There are three levers of financial independence

To increase the chances of achieving financial independence (i.e. having sufficient investment wealth to fund your desired lifestyle indefinitely, without the need to work), you have essentially three options or levers available to you. They are listed below in order of capacity to directly control:

- Reduce cash outflows, including lifestyle spending, taxes and investment costs;

- Increase cash inflows, primarily from increased employment or business income; and/or

- Increase net (i.e. after costs) investment returns.

Most families have significant discretion regarding the amount of their cash outflows and, within a fairly broad range, are able to decide (above a base level of living) how much they want to spend.

They have much less direct control over cash inflows, but are able to influence them through input decisions they make e.g. education, career choice, skills training, hours worked, networking.

Finally, they have no direct control over net investment returns. Returns are the product of investment risk taken and, while higher returns almost invariably require taking higher risk, higher risk doesn’t guarantee higher returns. In our view, to give yourself the best chance of increasing returns you should choose the maximum risk you can live with and make sure that risk is appropriately structured and managed.

Therefore, if financial independence is important to you, reducing cash outflows/saving more (from a given income) is the lever over which you have most control. Also, an often overlooked, but extremely important, byproduct of permanently reducing cash outflows is that it correspondingly reduces the investment wealth accumulation required to achieve financial independence. Yet many are seduced to believe that high incomes and “smart” investing are the keys to achieving financial independence.

The financial independence levers in action

The rest of this article examines how the “three levers” impact the financial independence plans of a currently 35 year old couple, the Brights, looking to retire in 30 years’ time at age 65. The initial assumptions made are that the Brights:

- would like to be able to afford a $200,000 p.a. retirement lifestyle (in today’s dollars); and

- expect they will be able to save an average $50,000 p.a. over the next 30 years.>

Our “Rule of 25” suggests that the Brights will need to accumulate investment wealth of about 25 times their desired retirement spending by age 65 (i.e. $5 million) to be highly confident of meeting their objective. However, based on savings of $50,000 p.a., this implies a required after-inflation and after-tax investment return of 7.32% p.a. over a thirty year period.

How realistic is this? To provide some perspective, for the period from 31 December 1999 to 28 February 2017, the Australian share market[1] returned 5.09% p.a. after inflation, but before tax, and bank deposits/bills[2] returned 1.84% p.a., on the same basis. Therefore, an after inflation and after tax return of 7.32% p.a. looks highly unlikely and implies very high investment risk.

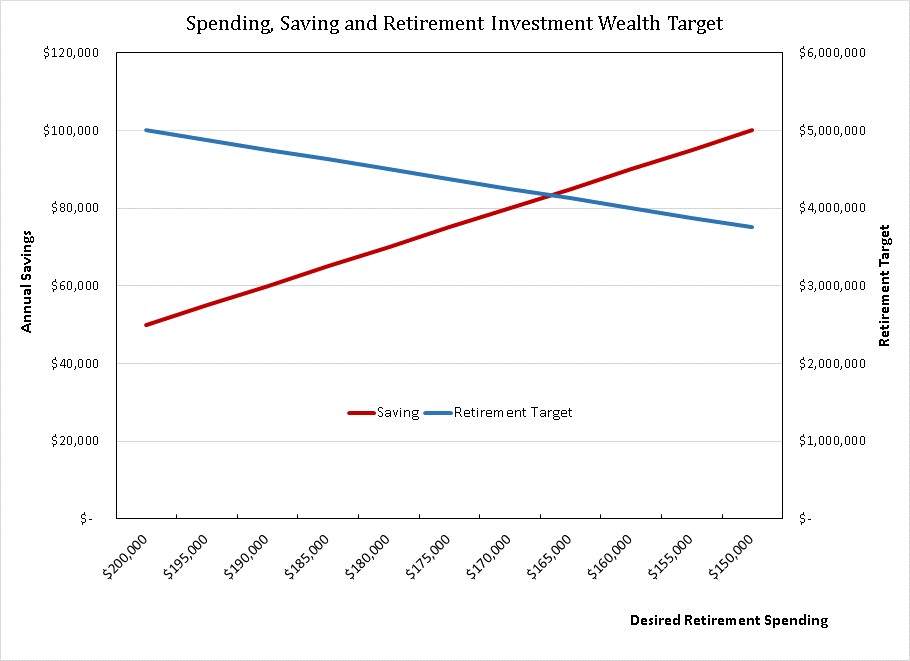

So, if investment returns aren’t the likely solution to the Brights achieving their version of financial independence, they can either reduce cash outflows/increase saving and/or increase cash inflows. First, the chart below, examines how increased saving, that is assumed to translate to a commensurate reduction in desired retirement spending, affects the retirement wealth target (based on the “Rule of 25”).

It shows that as savings are increased from $50,000 p.a. to $100,000 p.a., desired retirement spending falls from $200,000 p.a. to $150,000 p.a. and the retirement wealth target falls from $5 million to $3.75 million.

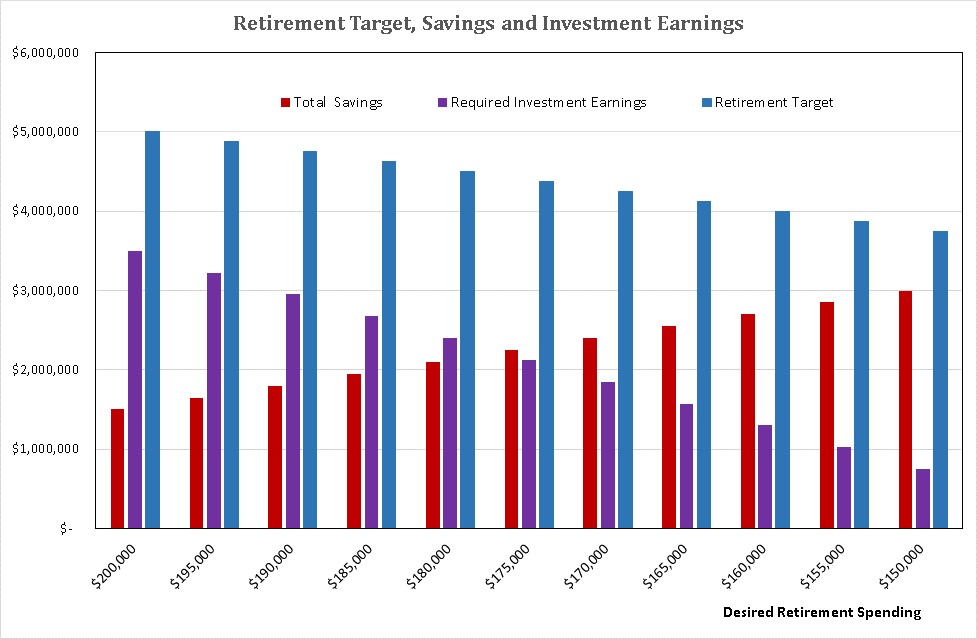

The following chart reveals the total savings over 30 years (red bars) and retirement wealth target (blue bars) for each level of desired retirement spending, with the purple bars showing the implied total investment earnings required.

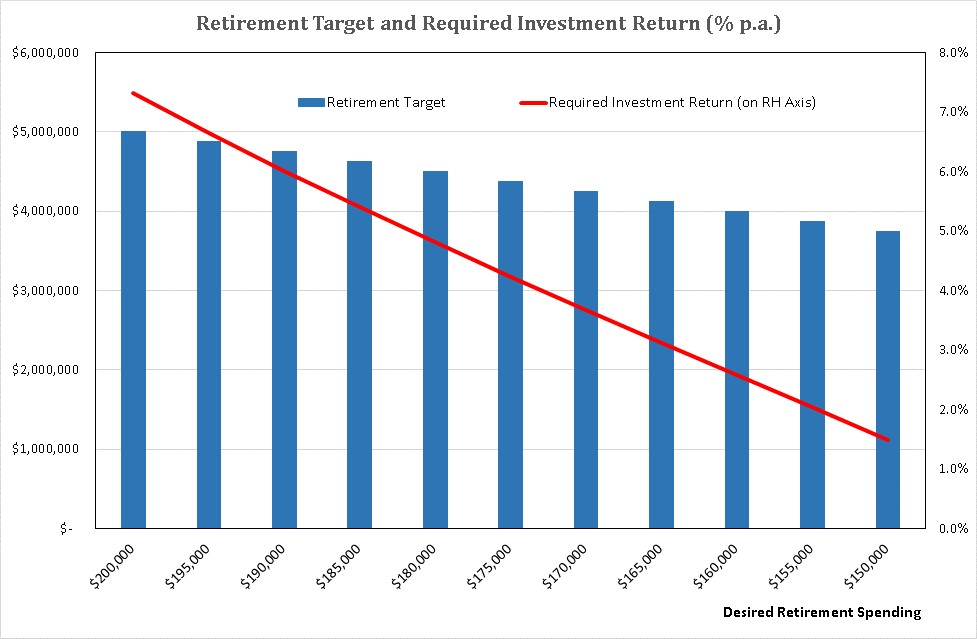

It’s clear that the reliance on investment returns for financial independence falls dramatically as savings rise and desired retirement spending and the retirement wealth target reduces. The next chart translates these required dollar returns to % p.a. returns:

At annual savings of $100,000 p.a. and desired retirement spending of $150,000 p.a., a required investment return of 1.49% p.a. suggests a reasonably low risk investment strategy is likely to be consistent with financial independence.

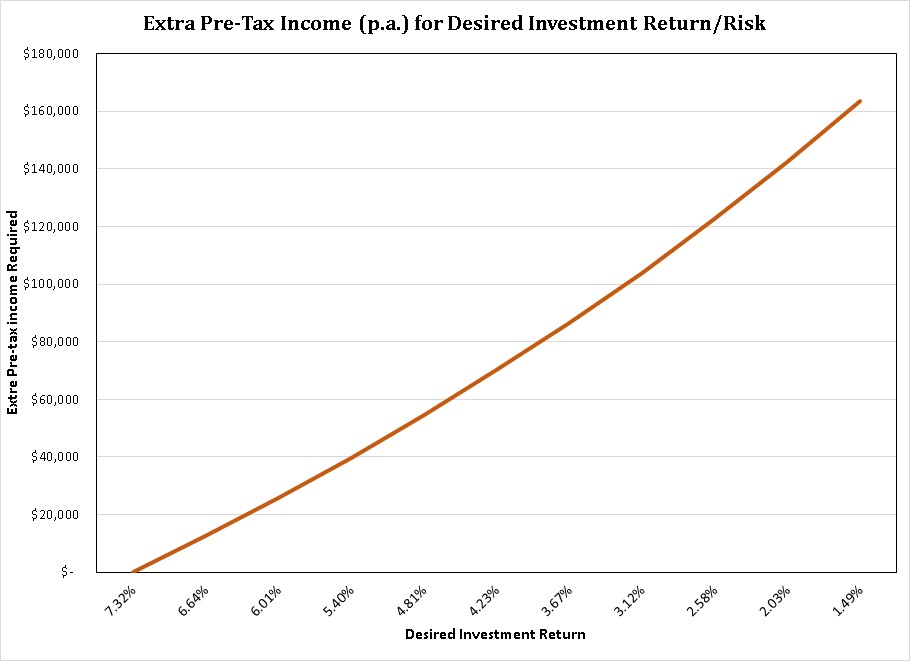

But what if the Brights don’t want to reduce either their current or desired retirement spending to achieve financial independence. How much additional pre-tax cash inflow would be required, for each level of investment risk (as measured by required investment return)? The chart below answers this question, assuming the Brights are on the top marginal tax rate:

It shows that if the Brights were only comfortable with the lowest return / lowest risk investment strategy and were not prepared to reduce their spending, they would need to earn an additional $163,400 p.a. for 30 years to achieve financial independence.

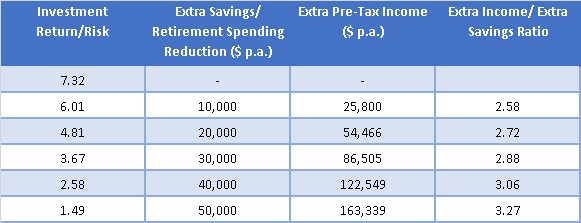

The table below summarises the above analysis, showing the additional savings/reduction in retirement lifestyle or increase in pre-tax income to achieve financial independence, for each level of implied investment return/investment risk:

The final column suggests that for every $1 the Brights don’t reduce cash outflows to increase the chances of achieving financial independence, they need to increase their pre-tax cash inflows by a minimum of around $2.50. This value increases as appetite for investment risk reduces.

Don’t rely on what you can’t control for financial independence

The proposition that the more you focus on what you can control (i.e. your cash outflows) the less you need to rely on uncertain cash inflows and volatile investment markets to achieve financial independence is both simple and powerful. But relatively few embrace it. Often unwittingly, most assume rising cash inflow and adequate investment returns will deliver financial independence without the need for a disciplined long term approach to cash outflows.

Unfortunately, too often we see prospective clients, at or toward the end of high income careers, that have failed to give adequate attention to cash outflow over their working life. Poorly structured, excessive investment risk is being held as the hoped for panacea, but may just be a ticking time bomb that could easily decimate already inadequate retirement plans.