The investment equivalent of par golf

One of our four key investment philosophies is that “Diversification is key”. Effective diversification requires you to invest in broad based asset portfolios of every asset class where risk is rewarded over the long term in a strong and reliable manner.

Diversification provides the opportunity to reduce investment risk, without reducing expected return. As such, it is often described as “the only free lunch in finance”. But when combined with the practice of rebalancing your investment portfolio on a regular basis to target asset allocations, in order to preserve a desired risk exposure, a “free” return benefit may also arise (i.e. “the rebalancing effect”).

The discipline of regularly reducing exposure to asset classes when they become overweight, due to relative outperformance, and increasing exposure to relatively underperforming asset classes imposes a desirable “buy low, sell high” bias to an investment portfolio. Provided asset class values move differently, but generally have extended periods of relative outperformance and underperformance, rebalancing will not only serve to maintain a desired risk exposure but also enhance investment return.

For those who view investment as a sport or a form of entertainment, the practices of diversification and rebalancing are often seen as both boring and bound to produce mediocrity. However, to extend the sport analogy, we prefer to see their disciplined implementation as akin to playing “par golf”.

Just as there are relatively few golfers that can regularly beat par and most don’t get anywhere near it, research suggests that investors who outperform a strategy of “diversification and rebalancing” over an extended period are in a small minority. And with investment, unlike golf, it’s hard to separate whether that outperformance is due to luck or skill.

Diversification and rebalancing increased return and reduced risk

The rest of this article examines how diversification and rebalancing could have worked favourably[1] for investors for the period from December 1981 to June 2015. The period is dictated by the availability of reliable data.

We compare the performance of the major growth asset classes, Australian and international shares and listed property (i.e. real estate investment trusts), with two diversified growth asset portfolios, “Diversified rebalanced” and “Diversified never rebalanced”. The diversified portfolios are structured as follows:

The Diversified rebalanced portfolio is rebalanced to target every three months, while the Diversified never rebalanced portfolio is not rebalanced subsequent to the initial investment.

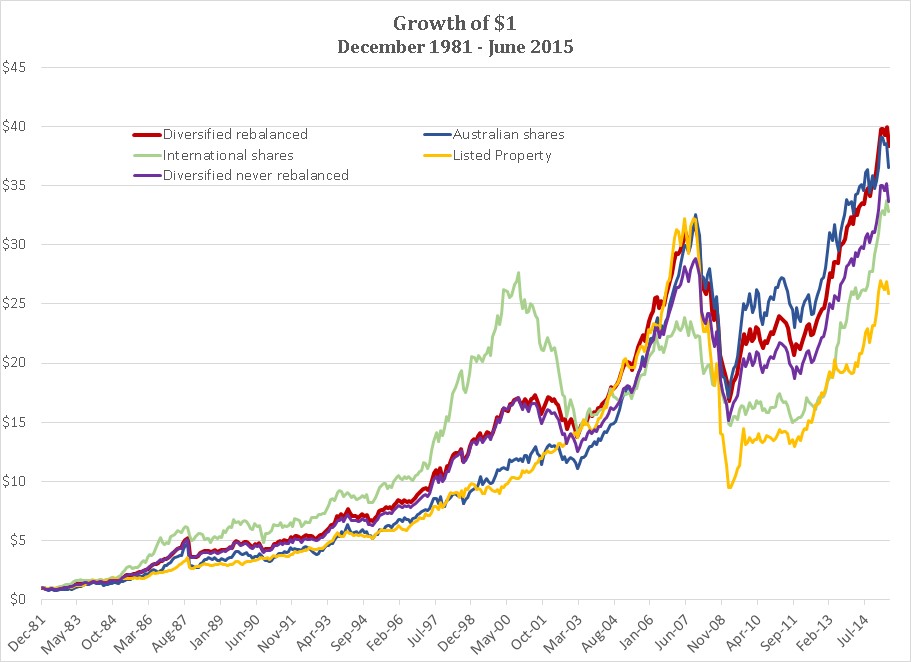

The chart below shows the growth of $1 for the period from 1 December 1981 to 30 June 2015 for the individual asset classes (using widely recognised indices) and the two diversified portfolios:

In what may be a surprise for many, over this extended period the Diversified rebalanced portfolio outperformed each individual asset class and the Diversified never rebalanced portfolio. While it may not be immediately apparent from the chart, this outperformance was achieved with lower volatility (i.e. standard deviation, a measure of investment risk).

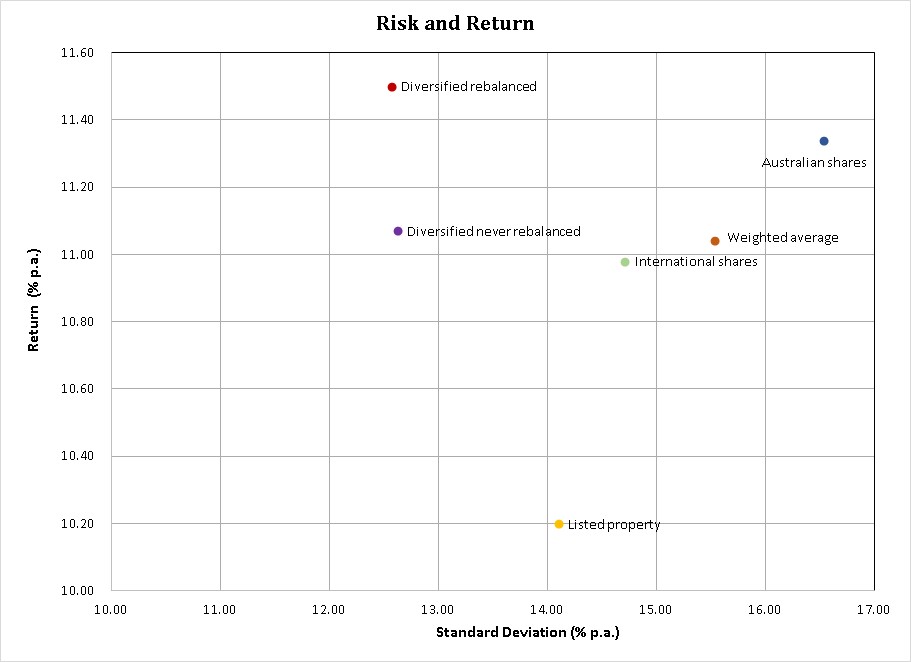

The superiority of the Diversified rebalanced portfolio is revealed more clearly in the Risk/return chart shown below. With risk measured by standard deviation and where the preference is for higher returns and/or lower risk, the Diversified rebalanced portfolio exhibits both the highest return and the lowest risk. This is the investment equivalent of alchemy!

To isolate the benefits of diversification, we have plotted a point on the chart above called “Weighted average”. It is simply the sum of the returns and standard deviations of each of the individual asset classes, weighted by their initial allocations in the diversified portfolios.

The “Weighted average” standard deviation of the individual asset classes is 15.53% p.a., compared with only 12.57% for the diversified rebalanced portfolio. An almost 20% reduction in risk is achieved through diversification.

There is also a 0.46% p.a. increase in investment return. However, most of this return increase derives from the rebalancing benefit. This is graphically revealed in the chart above as the return difference between the Diversified rebalanced portfolio and Diversified never rebalanced portfolio.

We can’t guarantee you can always have your cake and eat it too …

So, for the period under examination, diversification and rebalancing was a “have your cake and eat it too” experience. It resulted in both lower risk and higher returns than recorded by any of the individual growth asset classes.

And it didn’t require selecting a winning asset class or judicious market timing. It also didn’t require any knowledge of economies or markets. It just required selection of an appropriate asset allocation and the discipline to regularly rebalance regardless of what investment markets were doing. But as others have noted, while it’s simple it’s not easy!

Looking forward, we are comfortable that over any extended investment period (i.e. greater than ten years), diversification (risk reduction) benefits will be evident i.e. the free lunch will continue to be available. However, while a positive rebalancing effect is likely, it’s not guaranteed.

Despite this uncertainty, you should remember that the primary purpose for rebalancing is to maintain a desired investment risk exposure, rather than to increase return. A positive rebalancing effect should be seen as a bonus.

[1] No account is taken of taxes and transaction costs in the following analysis. They may affect the conclusions.