A portfolio’s yield or income return should not be the focus

Determining the level of sustainable annual income your retirement capital can provide is a far more complex calculation than most people appreciate.

Many retirees manage their wealth by simply living off the income generated from their retirement portfolio while leaving their capital untouched. They tend to favour investments that maximise income distributions and this explains much of the (recent) popularity of high yield investment strategies. But are these strategies likely to provide a sustainable income stream throughout retirement?

Consider a retiree, in their first year of retirement, who generates income of $55,000 from their $1 million retirement portfolio (i.e. a yield of 5.5%). Can they confidently expect an (inflation adjusting) income stream of $55,000 a year throughout the remainder of their retirement? All the research suggests that this expectation is unrealistically high.

The reality is that a portfolio’s income return is effectively meaningless in terms of its impact on portfolio survival rates. Issues of far more importance are:

- your portfolio’s ability to maintain pace with inflation,

- the variability of your portfolio’s total returns (i.e. income and growth), in terms of both the magnitude of the returns (both positive and negative) and the sequence in which they occur, and

- how long your portfolio is required to last.

The rule of 25

We use a rule of thumb to assist our clients to work towards a meaningful retirement capital target – we call it the Rule of 25. It is in line with the widely recognised “4% rule”, which recommends retirees aim to draw an inflation adjusting income stream of no more than 4% of their starting retirement capital.

While the 4% rule has its critics, it remains the most widely accepted safe withdrawal rate. Variations in safe withdrawal rates range between 2% and 7%, suggesting a staggering range of retirement capital targets. For example, a retiree needing $100,000 of sustainable annual income would need retirement capital that ranged anywhere between $1.4 million (assuming a 7% safe withdrawal rate) and $5.0 million (assuming a 2% safe withdrawal rate). This compares to a $2.5 million target under a 4% withdrawal rate.

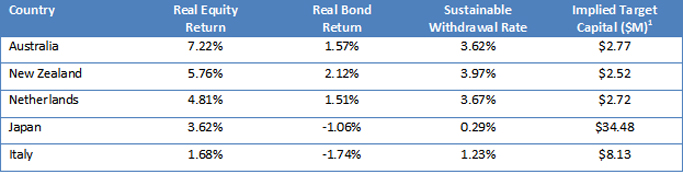

The Financial Services Institute of Australia (Finsia) has just published a research paper [1.] that tests the veracity of the “4% rule”. Finsia looked at it on a country-by-country basis using actual data from 1900 to 2011. They focused on five countries, in particular, out of their test pool of 19 countries.

They found the 4% rule stood up fairly well in Australia. In fact, they found that 3.6% was an historically safe withdrawal rate for an Australian retiree investing in a balanced portfolio (made up of a 50/50 exposure to local bonds and shares), over a 30-year time horizon (assuming a 90% chance of success)[2.]. That implies that a retiree would need starting retirement capital of $2.77 million to fund an inflation adjusting income stream of $100,000 a year throughout a 30 year retirement.

Australian shares showed the highest inflation adjusted return over the research period at 7.22% per annum. Australian bonds showed the 9th highest inflation adjusted return at 1.57% per annum.

Yet it’s not simply the magnitude of the returns that affect the level of safe withdrawal rates. The Netherlands, for example, showed lower share and bond returns, yet had a higher safe withdrawal rate than Australia’s.

As perplexing as this may seem, retirement planning is about much more than just getting the highest rate of return.

The outcomes for the five countries that Finsia focused on in their publication are shown in the table below [3.]:

[1.] Assuming $100,000 of annual sustainable income.

The Japanese and Italian experiences are sobering!

Finsia research confirms the Rule of 25 is a useful guide

What can we learn from this research?

We identified four key take-aways:

- The 4% rule (or Rule of 25) remains a valid tool for estimating your sustainable annual income in retirement. However, it’s simply a guide and should be used as a rough rule of thumb only;

- Don’t forget about the impact of costs and taxes. The research is based on pre-tax cash flows. Taking account of outflows such as costs and taxes infers the need for even higher levels of retirement capital. Investing in pre-retirement planning that helps to minimise your retirement tax is likely to prove one of the smarter moves you can make;

- Regularly reviewing and adjusting your withdrawal rates, particularly in the early years of retirement, can significantly extend the life of your retirement capital;

- The variation in withdrawal rates across countries indicates a need for diversification away from home country biased portfolios. Italian retirees who held portfolios consisting solely of Italian bonds and shares would have been much worse off than those who diversified their portfolios via the inclusion of foreign asset exposures.

More often than not when we introduce the concept of the Rule of 25 to prospective clients we get some surprise at the magnitude of the retirement capital required. I think some believe we use it as scare tactic. But the Finsia research confirms that the Rule of 25 is anything but a scare tactic. Perhaps it’s time to review your retirement plan.

[1.] “How safe are safe withdrawal rates in retirement? An Australian perspective”, published March 2014, Authors: Michael E Drew and Adam N Walk.

[2.] Note: the safe withdrawal rate varies according to portfolio risk, time frame and the degree of certainty.

[3.] Based on a 30-year time horizon, using a balanced portfolio, with a 90% probability of success.