Invest in international shares for reduced risk …

Invest in international shares for reduced risk …

Many individual investors, particularly do-it-yourselfers, do not hold international shares in their investment portfolios. Why would you, they ask – returns have been poor for almost a decade now.

But the argument for allocating part of your share portfolio to international shares is not based on returns. Returns cannot be reliably predicted – past performance does not provide a guide to future performance.

As part of your portfolio, international shares offer the prospect to reduce risk without affecting expected return i.e. increasing your risk adjusted rate of return. This is partly the “don’t put all your eggs in one basket” idea. But also because global share markets do not go up and down in tandem with the Australian market, international shares can reduce the variability of your share portfolio’s returns.

The risk reduction effect, or diversification benefit, is sometimes called “the only free lunch in finance”. But if this argument for holding international shares is accepted, how much should be allocated to them?

The purist financial economists say that you should not make a distinction between domestic and international shares. They suggest your portfolio should be approximately market weighted, with country weights dependent on the size of a country’s share market relative to all share markets i.e. the world market.

On this basis, an Australian share investor would hold only about 2% of their portfolio in Australian companies, more than 50% in North American companies, roughly 20% in European companies, 9% in UK companies and about 10% in Japanese companies.

The reality of “home bias”

But we do not know any Australian share investor that puts the theory into practice. Even large institutional investors show a strong “home bias”. Their weighting to Australian shares is far in excess of our share market’s proportion of global share markets.

And this “home bias” is seen in most countries. Is this behavior irrational?

Yes, if it is motivated by the view that the familiar will outperform the unfamiliar. Psychological research confirms this “familiarity” bias, but reality does not support its validity. It is simply impossible for everybody’s home share market to outperform!

But while a “home market” preference may not make sense to financial economists, there are at least two behavioural reasons why investors do not accept the purist view.

The first is that most investors do not want to be too different from other investors that they compare themselves with, particularly if the difference could result in an adverse outcome. They are prepared to accept increased risk of loss and volatility for lower “tracking error”.

A related second reason is that unless investors are “global citizens”, they want their share portfolio to help finance their home country lifestyle. They believe this is more likely to be achieved if their portfolio holds mostly companies that produce the home country’s goods and services.

Economists would argue with this logic, particularly over the long term. But investors are more concerned to act in a way they think will maintain their short to medium spending power in the home country.

Accepting reality …

The financial economists may be right in theory. In practice, the argument just doesn’t feel right for most people. Is there a basis for reasonable compromise?

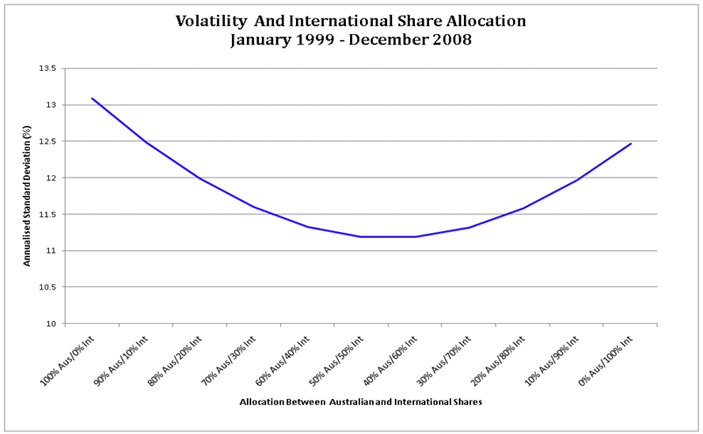

The chart below shows the annual volatility (measured by a statistical measure of variability called standard deviation) of various combinations of Australian and international shares for the 10 year period, December 1998 – December 2008.

Explanation:

Australian shares (“Aus”) represented by S&P/ASX500 Accumulation Index

International shares (“Int”) represented by MSCI World Index (net of dividends)

Based on monthly rebalancing; standard deviation calculated on a monthly basis and annualised

It shows that as the international share component increases from 0% to about 40%, volatility reduces. Beyond 40%, there is little gain from further increases in the allocation to international shares .

Pragmatism rules …

Based on this analysis, a pragmatic approach suggests that share investors hold at least 30-40% of their allocation in international shares. This will provide some diversification benefits and is likely to reduce the overall volatility of share portfolios.

But in following this approach, investors should not delude themselves that they are maximising their expected risk adjusted return. Why?

Because it implies that they continue to hold 60-70% of their share portfolio in Australian shares. However you look at it, this is a big bet on a market that only represents about 2% of world share markets!

At least investors are making the decision with their eyes wide open.

1 Comment. Leave new

Excellent site, keep up the good work. I read a lot of blogs on a daily basis and for the most part, people lack substance but, I just wanted to make a quick comment to say I’m glad I found your blog. Thanks,

A definite great read…

-Bill-Bartmann