Past investment performance is seductive

It’s a difficult task being a good investor. You’re keen to celebrate when your investments perform well, yet you’re also looking for opportunities to acquire new exposure when prices are low. Unfortunately, good investment performance and low prices rarely go hand in hand. This creates an ongoing dilemma for wealth accumulators – do you want your investments to go up or down in the short term?

Many investors are reluctant to invest new money in asset classes that show poor recent performance, instead preferring to increase their exposure to the better performing asset classes. This seems to be a logical thought process, but is it conducive to the achievement of your wealth accumulation plans?

We aim to challenge this thinking by testing a strategy that relies upon recent past performance to influence investment decisions.

Past performance as an investment strategy

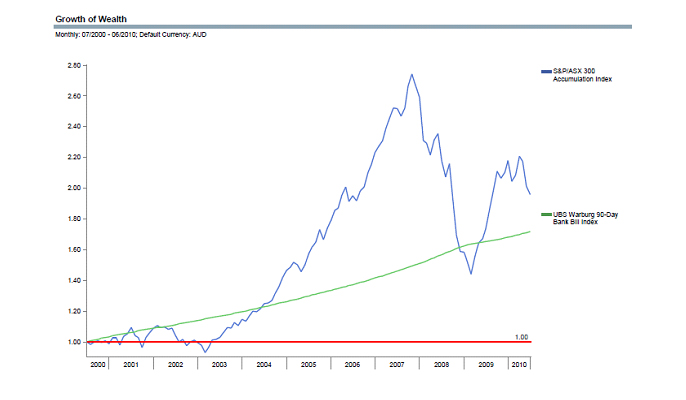

In order to test the benefit of making investment decisions based on recent past performance, we chose to look at the returns of the Australian Share Market relative to Cash over the past 10 years (to 30 June 2010) . This is shown in the chart below.

To determine the relative performance of Shares to Cash, we calculated the difference in return between the two (known as the Share Premium). This is shown in the graph below.

Over the entire period, there was a positive share premium, but it fluctuated considerably.

We assumed an investor had $1 million available to purchase share market risk exposure at any month during the 10 year period. We then calculated the exposure that could be purchased at each month by dividing the $1 million by the (share premium) price at that time. For example, had they invested in March 2003 when the price had fallen to $0.81, their $1 million would have purchased 1.23M units of exposure.

The number of units of share exposure that could be purchased is calculated the same way for every month, for a total of 120 months. A Final Portfolio Value for each monthly purchase is then determined by multiplying the units purchased by the share price per unit at the end of the period (i.e. 30 June 2010).

For each of the 120 months, we also determined the performance of shares for the prior 12 month period.

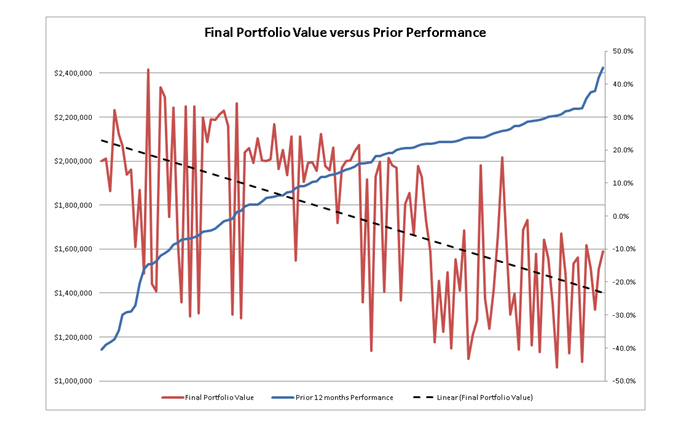

We then compared the 120 Final Portfolio Values (Values shown on left axis) with their associated share performance of the previous 12 months, ranked from worst to best (performance shown on right axis):

The upward sloping blue line shows the past performance of shares. The worst 12 month performance was -40.5% and the best was +45.1%.

The red line represents the Final Portfolio Values that correspond with each prior performance figure. For example, the investor who invested in the month after the worst prior performance (-40.5%) would have a portfolio valued at $2.0M in June 2010. The investor who invested in the month after the best prior performance (+45.1%) would have a portfolio valued at $1.6M.

The dashed trend line of Final Portfolio Values is downward sloping indicating that Final Portfolio Values decrease when prior performance is higher.

When we segmented each of the months into quartiles according to prior performance, the following was revealed:

| Share Performance by Quartile | Recent Past Share Performance | Share Premium Buy In Price | Units of Exposure Purchased | Final Portfolio Value as at 30 June 2010 |

Worst 30 Months | -16.3% | $1.05 | 991,020 | $1,941,706 |

2nd Worst 30 Months | 7.5% | $1.02 | 999,848 | $1,959,003 |

2nd Best 30 Months | 20.5% | $1.26 | 824,695 | $1,615,825 |

Best 30 Months | 30.3% | $1.37 | 749,760 | $1,469,004 |

Average – 120 Months | 10.5% | $1.17 | 891,331 | $1,746,385 |

The figures shown reflect the average across each quartile.

The 30 months that corresponded with the worst Share performance for the prior 12 months had an average prior performance of -16.3%. The average buy in price for those months was $1.05 and the average market exposure purchased was 991,020 units. These units were worth $1.94M in June 2010.

At least for the period examined, the analysis suggests that buying share market exposure following recent superior market performance was likely to be an inferior strategy to buying following poorer performance i.e. the exact opposite to what many investors actually do.

Does this help us with any sort of predictive strategy? Probably not, as we will never know in advance which are the worst performing months and which are the best. However, waiting for confirmation of good performance prior to purchasing appears to be a poor strategy.

Is past performance important for investors?

You could imply from the above that past performance is of no use at all. Yet, it’s important to know that your investment strategy is performing according to expectations. In this sense, feedback on the relative performance of your strategy is valuable. We use a method that compares the return of the strategy to a market based portfolio with the same risk exposures. In this “apples versus apples” comparison you get to see how you have performed versus the market.

Good investors don’t rely on picking the tops and bottoms of markets. Nor do they invest only when they can justify the purchase by reference to past performance. Over reliance of prior performance may not be good for your overall wealth outcome – it may lead to a buy high, sell low strategy that can substantially affect the quality of your retirement lifestyle.

The aim of every investor should be to purchase as much market exposure as they can, consistent with their pre-determined capital allocation to risky assets. Improving your purchasing power has little to do with recent past performance.