We appreciate investors are faced with some difficult decisions, particularly with cash and fixed interest investments expected to offer low returns for some time. However, we encourage them to view their portfolio as a whole (rather than the sum of its parts) and focus on the after-tax, inflation-adjusted return.

Our rough rule of thumb for financial independence is to achieve a retirement expenditure multiple of 25 times – this is based on achieving an after-tax, inflation-adjusted return of 4% per annum.

Has the achievement of this outcome become more difficult as a result of the decline in expected returns?

Many may think it has, however the decline in inflation provides an equal (and potentially greater) offsetting benefit.

Consider an investor with an average tax rate of 20% seeking to achieve a 4% after-tax, inflation-adjusted return in an environment with a 4% inflation rate. They would need to achieve a return before tax and inflation of 10% per annum to reach this goal.

Imagine inflation falls by 3% (from 4% to 1%). Presumably, our investor’s required return before tax and inflation will also fall by 3% to 7% per annum to achieve their goal. However, this is not the case. In fact, our investor’s hurdle rate (before tax and inflation) falls by 3.75% to 6.25% per annum.

Where did this additional 0.75% per annum benefit come from?

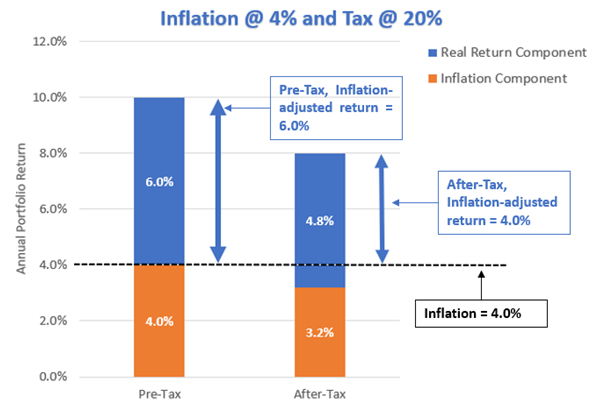

It all relates to the fact that tax is levied on the inflation component of our return. The chart below provides a summary of this impact.

The chart shows our investor’s total return before tax and inflation at 10% per annum. This is broken into two components – a real (or inflation-adjusted) return component and an inflation component.

The investor pays tax of 20% on both components. As a result, the real return component reduces by 1.2% and inflation component by 0.8%. Unfortunately, our investor needs to maintain an after-tax inflation component of 4.0% and therefore must recoup the 0.8% tax paid on the inflation component from the after-tax, real return component.

The pre-tax real return component (of 6.0%) translates to a 4.0% after-tax real return outcome. The ratio between the pre-tax real return and the after-tax real return target is 1.5 times (i.e. 6.0% ÷ 4.0%), implying that tax “eats” one third of the real return component.

As the average tax rate declines towards 0%, the ratio between the pre-tax real return and the 4% after-tax real return target will converge to 1.0 times.

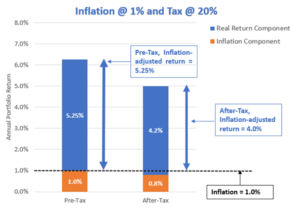

This relationship is not just tax, inflation also plays a part. The chart below shows the situation under a 1% inflation environment.

As highlighted earlier, the investor requires a return of 6.25% per annum before tax and inflation under this environment.

In this case, the ratio between the pre-tax real return and the after-tax real return target has declined to 1.31 times (i.e. 5.25% ÷ 4.00%) from the prior 1.5 times. Even though the investor’s average tax rate remains unchanged, tax will now “eat” less than one quarter of the real return component.

This is because there is less tax payable on the inflation component (because it has fallen by 3%). This translates into a reduction in the required pre-tax real return hurdle rate – in this case, by 0.75% per annum over and above the 3% fall in inflation.

So, declining inflation helps to reduce investors tax impost and thereby makes the ultimate after-tax, inflation-adjusted return goal more achievable (despite lower returns).

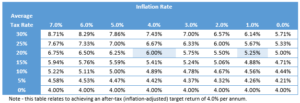

The table below provides a summary of the pre-tax (inflation-adjusted) return component that is required to achieve a 4% after-tax (inflation-adjusted) target return based on varying inflation and tax rates. The example we referred to is highlighted showing the pre-tax (inflation-adjusted) return declining from 6.00% to 5.25% per annum as the inflation rate shifts from 4.0% to 1.0%.

The table highlights that, in a declining inflation environment, the pre-tax real return hurdle rate for investors (except those paying no tax) will decline by more than the decline in inflation. This makes the after-tax, inflation-adjusted return target more achievable.

We appreciate the expectation of a low return environment may create some anxiety, however we encourage a focus on what really matters – your after-tax, inflation-adjusted return – and a recognition that low inflation provides a helpful offset in this low return environment.