The concept of a single strategic equity asset class

Globalisation has meant that world equity markets are now much easier to access. This is leading to the next stage in investment development – global equity investment mandates that offer access to world equity markets via a single investment exposure.

This differs from the current approach that involves holding a combination of equity investments that include a home country exposure, international developed market exposure (often held at a country or regional level) and international developing market exposure.

Modern Portfolio Theory and the Capital Asset Pricing Model (CAPM) proposed that investors could improve their risk adjusted return by holding a combination of highly diversified risky and defensive assets. The exposure to risky assets (theoretically) meant holding all risky assets imaginable. At the time, this exposure was not even observable. The proxy used for exposure to risky assets was the US S&P 500 index (the index that tracks the value of the top 500 US companies). It covered 75% of the investable equity universe in the US.

In the mid 1970’s, the MSCI World Index was introduced, which at the time covered around 60% of the market capitalisation of the world’s 20 developed market countries. It became the new proxy for risky asset exposure. It was subsequently replaced in the 1980’s by the MSCI World All Cap Index which included exposure to small capitalisation stocks.

The most recent update is the MSCI World All Cap Investable Market Index that covers all stocks from both developed and developing countries. It accounts for around 98% of the global equity investment opportunity set.

Portfolio construction has evolved to include this expanding opportunity set of risky assets. However, it still retains many legacies of a less integrated world. For example, there is still a strong home country bias in most portfolios and any move towards global equity investing is likely to require a shift in thinking with respect to domestic equity allocations.

Australian versus Global equity investing

What are the differences between investing in a global equity portfolio [1] versus an Australian equity portfolio [2]? The table below highlights some of the key differences:

| Characteristics | Global Equity | Australian Equity |

| Market Capitalisation | $31,197 billion (100%) | $1,023 billion (3.3%) |

| Average Company (Mkt Cap) | $3.6 billion | $3.8 billion |

| Top 10 stocks as a % of total | 8.5% | 53.4% |

| Largest stock as a % of total | 1.8% | 10.6% |

| Dividend Yield | 2.8% | 4.8% |

| Price/Earnings Ratio | 14.3 | 13.9 |

Above figures are compared in USD terms

And from a sector allocation perspective, the comparisons are as follows:

| Sector | Global Equity | Australian Equity | Variance |

| Financials | 19.6% | 44.2% | +24.6% |

| Information Technology | 12.7% | 0.7% | -12.0% |

| Industrials | 11.1% | 6.4% | -4.7% |

| Consumer Discretionary | 11.0% | 3.3% | -7.7% |

| Energy | 10.4% | 6.5% | -3.9% |

| Consumer Staples | 10.1% | 8.7% | -1.4% |

| Health Care | 9.5% | 4.1% | -5.4% |

| Materials | 7.6% | 22.1% | +14.5% |

| Telecommunications | 4.3% | 1.9% | -2.4% |

| Utilities | 3.7% | 2.1% | -1.6% |

100.0% | 100.0% | 0.0% |

Above figures are compared in USD terms

Clearly there are some significant differences. And while an Australian equity investment has done relatively well over the past 10 years, it’s not prudent to rely on this repeating in the future.

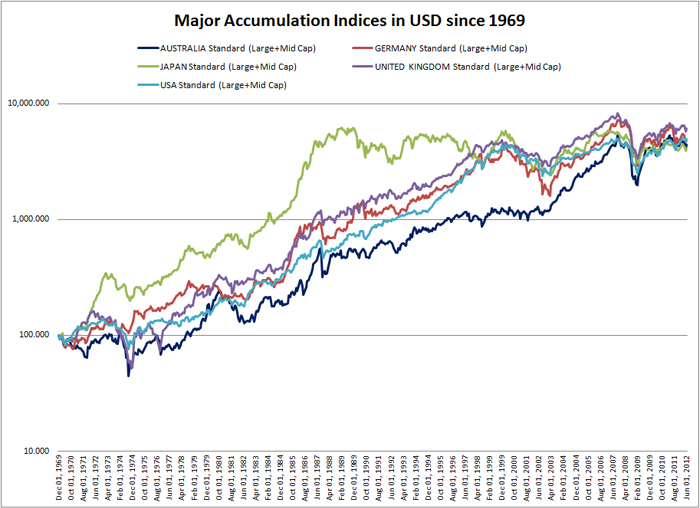

The chart below shows the performance of equities by country since 1969 [3], shown from the perspective of a US investor (investing on an unhedged basis):

Of particular interest is the similarity in the growth of each market over the 42 year period. Despite large intra period differences, no country has consistently outperformed. For example, a US equity investment in Japan would have had roughly the same value increase as a US equity investment in Australia. That may seem perplexing to some given the ongoing woes of the Japanese stock market.

It highlights two things:

- the effect of currency as a re-balancing mechanism. It reinforces the view that (real) prices of cross-border assets tend to equilibrate over time; and

- that a portfolio that includes exposure to all countries is likely to offer a far better risk-adjusted return than an exposure to a single country portfolio. In other words, the idiosyncratic risk associated with exposure to one country can be diversified by including exposure to all countries.

Obviously, an Australian investor would have had a different experience to a US investor (according to the AUD/USD exchange rate over the period). However, the relative performance of each country would have been the same. The above outcomes therefore equally apply to Australian (and non-US) investors.

Incorporating globalisation into your investment approach

While global equity investing is yet to fully develop it is at the forefront of investment thinking and a natural consequence of the globalisation process. From both a theoretical and a practical view, it represents a much more comprehensive proxy for risky equity exposure within an investor’s portfolio. It is also likely to offer cheaper, more liquid and more diversified exposure for investors, involving much less transacting than the current approach of partitioning exposure by country, region and emerging markets.

Investors may wish to shift their thinking towards this approach by regarding the global equity portfolio as the starting (or default) position for their equity exposure. It’s likely to reveal some significant variations to existing equity allocation strategies and may raise some interesting questions about the rationale behind these strategies [4].

[1] As measured by the MSCI World All Cap Investable Market Index [2] As measured by the MSCI Australia Investable Market Index [3] Data taken from MSCI Index Performance (www.msci.com) and reflects all historical data available. [4] We would like to acknowledge MSCI Research and in particular their papers, “Globalization of Equity Policy Portfolios”, Subramanian, Nielson and Fachinotti and “The New Classic Equity Allocation?”, Kang, Nielson and Fachinotti.