Self managed super funds to come under increased scrutiny

Self managed super funds to come under increased scrutiny

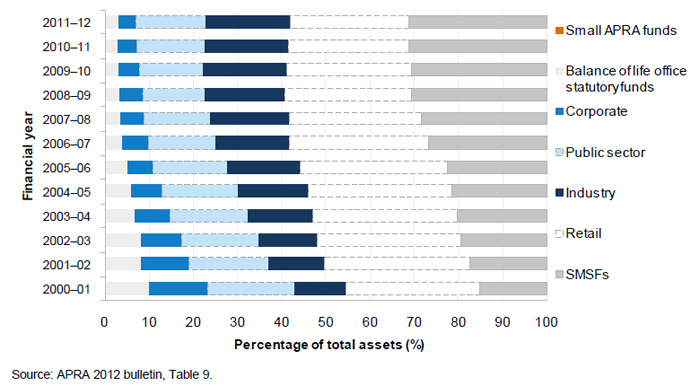

Self managed super funds (SMSFs) are being set up at a faster rate than ever before. They’re now the fastest growing sector of the superannuation industry and account for around one third of total superannuation assets in Australia (see chart below).

Proportion of total assets by superannuation fund type

As a result of this growth regulators are taking a keener interest in the SMSF sector, which is likely to come under much more scrutiny than in the past. ASIC recently completed a review of the sector and identified “room for improvement.”

In the Review, ASIC noted the primary drivers for setting up an SMSF were:

- a desire for control over investments; and

- a wish to lower costs.

The latter motivation often leads to “corner cutting” that results in important responsibilities being neglected. The ASIC Review noted:

“It is therefore essential that, before making the decision to set up an SMSF, investors have access, through gatekeepers, to good quality, tailored advice that is not conflicted. At the very least, investors need to understand the time, resources, compliance obligations and risks associated with a do-it-yourself (DIY) superannuation option before deciding to move their superannuation savings out of an APRA-regulated environment.”

It is our contention that many of the ongoing roles and responsibilities of managing a SMSF are being overlooked, with most attention focused on the establishment of new funds and making investments.

What are the key SMSF roles and responsibilities

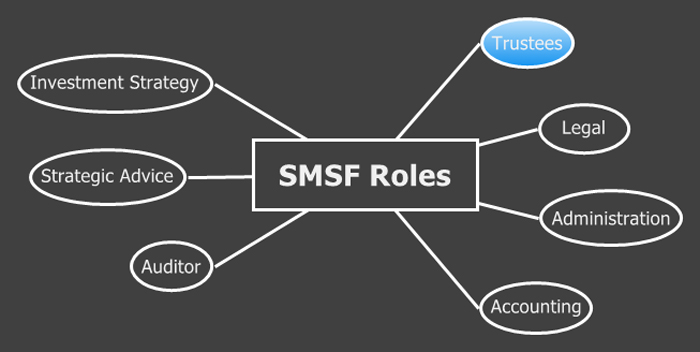

There are a number of important ongoing roles that every trustee should be aware of. Some of them are illustrated in the chart below, together with a relevant explanation:

Trustees

Ultimately, the trustee/s, are responsible for ensuring the fund is complying. They are still responsible for the fund, even when they outsource functions.

Legal

Each fund has a trust deed and all actions need to comply with the terms of the trust deed. Some trust deeds are quite prescriptive. It’s insufficient to assume that just because the law allows a particular action that the trust deed will also allow it. Accordingly, trustees need to ensure that they (or someone else) are confirming that actions not only comply with the law but also comply with the terms of the trust deed.

Trust deeds should be reviewed regularly to ensure their relevance with current legislation. We have seen trust deeds that have not been reviewed since their establishment many years ago, creating a risk for the trustee.

Administration

Each fund has administrative tasks that must be met, such as lodging the annual return on time, maintaining records relating to decisions affecting the fund (e.g. commencing a pension, adding a member etc.) and ensuring the fund’s records are kept up-to-date. Minutes of meetings, changes and appointments of trustees, declarations, and copies of all reports given to members must be kept for at least for ten (10) years.

Accounting

Annual financial statements must be prepared and lodged with the ATO. These will include information about all contributions made to the fund and all benefits taken from the fund. You need to ensure that all benefits of the fund are correctly allocated to each member and that any segregation of assets is managed appropriately.

Auditing

You need to ensure that an approved auditor is appointed each year to perform a financial and compliance audit of your fund’s operations before the annual return is lodged.

Strategic Advice

Most post 65 year old superannuants can withdraw all of their benefits tax free. Doing so, however, isn’t necessarily the smartest idea. There’s a big difference between knowing what you can do and knowing what you should do. Strategic advice aims to address the latter.

We find a lot of trustees use their accountant/adviser to simply seek advice on what they can and can’t do. While this information is obviously important, it’s a very different issue to knowing what you should do. In our experience, advice that’s more strategic in nature (as opposed to purely informational) will enhance the value to be had from a SMSF.

Investment Strategy

Trustees have an obligation to ensure the SMSF’s money is invested appropriately and for the sole purpose of saving for retirement. You therefore need to possess a reasonable level of financial literacy (i.e. skills and expertise) to understand the investment decisions you are making on behalf of the members the fund.

Do you have the necessary skills and expertise to make the investment decisions for your SMSF? Do you understand the benefits of investment diversification and the risks associated with investing all your superannuation in a single asset class? Is your investment strategy likely to deliver the returns required to adequately fund your retirement?

The SMSF trustee/s can’t outsource responsibility

SMSFs are potentially valuable financial structures that offer some particular advantages compared with alternative superannuation arrangements. However, they also come with additional responsibilities and obligations.

As a SMSF trustee, you need to be aware of these roles and responsibilities. While you may outsource roles, you can’t outsource responsibility. Ignorance will not be an adequate defence should your fund prove to be in breach of its obligations.

Receive monthly notification of new articles by signing up to our Smart Decisions blog now.