Investment is only a piece in the “puzzle”

Investment is only a piece in the “puzzle”

The terms “wealth management” or “financial planning” are seen as synonymous with investment advice and investments by most people. This is not surprising given that much of the financial planning industry also thinks this way: the primary reason why the major financial institutions employ financial advisers is to sell their investment (and insurance) products.

But, in our view, wealth management should be much more than giving investment advice and promoting investment products. Its purpose should be to help you maximise the chances that you achieve your desired financial future.

Your investment approach should be consistent with and driven by this purpose, rather than a pursuit undertaken for its own sake. Accepting this, investments are properly relegated to their place as a piece in a much bigger “puzzle”.

The experience since 2000 and, particularly, the last four years, have highlighted the reality that you cannot rely on increases in the prices of your investments to secure the financial future you want. A smarter approach to wealth management places the focus on the things you can control or influence (i.e. your income earning capability, costs, risk and taxes), rather than unpredictable short term investment returns.

To illustrate the effectiveness of this more comprehensive approach to wealth management, last year we published an eBook called “The Value of Financial Planning: The Wealth Foundations Way” that examined the progress of ten Wealth Foundations’ clients on a number of key financial metrics. In the rest of this article we review the experience of the three longest standing clients (identified in the eBook as Clients 1, 2 and 3) to reveal the contribution of non-investment related aspects of wealth management to each client’s current financial position (as measured by net worth).

Investment a minor contributor to our clients’ success

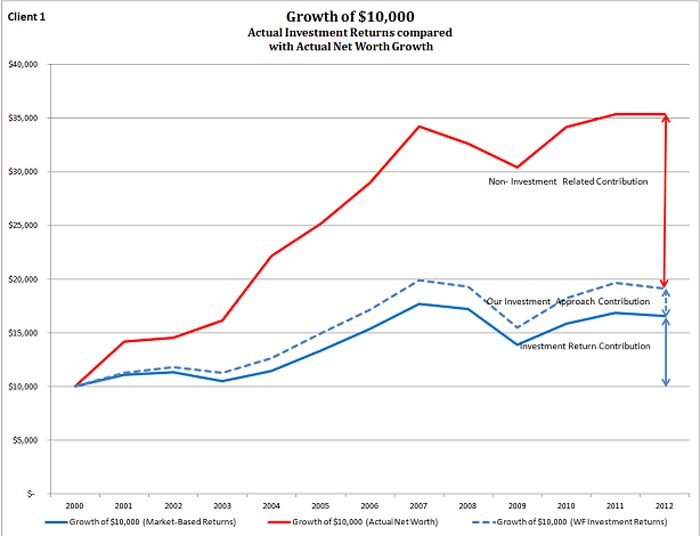

The chart below shows how $10,000 would have accumulated assuming growth consistent with that of Client 1’s net worth since 2000. The growth is broken down into three components or contributions:

- “Investment Return Contribution”: this is the growth of $10,000 since 2000, on the basis that there are no additions to or subtractions from the initial $10,000, distributions are reinvested and investment returns are consistent with a proxy Growth portfolio [1];

- “Our Investment Approach Contribution”: shows the additional return added by Wealth Foundations’ investment philosophy, with its tilts to “small” and “value” shares; and

- The “Non – Investment Related Contribution”: it essentially shows the contribution to growth resulting from the client’s adherence to a long term strategic financial plan, resulting in the generation of ongoing savings.

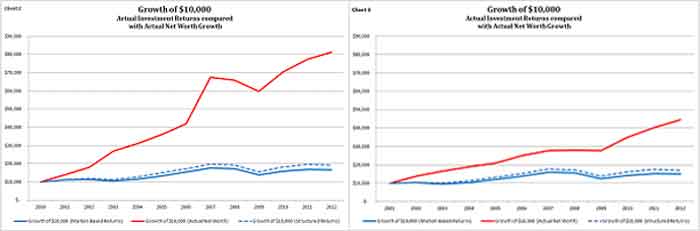

Of the total more than $25,000 growth over 12 years, more than $15,000 (or 60%) is attributable to non-investment related wealth management practices. To prove that this was no accident, the parallel charts are shown below for Clients 2 and 3.

In fact, the non-investment wealth management contribution is significantly greater for these clients than for Client 1.

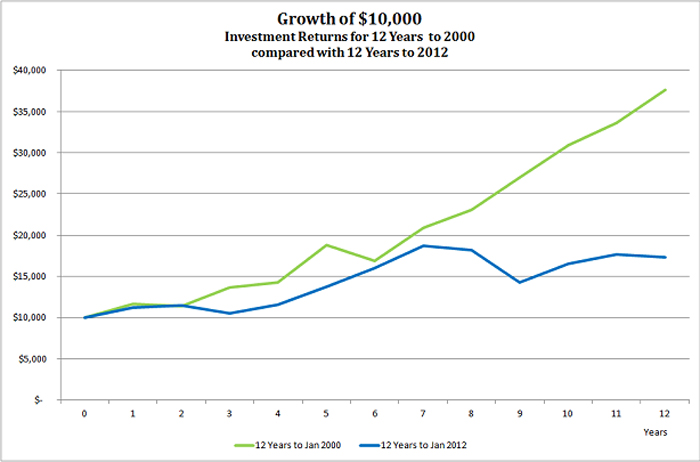

Now you may be thinking that the 2000’s were a pretty dreadful period for investment returns and we’re understating the importance of investment. Certainly, as revealed in the chart below, investment returns were much more favourable in the 1990’s, a “golden period” for domestic and international shares. It shows the pre-tax returns of our growth portfolio for the 12 years to 2000 and the 12 years to 2012.

Clearly, our clients would have had a much larger investment contribution if they were accumulating in the 1990’s than they actually experienced.

But with our investment approach, clients will essentially get the returns of the market, whatever they may be. It is the disciplined adherence to the non-investment related and more controllable aspects of our wealth management approach that increases the chances they will achieve their desired financial futures.

Investment is simply a means to an end

Despite the impression that the financial media and many in the financial planning industry want to give, successful wealth management is not about picking winning shares or fund managers and/or timing entry or exit from investment markets to take advantage of prescient forecasts. Realistically, if anybody knew how to reliably do this, they wouldn’t be talking to you or us about it.

Rather, it is about disciplined adherence over extended periods of time to a well conceived strategic plan and tailored investment strategy. Both reflect your best expectations of your financial resources, your attitude to risk and the life you want for you and those you care about.

Investment is the application of those diligently harnessed financial resources, hopefully, to earn an adequate return for the risk taken. It should not be regarded as a sport or form of entertainment. It is simply a means to an end that should be conducted in a manner most likely to achieve that end.

[1] As a proxy for the contribution of investment, we assume a growth portfolio (i.e. 30% defensive assets / 70% growth assets) that achieves a market based return, after an assumed effective tax rate of 10% p.a.