Your age may be a poor guide to financial decisions

When it comes to personal finance, as in most areas of our lives, we often rely on some fairly simple notions to make some very significant decisions e.g.:

- “As a 40 year old, the bank is willing to lend and I’m comfortable borrowing five times our household income to purchase a family home – all my friends are doing the same thing”;

- “I’m only 35, with plenty of time to recover if things go wrong. Therefore, I’m investing all my surplus funds in growth assets”;

- “As I approach retirement, I need to reduce my level of financial risk. Everyone knows it’s the prudent thing to do”;

- “As a surgeon in his early 50’s earning over a $1 million after-tax a year, I can easily afford to borrow $3 million to upgrade to the $6 million house my family deserves”;

- “I’m 55 and have a 10 year retirement plan. I’ll use the equity in my residence to borrow to purchase some investment properties. The money I make on sale should be sufficient to fund my retirement”; and

- “I’m earning a great income as a 40 year old investment banker and living very well. However, I can’t see myself doing this for more than another 5 years when I’d like to be financially independent”.

We’ve heard these and similar statements self-assuredly made on many occasions. At a superficial level, they may sound reasonable.

However, taken at their face value, they all reflect a potential failure to consider how these major decisions or desires may interact with a reasonably likely future. In some cases, the consequences of taking the decisions could be financially disastrous.

In our view, the reasonableness of any of the above statements can’t be assessed without making a “best guess” calculation of “future capital”. Future capital, that we have discussed in a number of previous articles, is your total expected savings from earned income, after tax and ongoing living expenses, from now until your date of desired retirement or financial independence.

Without an understanding of your future capital, you are effectively “running blind” when either contemplating or making financial decisions of the type described above. Despite the implication of many of the above statements, most such decisions are not age dependent but need to be guided by both your current net investment wealth together with your estimate of future capital. Combined, they comprise your projected lifetime investment wealth.

The future capital calculation is unique to each individual’s or family’s particular circumstances and expectations. Generalisations, based on age, your current lifestyle or what your friends are doing, may lead to badly erroneous judgements and predictably poor outcomes.

Your future capital will differ from someone who looks like you

To illustrate how the calculation of future capital will assist decision making for the statements made above, we focus on the first i.e. the 40 year old borrowing five times household income. We assume initial household income is $300,000 p.a., initial tax is $90,000 p.a. and ongoing lifestyle spending is $110,000 p.a. Retirement by age 65 is desired.

Implied net saving in the initial year available to service debt is $100,000. This will just service a $1.5 million loan, at 5% p.a., based on a 30 year term. However, provided there is a sufficient deposit, there are likely to be willing lenders. But simply because a bank is prepared to make such a loan doesn’t mean it’s a sound decision to borrow this much. A future capital calculation will usually shed some light.

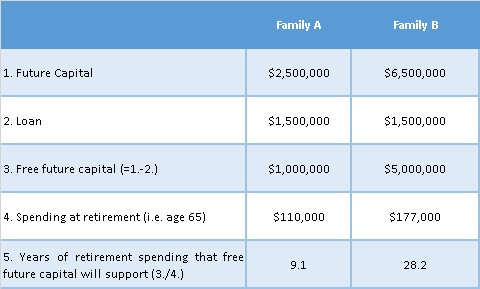

Consider two families with the same current circumstances as described above. Family A expects no growth (above inflation) in its annual after-tax income and spending over the next 25 years to retirement. Family B expects 5% p.a. growth (above inflation) in after-tax income and 2% p.a. growth in spending. The table below reveals that the implications of borrowing $1.5 million are likely to be very different for each family.

After allowing for repayment of the loan, Family A only has $1,000,000 of free future capital to commit to financing retirement. This is about 9 years of desired retirement spending. Assuming net investment wealth of zero at age 40, this simple analysis suggests a highly likely consequence of a decision to borrow $1.5 million now is that retirement expectations will not be met at age 65.

Compromises will be needed. These include working longer than desired, spending less than projected and/or selling down the family home. Knowing this, a smaller loan and less expensive house may be a better alternative.

In contrast, if Family B’s expectations are realised, the future capital calculation suggests they will be able to comfortably repay the loan and accumulate sufficient to fund their desired retirement lifestyle. No compromises of retirement expectations are foreseen.

Similar analysis applied to the other statements would also reveal their potential flaws and how their validity depends not only on current circumstances but on an understanding of future capital in each situation.

A peek into your financial future may be revealing

So generalisations and conventional wisdom are not solid foundations for smart financial decisions. If they have worked for you in the past, it’s probably more due to good luck than good management!

While coming up with a “best guess” of your future capital is not a trivial exercise, it will more often than not expose you to a view of the future that may have a significant influence on your current decision-making. If you don’t like that view, you have the opportunity to avoid locking you and your family into almost inevitable financial and emotional stress.