Your financial resources are the best predictor of a successful retirement …

As financial planners, we are heavily focused on our clients being financially well prepared for the retirement they desire. And, the psychological research[1] that we discuss in this article suggests that the adequacy of your financial resources is the most important indicator of a successful adjustment to retirement and to retirement satisfaction.

However, it’s probably fair to say that adequate financial resources are a necessary, but not sufficient, condition for a successful retirement experience. The research identifies five other resources’ domains that require assessment and, potentially, proactive interventions. These are, in order of importance after finances:

- Physical;

- Social;

- Cognitive;

- Emotional; and

- Motivational.

A brief explanation of each of the domains is provided below.

…but the adequacy of other retirement resources can’t be ignored

“Financial” resources include whatever is available to support ongoing living expenses in retirement. This is the area that both we, and our clients, are most familiar. It is also the resources domain that gets the most attention. However, the retirement resources framework alerts us to the reality that your retirement experience isn’t pre-ordained by the amount or adequacy of your investment wealth.

Your “Physical” resources refer to your state of health. A high level of physical resources is evidenced by an absence of major physical illnesses and mental disorders and the energy to carry out daily activities and/or activities of interest.

“Social” resources reflect your access to support from friends and family, to both exchange information and receive emotional support. The more tangible and practical this support, the higher are your measured social resources.

“Cognitive” resources are assessed by such things as your ability to:

- remember where things are;

- learn new skills and acquire knowledge;

- process information quickly;

- solve problems; and

- make good decisions.

“Emotional” resources are evaluated based on responses to questionnaires that measure:

- demonstration of positive emotions;

- awareness of your own and others’ emotions;

- knowing how emotions affect behavior; and

- sense of personal worth.

Finally, “motivational” resources indicate such things as your ability and/or willingness to:

- increase effort in the face of difficulty;

- find new approaches; and

- set realistic goals.

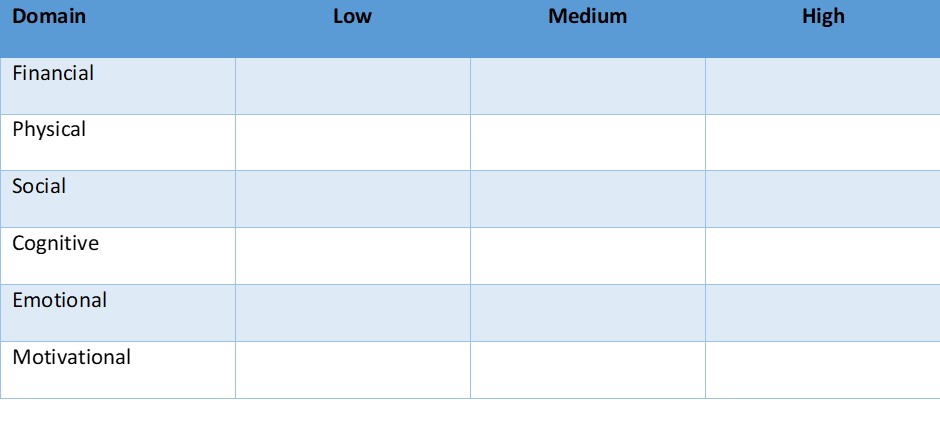

Based on the above (admittedly, high level and simplistic) explanation of the retirement resources framework, the table below provides a simple tool to self-assess where you are placed on each of the domains.

Desirably, you rate yourself as medium to high on all domains. But the self-assessment may highlight areas that need attention in order to increase the chances of a successful adjustment to retirement or to increase retirement satisfaction. The research suggests that adding to your resources in any domain will improve your retirement experience.

Early intervention across all retirement resources is recommended

The retirement resources framework highlights that not only is a successful retirement experience likely to depend on having adequate financial resources but also on identifying and responding to any other resource weaknesses.

While we are well placed to assess the adequacy of financial resources, and to suggest changes to financial behaviours, as appropriate, our ultimate aim is for our clients to have a fulfilling retirement, in the broadest sense. Clearly, we don’t have expertise to assist across the other domains.

But should the self-assessment discussed above identify any potential issues of concern, we hope it’s a catalyst for clients (and other readers) to seek appropriate medical, psychological or other relevant professional assistance. As is usually the case with inadequate financial resources, the earlier a weakness is identified the more effective (and, potentially, less disruptive) any intervention is likely to be.

[1] Much of this article is based on a video presentation, titled “The emotional side of retirement”, by Dr Joanne Earl of Macquarie University at the AFA National Practitioner Roadshow 2017.