How do you close the gap between your current and target asset allocation?

How do you close the gap between your current and target asset allocation?

Our previous article, “Measuring your current asset allocation”, explained how we believe wealth accumulators (those whose after-tax earnings exceed their lifestyle expenditure) should measure their current asset allocation. It requires them to estimate their projected surplus or future capital to add to their Net Investment Wealth, to calculate a measure of total Projected Lifetime Investment Wealth.

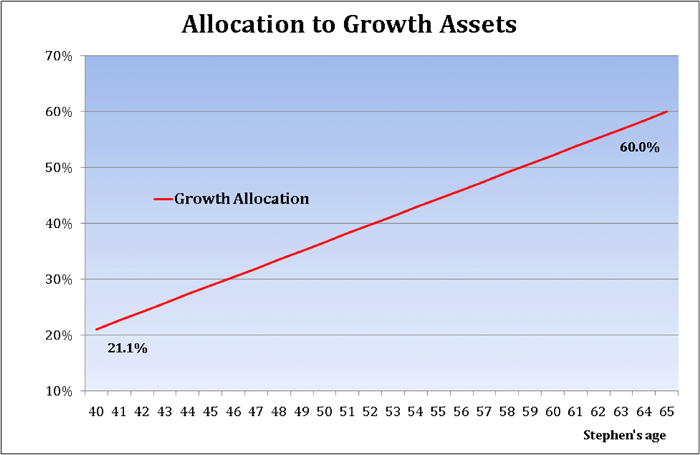

This future capital is regarded as a component of defensive asset holdings, with the upshot being that those with many years of expected accumulation ahead of them may be considerably underweight growth assets compared with their target growth asset allocation. Previously, we looked at the example of Stephen, a 40 year old medical specialist, with a current growth allocation of 21% compared with a target at age 65 of 60%, as illustrated in the chart below:

This article builds on the discussion in “Measuring your current asset allocation”. It briefly examines a proprietary framework we have developed that would help Stephen choose an appropriate investment strategy to transition from his current 21% growth exposure to 60% growth over the next 25 years.

Transitioning to your target asset allocation: by accident or by design?

To illustrate the framework, let’s consider a couple of investment strategies that accumulators commonly adopt. These were discussed in a previous article, “Building your exposure to shares and property”. The first strategy is often considered “conservative”. It involves no serious attempt to build growth exposure until the mortgage has been paid off.

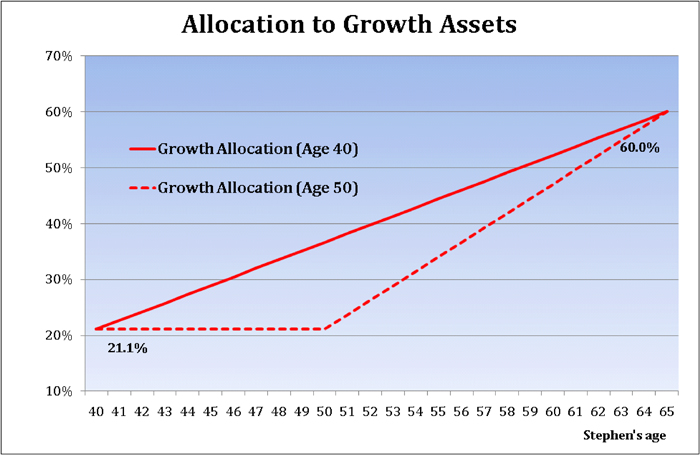

Let’s assume Stephen initially allocates future savings to paying off his $1 million mortgage. The mortgage is repaid in ten years so that by his age 50, in terms of the methodology discussed in “Measuring your current asset allocation”, his future capital has reduced by $1 million, as has his debt, leaving his net defensive position unchanged. If the (after inflation) value of growth assets has not changed over this period, the following chart shows Stephen’s growth exposure as unchanged over the past ten years. It also reveals what needs to be achieved over the next fifteen years to reach the target of 60% by his age 65.

The chart highlights that Stephen’s decision to focus initially on repaying his mortgage means that the time available to achieve his growth target has been compressed. And there is the possibility that during the period that future capital was directed to repaying debt, the price of growth assets may have increased substantially implying that future growth exposure will be more expensive to acquire. Of course, the prices of growth assets could have fallen or stayed the same.

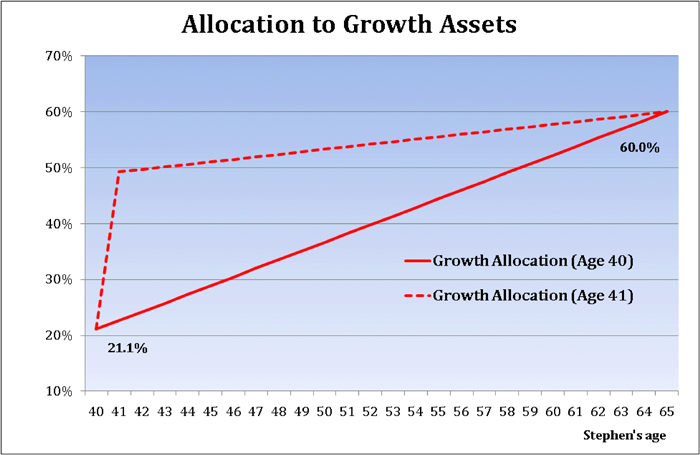

The second “default” strategy we see is considered more “aggressive”. It involves borrowing a relatively large amount of funds (relative to investment wealth) as soon as there is sufficient equity in the family home, and investing these funds in growth assets. The strategy is driven by a desire to reduce tax (through negative gearing) and accelerate wealth accumulation.

As an example of this strategy, we assume that at age 41 Stephen borrows a further $1 million and invests the funds in a portfolio of growth assets. Based on our methodology, this results in a shift of $1 million from defensive assets to growth assets. The revised path to the target growth asset allocation is shown below:

Borrowing and investing have pushed Stephen’s growth exposure to almost 50% at age 41, meaning that in one year he has completed the great bulk of the growth investment necessary to achieve his 60% target by age 65. This will prove a great strategy if the price of growth assets continues to rise over the next 24 years. However, if they fall he has limited capacity to take advantage of the lower prices as much of his future capital will be directed to repaying borrowings.

Both strategies fail to effectively spread the risk of increasing growth exposure across time. The “conservative” strategy back-ends the increase in growth exposure while the “aggressive” strategy brings it forward. Both strategies implicitly and, usually, unwittingly, take timing bets that add to the risk that less than desired long term wealth outcomes will be achieved.

Our framework reveals that a lower risk strategy may be to spread the required increase (or decrease) in growth exposure to reach your target evenly over the period between now and the time you wish your target to be achieved. It is represented by the solid red line on the charts above.

For Stephen, it would imply increasing his growth allocation by about 1.6% p.a. of Projected Lifetime Investment Wealth for 25 years, spreading his growth bets as broadly as possible. Provided nothing changes, this implies that Stephen should invest $55,000 of savings into growth assets (i.e. 1.6% of $3.55 million) next year. This may mean deferring paying off the mortgage or, perhaps, borrowing tax deductible debt to purchase the growth assets.

In practice, our clients do deviate from this default strategy. But they do so with their “eyes wide open”. A move above the solid red line indicates a deliberate bringing forward of growth exposure, while a move below the line is a deliberate deferral.

Projected Lifetime Investment Wealth framework key to integrated investment strategy

Hopefully, the four articles (this one and our previous three) in our “Understanding asset allocation” series have provided you with a few new concepts to consider and food for thought. These concepts particularly apply to those who are wealth accumulators. In summary, the key insights we discussed include:

- There is only one target asset allocation: that which you feel you can live with when you have no future earning capacity and need to rely totally on your investment wealth to support your lifestyle. Your target growth exposure will be limited by your attitude to investment risk;

- Borrowings are negative defensive assets, that should be offset against cash and fixed interest holdings to calculate your defensive asset exposure; and

- A measure of future capital should be explicitly taken into account as part of your investment wealth, both when determining your current asset allocation and deciding on an appropriate investment strategy to transition to your target asset allocation.

The Projected Lifetime Investment Wealth framework introduced in this and the previous article provides powerful insights into the consideration of a number of personal financial planning issues. Most importantly, it guides the development of an investment strategy that uniquely and explicitly links your lifestyle expectations to your desired level of long term (or lifetime) investment risk. Without the benefit of such an integrated approach, most investment strategies are effectively “flying blind”, almost certainly involving greater or lesser investment risk over time than intended.

Our “Understanding Asset Allocation” series of articles is now available as a free eBook. Download here now.