Baby boomers’financial behaviours should reflect in the data

We previously published an article (in June 2011) that looked at the financial strength of the average Australian household and how it had changed over time. This article provides an update to reveal changes over the past three years.

The data, taken from the Reserve Bank of Australia’s statistical tables, is highly aggregated and covers all working age groups, so it’s difficult to relate to an individual’s circumstances. However, it does provide us with an idea of how the finances of the household sector are progressing as a whole.

As wealth managers, we spend a lot of time working with our clients on the structure of their financial affairs. We pose questions about the balance between lifestyle and financial assets, whether there is too much debt, or perhaps not enough, and whether financial assets are growing sufficiently relative to planned outgoings. This is at the core of good financial planning.

There are at least three financial trends we would expect to see as a client approaches financial independence:

- The ratio of (net) financial wealth as a proportion of net worth increases, indicating an increasing proportion of wealth is being dedicated to securing financial security rather than to lifestyle assets;

- The ratio of borrowings to investment assets should fall, so that financial independence can be maintained without the use of excessive investment risk. Debt adds to financial risk and is inconsistent with investment strategies designed to withstand extremely adverse markets. This is a critical requirement for someone who can’t or doesn’t ever wish to return to the workforce; and>

- The ratio of (net) financial wealth to annual (retirement) expenditure increases. Ideally, we like to see our clients accumulate financial wealth of at least 25 times their annual expected retirement spending to achieve financial independence.

Currently, Australia’s baby boom “bulge” is entering the retirement phase and we would expect them to be holding at or near to their peak wealth in (non-housing) financial assets. We would therefore also expect this generational effect to be reflected in how the financial position of the average Australian household changes over time.

There has been some consolidation of household finances since 2010

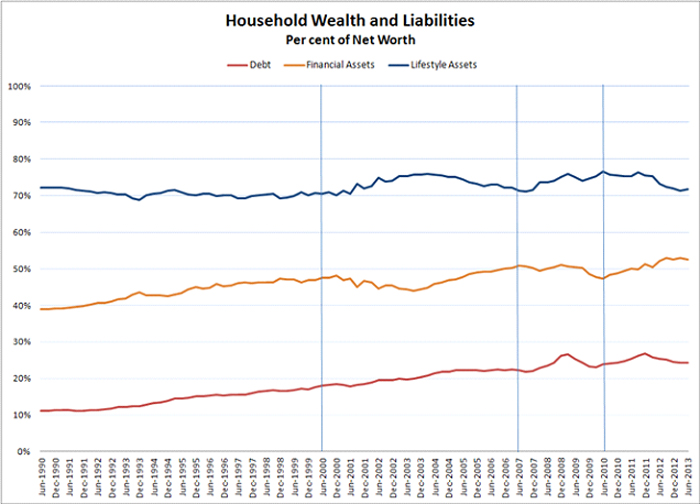

The chart below shows how major components of household net worth have trended over the past 23 years.

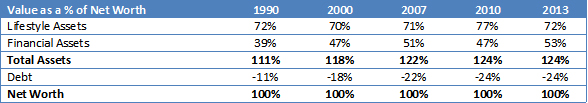

The table below shows the charted data for selected years:

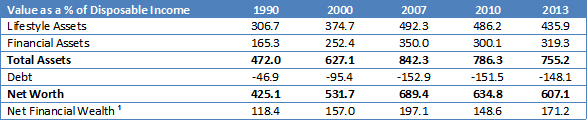

In the following table, the components of wealth are provided as a percentage of household disposable income:

¹ Net Financial Wealth = Net Worth less Lifestyle Assets

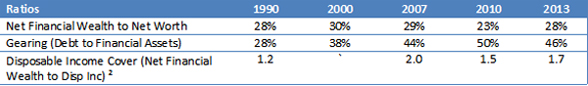

Key household financial ratios calculated from the above data are tabulated below:

² Reflects the number of times Net Financial Wealth covers Disposable Income. This is a similar measure to the ratio of Net Financial Wealth to annual (retirement) expenditure with Disposable Income being a multiple of annual expenditure.

The tables reveal that on the asset side of the national household balance sheet, lifestyle assets grew disproportionately from 1990 to 2010, (from 72% to 77% of net worth), but in the past three years have since reverted to 1990 levels. The reversion reflects the more subdued housing market (relative to other asset markets).

Financial assets have increased significantly from 47% to 53% of net worth since 2010 which, unlike prior periods, occurred without the “accelerant” of debt. While gearing levels have fallen from 50% of financial assets to 46% since 2010, debt remains high in historical terms. Many households continue to hold high levels of debt and are doing so until much later in life (including into retirement).

There has still been a more than doubling in debt (relative to net worth) since 1990, which is the opposite of what we would have expected as the baby boom bulge approaches retirement. Because of this continued high leverage, household net worth has the potential for far more volatility than in the pre 2000 period.

The most noticeable change over the past three years has been a reversal of the (post 2000) trend of allocating a greater proportion of wealth to lifestyle assets relative to financial assets. Net financial wealth peaked at 30% of net worth in 2000 and fell to a low of 23% by 2010.

This position has since recovered to 28% driven by stronger financial markets and more subdued spending. As a guide, for those approaching retirement we recommend net financial assets of at least 55% of your wealth to give yourself a good chance of outliving your capital.

No evidence that baby boomers are significantly changing financial behaviour

The slowdown in the housing market and a recovery in (non-housing) financial asset markets have translated into some improvement in household balance sheets over the past 3 years. While household debt remains an issue, at least there was no increase on the 2010 levels.

Lifestyle assets still comprise a huge proportion of our wealth, predominantly driven by the relatively high values of the family home. Our retirement wealth, as measured by our financial assets less debt, remains low on global standards (at 28% of net worth) and continues to be far more leveraged than was the case in 1990.

We would have expected the level of retirement wealth of the average Australian household to be much higher than 1990 levels, given the baby boomer effect. We would have also expected the level of leverage to have declined reflecting the lower risk the baby boomers should be taking in retirement. This is not evident in the data and increases our collective vulnerability to financial shocks.

As a national “herd”, these statistics suggest we may be living beyond our means. The corrective action requires both a re-balancing of lifestyle assets towards financial assets and a reduction in debt levels.

Typically, we tend to be highly influenced by what our neighbours are doing. Unfortunately, when it comes to responsibly managing our own affairs, our neighbours are not always the best guide.