Investment return volatility is poorly understood

Investment return volatility is poorly understood

Most investors understand that in order to increase their expected future return, they have to accept a higher level of volatility (or variability) in the value of their investment portfolios. But beyond that, they do not understand just how damaging volatility can be to their wealth aspirations.

The amount of volatility you expose yourself to affects your probability of achieving a desired wealth outcome. In this sense, it is a forward looking concept. And, as such, it is an extremely important factor to take into account when designing and managing any investment strategy.

But this article reveals some poorly understood aspects of volatility, by looking backwards. That even when you know actual returns and actual volatility, wealth outcomes may vary dramatically.

The timing of cash flow matters …

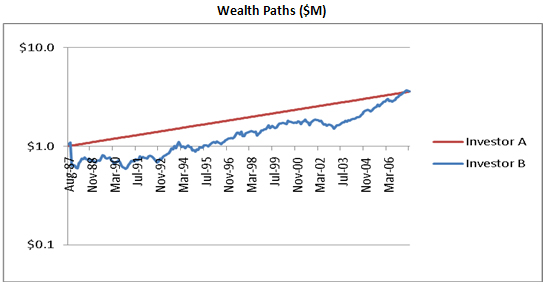

Consider two investors who each invested $1.0 million for twenty years from August 1987. Both earned a return of 6.4% p.a. (after inflation) . Investor A achieved his outcome with volatility of 0% p.a. and Investor B achieved it with an historical volatility of 16% p.a. Both ended up with a portfolio valued at $3.47 million.

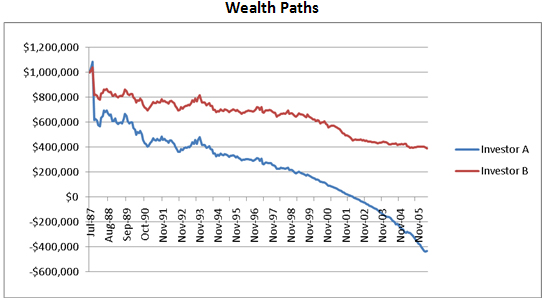

The chart below shows the wealth path for both investors. The wealth path for Investor B assumes actual Australian sharemarket returns and volatility for the period August 1987 – August 2007.

Logarithmic Scale

Which investor would you prefer to be? It doesn’t seem to matter. After the event, both end up with the same wealth.

But this comparison masks the importance of volatility, even looking backwards. It assumes our investors have no interaction with their investment portfolios, beyond the initial investment.

But in reality, most of us interact with our investment wealth on an ongoing basis (whether we realise it or not). We are either accumulating surplus cash flow and building up bank accounts, contributing to super, or perhaps repaying loans (i.e. investing in cash). Or, we are funding cash flow deficits by drawing on investment wealth.

When we factor in these ongoing interactions, volatility can have some unexpected and disconcerting consequences.

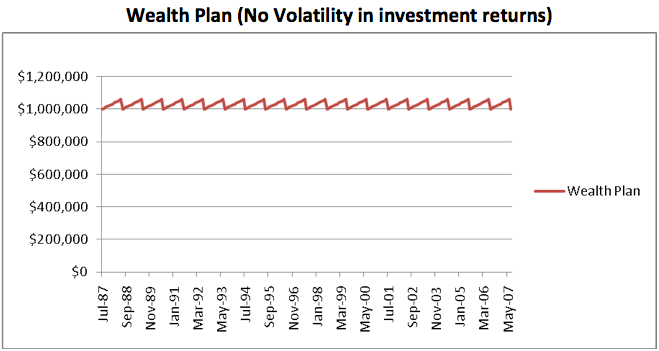

Consider first, the following admittedly unrealistic scenario:

You have $1.0 million in investment wealth at the commencement of your retirement in August 1987. You know that the return you’ll get over the next 20 years will be 6.4% per annum (after inflation). So, with certainty, you decide to withdraw 6.4% or $64,000 (in real terms) from your portfolio each year.

What would you expect your wealth to be at the end of the period?

If your $1.0 million grew by 6.4% in the first year (after inflation), and you spent that 6.4%, you’d still be left with $1.0 million at the end of the year – in today’s dollar terms. If this pattern repeated itself year after year, you’d have $1.0 million (in today’s dollar terms) at the end of the 20 year period.

Graphically, your wealth would move like this:

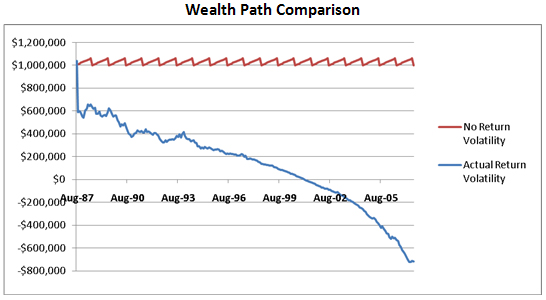

But let’s see what happens when we apply the actual return and volatility experience for the 20 year period from August 1987 – August 2007. A significantly different wealth path is revealed for the same cash drawdown pattern and the same average return.

You would have run out of money after 15 years! The portfolio nevers recovers from the devastating impact of the October 1987 crash.

Clearly, the pattern of investment returns (i.e. return volatility) has a major impact on your wealth outcome.

A higher return can be detrimental to your wealth …

Here’s another interesting comparison to consider:

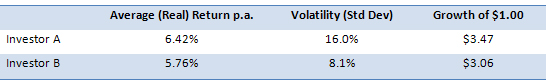

Investor A and Investor B take different risk exposures, with Investor A exposed to greater volatility. Let’s assume the following outcomes for each investor over a 20 year period:

If Investor A invested $1.0 million at commencement, without adding to or withdrawing from the portfolio it would have grown to $3.47 million by the end of the period. Under the same circumstances, Investor B would have a smaller end portfolio of $3.06 million.

But, more realistically, what would have happened if the investors “interacted” with their portfolios. Let’s assume each investor draws $5,333 per month (in today’s dollar terms) from the portfolio for the 20 year period.

Is it possible that Investor B, who is accepting a lower average return, could end up better off?

Counterintuitively, yes! For this example, Investor B (who invested in a balanced portfolio of cash and shares) ended up much better off than Investor A (who invested in Australian shares).

Wealth Paths

But it is only one of an infinite number of wealth paths that could be generated by varying the assumptions regarding cash inflows and outflows over the investment period.

Long term cash flow management as a volatility antidote

The above examples show that volatility can affect wealth outcomes in unexpected (and, potentially, financially catastrophic) ways. And this applies not only in a forward looking sense, when return volatility is unknown.

It can also be the case even when average investment returns and return volatility are known in advance. The interaction of the pattern of investment returns (i.e. volatilty) with cash inflows to and cash outflows from your investment portfolio will drive a vast range of potential wealth paths.

It is impossible to know the pattern of future investment returns. However, it is possible to make some reasonable predictions about your expected long term cash flows, both in terms of amount and timing.

In our view, a smart investment strategy should manage the investment of these cashflows to mitgate the risk of return volatility. Rather than investing only when cash is available or selling investments only when funds are needed, long term cash flow management offers the opportunity to smooth investment flows.

This reduces your exposure to severe adverse investment return volatility. As a result, you reduce the volatility of your investment wealth and increase the chances of achieving your desired financial future.

2 Comments. Leave new

[…] soon as you start to include investors’ contributions to and withdrawals from their portfolios, returns become […]

[…] How to manage the entry risk for their clients (i.e. the question of “when” to invest). […]