Surely, it’s better to defer paying tax

It is not unusual for clients to have sizeable exposures to individual shares that they have held for long periods of time. We generally would encourage them to sell these holdings and invest the proceeds into highly diversified investments to reduce the risk of their portfolios, without a loss of expected return.

However, we often experience considerable resistance to this advice if sale of the shares would result in the crystallisation of significant capital gains and the obligation to pay capital gains tax. Clients reasonably ask “What’s the point of taking an unnecessary action that brings forward the payment of tax?”

The reality of many of these situations is that they offer the opportunity to employ the funds in a more tax effective manner. As a result, the client may end up better off in a cash flow sense as well as having a more highly diversified investment portfolio.

Superannuation is a super friendly tax environment

To illustrate the potential to be better off in a cash flow sense, we assume that a client (personally) holds a share that currently has an unrealised capital gain. It is also assumed that the client is on the top marginal tax rate (i.e. 46.5%) to age 60, after which the marginal tax rate falls to 31.5%. The alternatives considered are:

- Hold on to the share for 20 years and then sell; or

- sell now, pay the capital gains tax, and place the residual funds into superannuation as a non-concessional or after-tax contribution. The funds are assumed to be invested in a diversified share fund, with the same expected return characteristics as the individual share [1]. At age 60, the client transitions to the pension phase resulting in zero tax on both ongoing distributions and capital gains on any sale.

A decision to sell now will result in an immediate cash outflow in the form of capital gains tax, the amount depending on the size of the capital gain. But for the next 20 years the more tax effective superannuation environment will result in significantly higher after tax returns on the diversified investment held inside superannuation than on the share held outside superannuation.

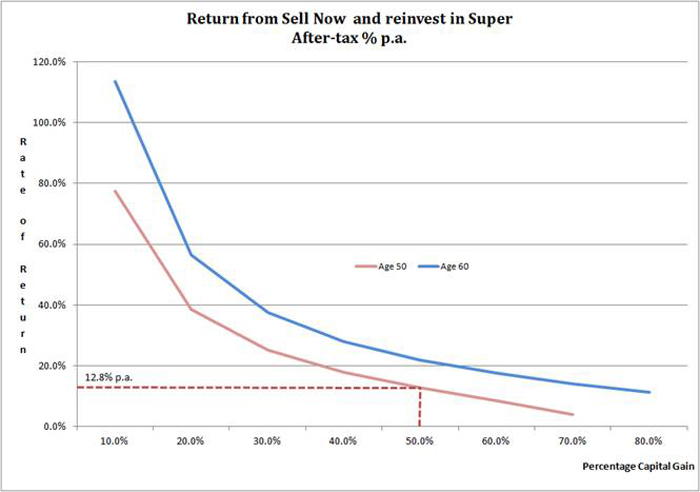

The upfront tax payment can be thought of as an investment, with the ongoing difference in cash flows between the alternatives over the 20 years providing the return on that investment. The chart below shows that rate of return for various sizes of capital gain (as a percentage of the share’s current value) for the client under two scenarios i.e. a current age of 50 and a current age of 60.

It reveals that when the client is aged 50, there is a positive return from selling and reinvesting into super provided the capital gain is less than about 75% of the share’s value. For example, if the share comprises 50% capital gain (i.e. a share worth $100 that consists of $50 of capital gain would result in an $11.63 capital gains tax outflow on sale), the future cash flow benefit would provide an after-tax return of 12.8% p.a. on the tax outlay.

At lower levels of capital gain, the returns are significant. As the capital gain increases, the net outflow for tax payments means there are less funds available to benefit from the favourable superannuation tax environment.

There is a higher return at all levels of capital gain at age 60 compared with age 50 and a positive return, regardless of the size of the capital gain. The immediate move to a zero tax environment in super more than offsets the negative effect on return of a large upfront capital gains tax payment.

Tax should not drive investment decisions

So there is potential to have your “cake and eat it” i.e. a superior cash flow and a better diversified portfolio. However, each situation needs to be looked at based on individual circumstances and the best assumptions that can be made at the time.

But as a generalisation, we would always caution against letting tax concerns outweigh sound investment principles. While tax implications should always be considered, they should not drive investment decisions.

Large concentrated share holdings add significantly to portfolio risk and, over extended periods of time, are expected to underperform the total share market. Individual shares may fall heavily (and, potentially, to zero), even in markets that are buoyant.

As the past four years have shown, a reluctance to diversify and balance portfolios because of capital gains tax implications can result in significant wealth erosion and severely jeopardise financial plans. We do admit, however, that it takes a very disciplined investor to deliberately create a tax obligation in the quest for increased diversification. Potential cash flow benefits may make that decision somewhat easier.

[1] The return characteristics of the share are assumed to be a 4% p.a., fully franked dividend, with growth of 5% p.a.