Some suggest a retirement expenditure multiple as low as 12 …

When clients ask us how much wealth they need to accumulate to ensure a high chance of meeting their retirement income needs, we suggest that a figure of 25 times their desired retirement expenditure is a good rough guide i.e. a retirement expenditure multiple (or “REM”) of 25. So, if you would like to be able to spend $150,000 p.a. in retirement in today’s dollars for an indefinite period, the multiple suggests investment wealth (i.e. excluding your residence and other lifestyle assets) of about $3.75 million is required.

This number is considerably higher than some others recommend. For example, Noel Whittaker in his “Ask Noel” column in the “Money” section of the “Sydney Morning Herald” of 22 February 2012 confirms that he continues to advocate a REM of 12. He does suggest that:

“it is a very rough guide, as the amount you need depends on a range of variables that includes how long you live, how much you spend, the return on your funds, the state of your health and your taste in travel and wine”.

Our strong view, particularly for healthy couples looking to live a lifestyle requiring wealth well in excess of that required to give eligibility for the age pension, is that such low multiples encourage complacency and a high probability of aspirations not being met.

… but US investment history does not support such a low multiple

To support this view, we looked at US data back to 1926 (reliable comparable Australian data is not available prior to 1981). We examined how long an initial $1 million investment portfolio [1] would have lasted over rolling 30 year retirement periods for various retirement expenditure multiples, starting from December 1925 and ending December 2011, and assuming:

- the retiree achieved market based returns on the portfolio;

- the returns were tax free; and

- constant annual inflation adjusted expenditure drawdowns on the portfolio.

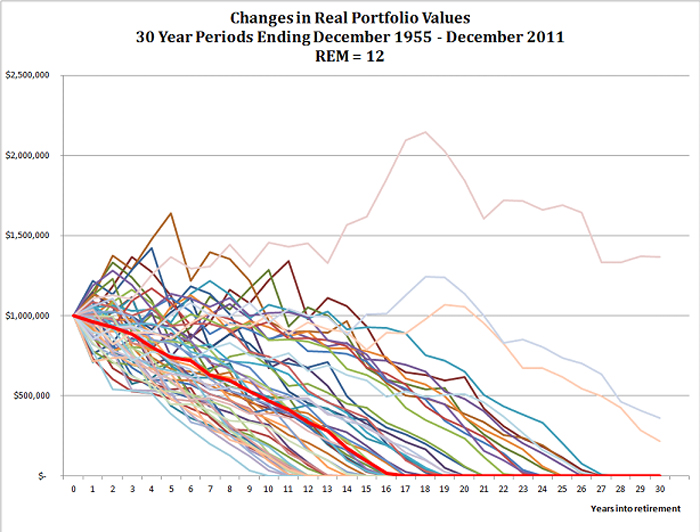

The first chart below shows the movements in portfolio values for each thirty year period assuming the retiree draws an initial $83,333 p.a. (i.e. a REM of 12):

It reveals that the portfolio lasted at least thirty years for only three periods (out of 56). The highlighted red line is the median or middle outcome and shows that this portfolio was exhausted at about 16 years i.e. for 50% of the periods, wealth was totally consumed earlier than 16 years!

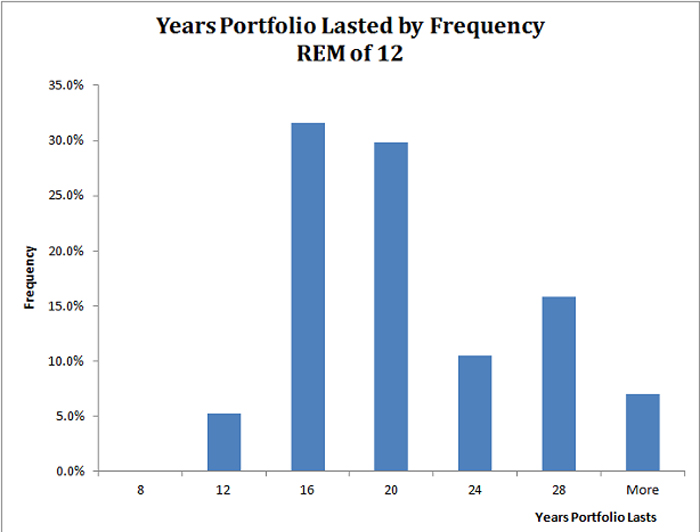

To further highlight the aggressiveness of a REM of 12, the histogram below indicates that for almost two thirds of the periods the portfolio lasted less than 20 years. Based on this history, a 60 year old retiree only has a 33% chance of their investment wealth lasting beyond age 80! We are not comfortable with these odds.

How do things look if the retiree draws an initial more modest $40,000 p.a. (i.e. a REM of 25)? As the following chart shows, for only 2 of the 56 periods was the portfolio totally exhausted within 30 years.

The red highlighted median portfolio suggests that in about 50% of the periods the after-inflation value of the portfolio increased i.e. a substantial estate was a high probability. While a REM of 25 did not guarantee that investment wealth always survived thirty years, it historically did a pretty good job. A multiple of 30 would have achieved 100% “success”.

A REM of 25 provides a high chance of success

There is no simple answer to the question as to how much is enough in order to avoid the risk of running out of money in retirement. This risk reflects the interaction of three uncertainties that are largely out of your direct control:

- longevity – how long you and your partner live;

- sequence and size of returns – low investment returns immediately following retirement followed by high returns requires more additional capital to meet desired spending than a sequence of high returns followed by low returns; and

- future inflation.

If you are too conservative in allowing for the risk (e.g. require an expenditure multiple of over 30), history suggests the likelihood is that you will continue to accumulate wealth, leaving a substantial estate, while short changing your lifestyle.

On the other hand, based on history, retirement expenditure multiples in the 12-15 range set up a high probability of failure. Too high in our opinion. The likelihood is that drastic changes in lifestyle may be required if you live significantly longer than your life expectancy.

An alternative to cope with the identified uncertainties is to purchase a lifetime, inflation adjusted income stream from an insurer to either partially or fully meet your desired future expenditure. Based on current market conditions, this could be purchased at a REM of around 20-22.

The insurer assumes all the uncertainties. The downsides include that you are reliant on the insurer being able to meet their obligations and that there is no upside. On death, the income stream ceases regardless of market conditions, meaning that the opportunity to build additional wealth and leave a sizeable estate is foregone. There are no free lunches.

But regardless of how you finance a retirement income stream, for accumulators the evidence supports a REM target of 25 as a reasonable “rule of thumb” in response to the “How much is enough” question.

[1] A 50% defensive / 50% growth portfolio, with defensive assets comprising equal proportions of one-month Treasury Bills and Long Term Government Bonds, and growth assets represented by the S&P 500 index. The portfolio is rebalanced quarterly.