How can I protect against a loss of investment capital?

How can I protect against a loss of investment capital?

Since the GFC there’s been a lot of talk about ways to protect investment portfolios from the types of falls experienced in late 2008. There are two ways to overcome this risk: portfolio diversification or portfolio insurance (or hedging). We’ve compared the two in this article.

Portfolio diversification involves the practice of combining investments with low correlation to reduce the overall volatility of the portfolio. This invariably means holding some “losers” amongst your “winners”; a practice that often doesn’t sit well with a “winner’s” mindset.

The alternative to diversification is portfolio insurance, or hedging. Hedging seeks to reduce downside risk via the use of derivatives. This approach seeks to neutralise negative market events by taking out a form of insurance with a third party. While it is often sold on the basis that it offers the upside without the downside risks, there is the ongoing insurance cost to consider.

A challenge to implementing the diversification approach is that it generally requires the investor to have a good temperament. Hedging, on the other hand, panders to those who find it difficult to show the patience, discipline and humility that aids successful investing. It offers extra “benefits” that diversification doesn’t – the upside without the downside risk, lots of flexibility to change your mind and a feeling of being a smart investor. But these attributes should come with a clear warning: they don’t necessarily deliver on the promise.

Diversification has been a proven technique for managing portfolios for decades and is considered an efficient (and effective) tool for portfolio risk management. Some may disagree, citing the failure of diversification during the GFC when the movement in growth asset classes was highly correlated. But, in our opinion, diversification (along with an intelligent capital management strategy) offers the better alternative to portfolio insurance for a number of reasons:

- It is cheaper than hedging;

- It does not involve the use of derivatives that add counterparty and basis risks;

- It presumes a more holistic and long term approach that provides significant efficiencies relative to hedging strategies, which generally tend to isolate and segregate risk; and

- It’s less expensive to amend or unwind.

When should portfolio insurance be considered for managing risk?

In our view, the decision to insure a risk is a long term consideration. You either choose to insure against a risk or you choose to live with it. Insurance is not something you choose to have one month and not the next. For example, it’s a little absurd to think that you’d consider stopping your insurance against fire and theft this month because you’ve got a feeling there’s a lower likelihood of it occurring. And, then reinstating it next month because you feel the likelihood has increased. We simply don’t “trade” our insurance policies. You choose to either buy insurance or not based on the odds of the risk eventuating (and, of course, its severity).

Unfortunately, when it comes to investment portfolio insurance decisions, many investors seem to want to have insurance one moment and not the next.

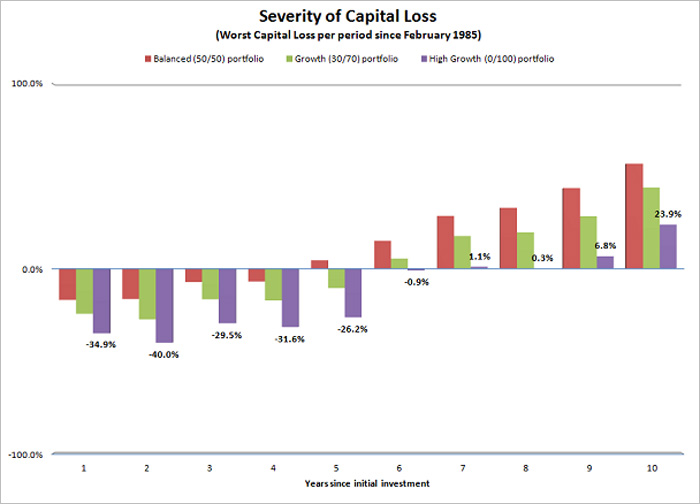

To assess the risks involved with investing, we looked at the behaviour of three typical investment portfolios (Balanced [1], Growth [2] and High Growth [3]. We aimed to measure two key risks:

- the severity of the risk (i.e. how much capital you could lose), and

- the likelihood of not getting your initial investment back.

To assess the severity of the risk, we calculated the worst capital loss for each portfolio over varying time horizons. The results are shown in the chart below:

This historical data indicates the severity of the risk is moderate to minor for the longer investment horizons. For periods of 5 years and shorter, it can be more severe. However, insurance is not necessarily the solution to coping with a concern about short term volatility. Lowering risk exposure is a much more sensible alternative.

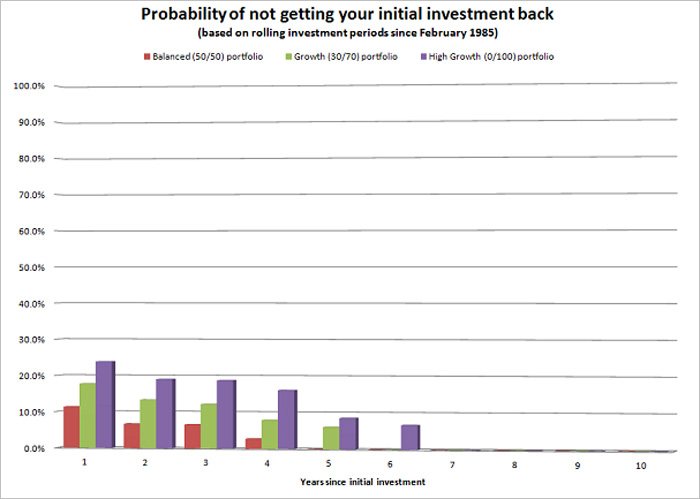

With respect to likelihood, we determined the number of periods for each portfolio structure where the end portfolio value was at or above the initial investment amount. We then compared this to the total number of periods to calculate the probability.

The assessment was based on rolling investment periods using historical data since February 1985. The results are shown in the chart below:

It reveals that the likelihood of not getting your initial investment back over longer time horizons (> 5 years) is remote, implying that long term portfolio insurance simply adds cost for little to no benefit.

Over shorter investment time horizons (i.e. <5 years) the likelihood is pretty low and is more easily addressed by reducing your risk exposure (e.g. shifting from a growth to a balanced portfolio).

The historical performances of the investment portfolios indicate to us that portfolio protection insurance is not a cost effective way to manage investment risk. The cost of the protection can amount to around 6% of your capital over 5 years. In the worse case scenarios, that means the best outcome you can expect to get back is 94% of your initial investment.

Be wary of investment options that promise too much

Recently, we’ve noticed an increase in the portfolio protection products available for advisers to use in assisting their clients. Ironically, many of these tools became available in late 2012 (just prior to the recent market uplift). These tools allow you to protect your portfolio exposure over periods from 5 to 10 years. While no guarantee is provided, they offer a minimum outcome equivalent to your initial investment (before protection costs).

Perhaps we’re a little cynical, but we suspect that much of the innovation in funds management is centered around the development of engineered products that pander to immature investor behaviours. Just as the health industry is littered with products that promise you a “Hollywood look” without the need to exercise or change your eating habits, the investment industry also offers apparently painless solutions.

There are much more effective and efficient ways to manage your money. It may require you to overcome some detrimental investment habits, but in our view its far better to learn to deal with your emotions than pander to them by purchasing an engineered investment structure that, at least based on historical evidence, is highly likely to over promise and under deliver.

[1] Balanced portfolio comprises a portfolio of 50% exposure to defensive assets and 50% exposure to growth assets.

[2] Growth portfolio comprises a portfolio of 30% exposure to defensive assets and 70% exposure to growth assets.

[3] High Growth portfolio comprises a portfolio of 0% exposure to defensive assets and 100% exposure to growth assets.

2 Comments. Leave new

Are there mutual funds or ETFs that provide ‘typical investors’ with hedging or portfolio insurance? Or are hedging/portfolio insurance only possible with exotic investment vehicles? Thanks!

Most of these recent products are aimed at the consumer market. You should notice an increase in the advertising of these products over the next few months. They’re stand alone products that are added to existing portfolios. Lots of flexibility … but also lots of additional cost.