“wealthcheck” reveals where you are on the path to your financial independence

In previous articles, “ ‘wealthcheck’ and retirement preparedness” and “ ‘wealthcheck’ for early career professionals”, we applied the “wealthcheck” framework to examine and compare the financial soundness of couples at both the early and late, pre-retirement, stages of their professional careers.

In previous articles, “ ‘wealthcheck’ and retirement preparedness” and “ ‘wealthcheck’ for early career professionals”, we applied the “wealthcheck” framework to examine and compare the financial soundness of couples at both the early and late, pre-retirement, stages of their professional careers.

In this article, we look at two “typical” mid-career professionals to again demonstrate the effectiveness of “wealthcheck” to highlight key sources of financial vulnerability. The article also highlights the reality that you can’t assess your progress on the path to financial independence by observing the financial and lifestyle behaviours of those you consider are a lot like you.

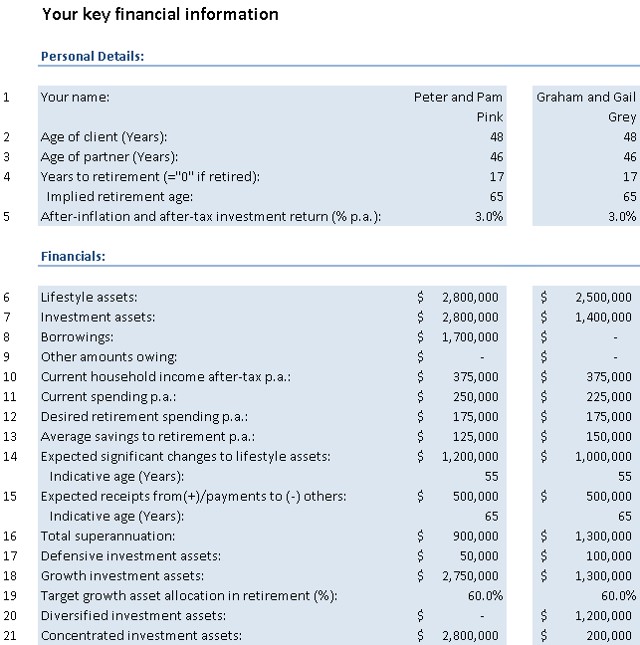

Again, two fictitious couples are illustrated, the Pinks and Greys. Both are 17 years away from a projected retirement and approaching their peak earnings years. Children are either in or soon to be in their teens, with lifestyle spending peaking due primarily to the cost of private schooling.

Fortunately, mortgages for residences have been eliminated, providing the opportunity to apply expected cash flow surpluses to investments rather than repaying non-tax deductible debt.

But, as revealed below, while both are seeking to become financially independent by age 65, the Pinks and Greys have adopted contrasting lifestyle and investment approaches. The “wealthcheck” inputs for each couple are provided below:

As for our previous illustrations of the “wealthcheck” framework, the couples exhibit a number of financial similarities. Both earn the same after-tax incomes, their net worth is currently the same and both wish to be able to spend $175,000 p.a. in their retirements. They also share the same target asset allocation – 60% growth assets / 40% defensive assets – to be achieved by age 65. But the strategies adopted to meet their retirement objectives vary significantly.

“wealthcheck” links lifestyle expectations and investment risk

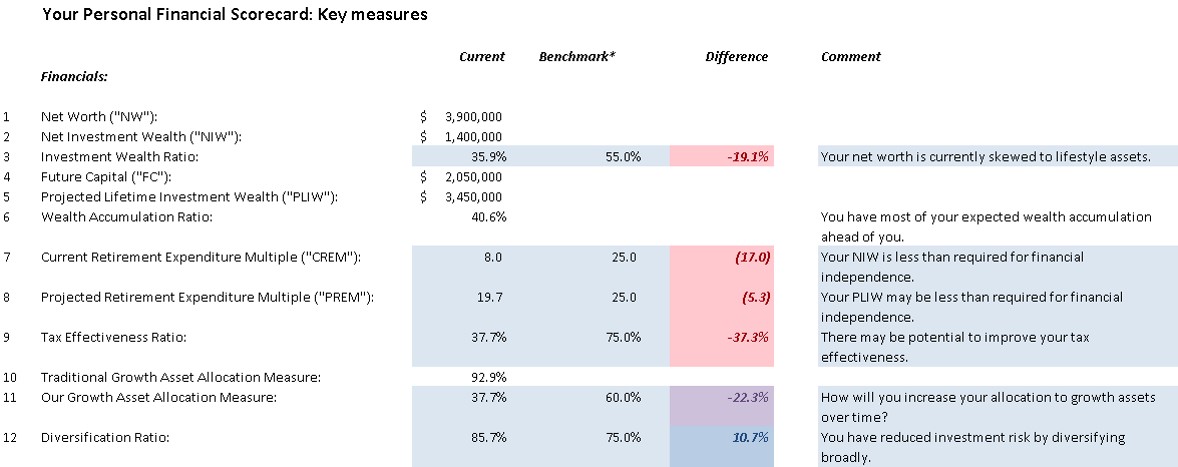

For the Greys, the “wealthcheck” key financial indicators, discussed in recent articles and calculated from the above inputs, are shown below. Relevant comments are also provided:

The Greys have already accumulated significant net investment wealth ($1.4 million), but well short of that required to meet their version of financial independence. They have focused on superannuation as their primary wealth accumulation vehicle, appreciating both the short and expected long term tax effectiveness of this environment. In addition, they hold their superannuation in well diversified managed and exchange traded funds.

As for the Pinks, the Greys wish to upgrade their residence at around age 55 (spending a further $1 million). But their expected future savings should be sufficient to allow for this and to continue to accumulate investment wealth. Although their current Tax Effectiveness Ratio (“TER”) is below the benchmark, the aim is to direct the majority of future savings to superannuation – it is likely that at age 65 the TER will comfortably exceed our benchmark of 75%.

Despite a traditionally measured growth asset allocation at a seemingly high 92.9%, our measure (that adjusts for borrowings and future savings) is only 37.7%. The majority of the Grey’s projected lifetime investment wealth is yet to be realised, providing them with the opportunity to gradually raise their growth asset allocation over the 17 years to their projected retirement age (i.e. to spread their risk taking over time).

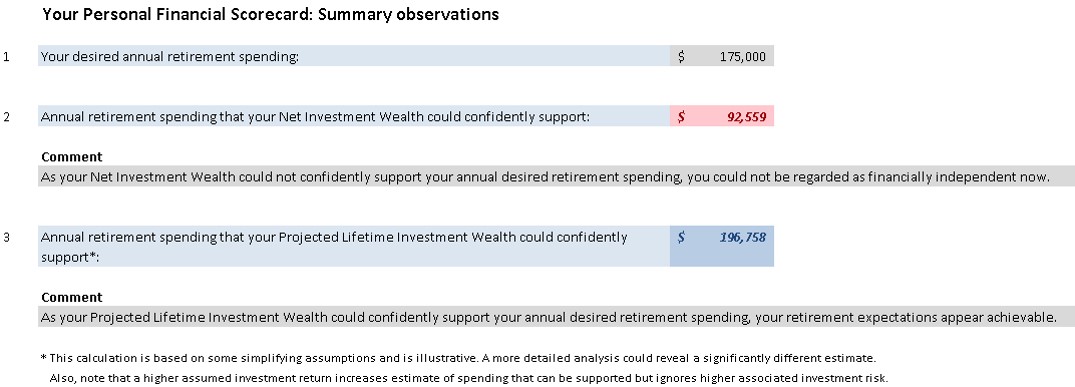

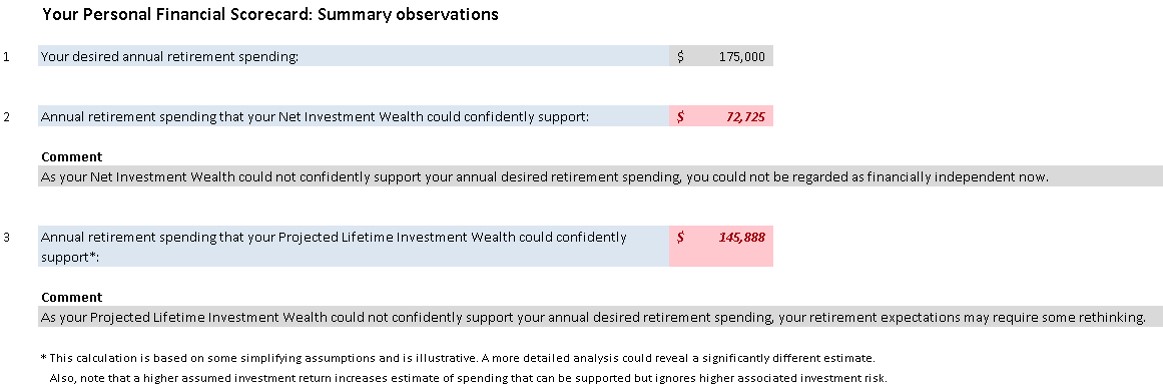

The “Summary Observations” report (shown below) reveals that while the Greys are currently well short of financial independence, the indications are that their version of financial independence is achievable by retirement.

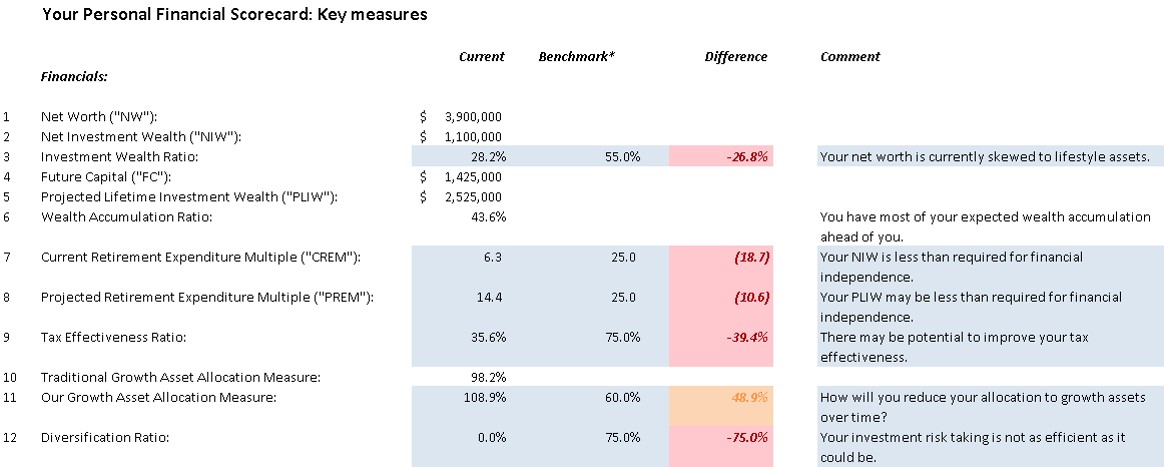

However, the Pinks’ “Key measures” report, shown below, suggests some vulnerabilities and, potentially, unrealistic expectations.

Their current net worth is more heavily skewed to lifestyle assets than the Greys. In addition, they also wish to spend $200,000 more on upgrading their residence at age 55 and about $25,000 p.a. more on lifestyle (or save correspondingly less) over the next 17 years.

But the Pinks’ greatest vulnerability is that they have used the equity in their home to borrow $1.7 million to purchase two residential investment properties worth a total of $1.9 million. Peter Pink is attracted to the tax benefits of this strategy and, like many Australians, believes that there is no danger of property prices falling.

Together with a lower current net investment wealth and lower projected future savings, a Projected Lifetime Investment Wealth of $2.53 million is implied, about 27% less than the Greys. Estimated future savings of $1.425 million are less than that required to repay outstanding debt by age 65. It will therefore not be feasible to both further increase wealth held in superannuation and simultaneously reduce debt, without property sales.

Traditionally measured, the Pinks’ growth asset allocation is a high 98.2%. But when adjusted for debt and future savings the measure is an even higher 108.9% which compares with a target growth allocation of 60%. This implies that despite being 17 years from retirement, the Pinks have no scope to increase their holdings of growth assets without deviating even further from their target.

In fact, to reach the 60% growth target by age 65, they will need to reduce the proportion of their wealth held in growth assets. This can occur through sales or, unhappily, combined with falls in the values of existing growth assets.

17 years from retirement, the Pinks have (unwittingly) taken a huge investment bet. They have borrowed more than their expected future savings to invest in a concentrated growth portfolio, comprising two residential properties. If the properties perform well over the next 17 years, they will congratulate themselves on their shrewd investment strategy.

However, any sustained fall in growth asset markets, particularly property markets, will expose the Pinks’ lack of investment flexibility. If they are not to move even further from their 60% growth asset target by investing future savings into growth assets rather than repaying debt, they have no capacity to take advantage of lower prices. Their large property bet at age 48 means they have effectively utilised (in fact, heavily overspent) their expected investment risk “budget”.

While they could sell out (at a loss) and restructure more consistent with their target asset allocation, such investors usually hang in hoping growth markets recover before retirement. At that time, the Pinks will need to sell at least one property to move to their 60% growth/40% defensive target or continue to carry more investment risk than they are comfortable with.

In the meantime, they have little room for maneouvre should savings fall short of expectations. In particular, a loss of employment could see them in a very difficult position.

In summary, the Pinks’ lifestyle expectations and investment “strategy” are not consistent with giving themselves the best chance of achieving financial independence. Their “Summary Observations” report, shown below, suggests that even without the unravelling of a highly risky investment strategy, their Projected Lifetime Investment Wealth falls short of that required to support their desired retirement spending.

“wealthcheck” pinpoints where you are in terms of your investment lifecycle

In mid-career, it is critical to appreciate where you are in terms of your investment lifecycle. In our view, it is important that your investment strategy is always guided by your target asset allocation and the best calculation you can make of future savings. “wealthcheck” explicitly focuses on these variables.

A failure to consciously integrate your desired lifestyle with your investment strategy may mean that, deliberately or unwittingly, you take on more investment risk than you are comfortable with. The Pinks are in this position. They are also currently reliant on investment returns being significantly better than expected to achieve financial independence. There is a high chance that at some stage unplanned changes in lifestyle will be forced upon them.