.

This Scorecard succinctly captures financial progress and highlights strengths and weaknesses in a client’s current situation. It’s easy to see whether a client is on track to achieve their desired financial future and what steps they need to take to enhance their financial position.

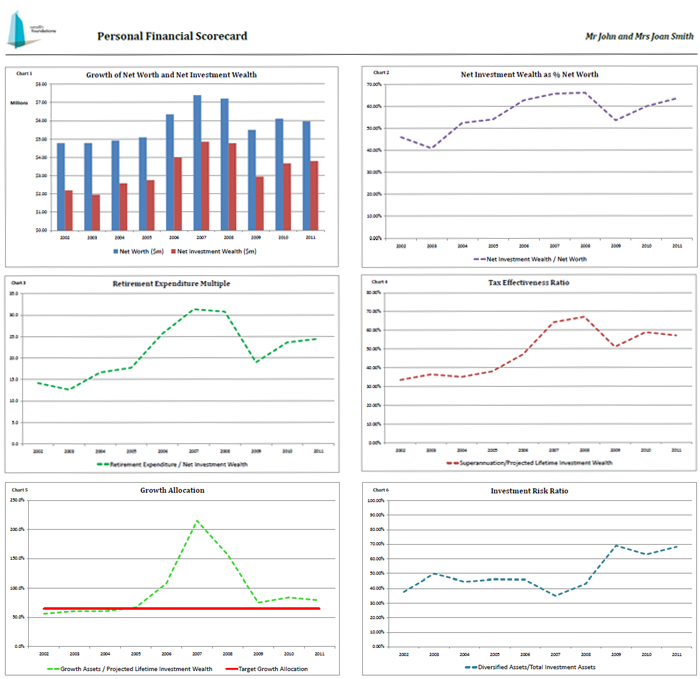

To illustrate the Scorecard’s power, we look at the situation of Mr and Mrs Smith, real clients whose names have been changed to preserve confidentiality. Their Scorecard is shown below:

The Smiths have been clients of a Wealth Foundations’ principal since 2002. They wish to be in a position of financial independence within the next two to three years, so they can choose whether and how they wish to continue to work.

What does the Smith’s Personal Financial Scorecard reveal?

Chart 1 shows the movement in the Smiths’ net worth and net investment wealth since 2002. Both measures were growing strongly to 2007, but were heavily impacted by the Global Financial Crisis. There has been some recovery since 2009.

While of interest, these absolute measures of wealth do not provide much insight as to whether the Smith’s are meeting their financial independence objectives. The remaining metrics tell us a lot more.

Chart 2 plots the ratio of net investment wealth to net worth, effectively measuring how much of the Smiths’ total wealth is dedicated to achieving financial independence, rather than being held as lifestyle assets. For most of our clients, we provide a guide of a minimum 55% as being consistent with financial independence. On this basis, the Smiths’ are looking pretty good.

Chart 3, the “Retirement Expenditure Multiple”, measures how many years of desired annual lifestyle expenditure current net investment wealth could support. As an indicator of financial independence, we like to see this ratio above 25 times to be reasonably confident that your desired financial future can be met. Again, on this measure, the Smiths are well placed.

Chart 4, the “Tax Effectiveness Ratio”, is a rough measure of the tax effectiveness of a client’s investment wealth. It divides the amount of funds held in the superannuation environment by Projected Lifetime Investment Wealth (i.e. net investment wealth plus an estimate of future savings).

Given the tax effectiveness of superannuation, a higher ratio implies a lower tax leakage. It therefore is consistent with increased likelihood of achieving financial independence. As a guide, we would like to see this ratio above 75% at retirement or for financial independence (although this will vary). The Smiths have only 58% of their investment wealth in the superannuation environment, suggesting an opportunity to increase the tax effectiveness of their financial affairs.

Chart 5, “Growth Allocation”, examines the consistency of the client’s growth asset allocation with their chosen target asset allocation (i.e. desired asset allocation when investment wealth is required to support lifestyle expenditure). It can be seen that in the run up to the GFC, the Smiths’ growth asset allocation went well above their target of 60% and then fell sharply.

This reflected Mr Smith’s exposure to his employer‘s share price, through awards of employee share options. Although he was prevented from effectively dealing in these options, with the benefit of hindsight more should have been done to partially offset the large overexposure to growth assets they created. Currently, while still a little overexposed to growth assets, the target asset allocation should easily be achieved by financial independence.

Finally, Chart 6, the “Investment Risk Ratio”, provides a measure of the investment portfolio’s level of diversification. Effective diversification (i.e. spreading investment holdings as broadly as cost effectively possible both within and across asset classes) reduces risk, without reducing expected return. The “Investment Risk Ratio” should be as high as possible and at least above 75% heading toward financial independence.

The Smiths’ low level of diversification in 2007 (at 35%), driven by the employee share options, increased their vulnerability to a market downturn. To further enhance the strength of their investment portfolio, we would like to see further steps taken to increase diversification from the current 68% level over the next couple of years.

In summary, the Scorecard shows that the Smiths are fairly well placed to achieve their desired financial future. However, there are clear opportunities to enhance the tax effectiveness and resilience of their investment portfolio.

Your Personal Financial Scorecard is personal

Everyone’s scorecard is different and needs to be individually interpreted in view of their particular circumstances and objectives. However, it provides each client with a succinct summary of where they are now, where they have come from and the direction they need to be heading.

While the Scorecard does not guarantee personal financial success, its implicit and increasingly more explicit application over many years has helped our clients focus on the controllable drivers of wealth, despite volatile and difficult investment markets. As evidence of the benefits of this approach, our free eBook, “The Value of Financial Planning”, documents the changes in the financial situations of ten clients who agreed to share their progress over the time they have been working with a Wealth Foundations’ principal.

The obvious question for readers is: “Do you know what your Personal Financial Scorecard looks like?” One thing for certain is that you are unlikely to get much idea of your “financial score” by casually comparing your lifestyle and financial behaviours with those of colleagues and friends. In addition to having different circumstances and expectations, they may have less idea of their score than you do of yours!

1 Comment. Leave new

[…] a minimum indicative benchmark measure we regard as consistent with financial independence (see “How does your “Personal Financial Scorecard” look?” for further […]