Spending less than you earn provides future choices

A simple but powerful piece of advice that we give to young adults looking to take control of their finances is not to allow salary increases to immediately translate into more expensive lifestyles. We suggest that they save most of any increase, making at most relatively minor adjustments in their lifestyle.

A simple but powerful piece of advice that we give to young adults looking to take control of their finances is not to allow salary increases to immediately translate into more expensive lifestyles. We suggest that they save most of any increase, making at most relatively minor adjustments in their lifestyle.

By heeding this advice throughout their careers, it implies that at the latter end of their working lives current spending and desired retirement spending will usually be much less than incomes. Accordingly, high levels of saving will be available to finance growth in investment wealth.

Also, because lifestyle has not risen in tandem with income, the required investment wealth to maintain a current living standard will be significantly less than had spending been allowed to continually rise with income.

This article uses a simple numerical example to reveal how modest changes in your spending response to income increases made early in, and maintained throughout, your working life can significantly expand future lifestyle choices.

The reward for deferred gratification is more than money

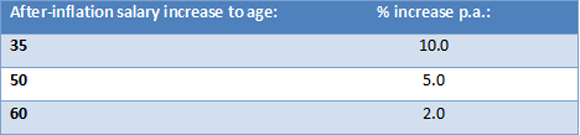

We compare two twenty five year olds, Anne and Sue, both on initial incomes of $50,000 p.a. Both enjoy successful careers, with average after-inflation increases in salary income as shown in the table below:

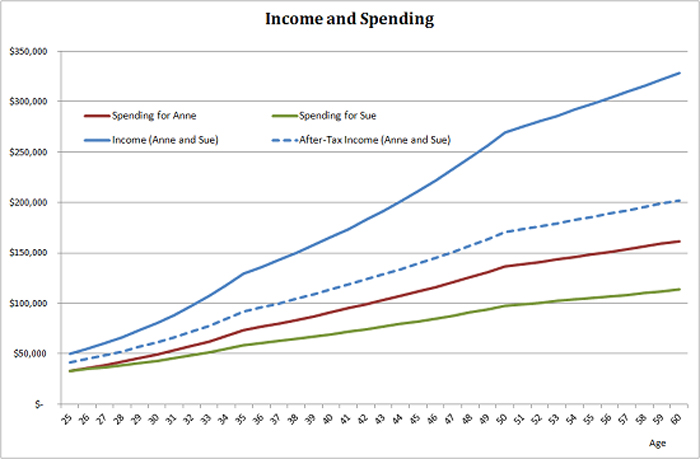

Both initially spend 80% of their after-tax salary incomes and save 20%. Anne spends a constant 80% of her salary after-tax income to age 60. Sue, however, chooses to spend only 50% of any salary increase and saves the rest. Savings, initially assumed zero, are projected to return 3% p.a., after-tax and after-inflation.

The chart below shows salary income and spending for Anne and Sue from age 25 to age 60.

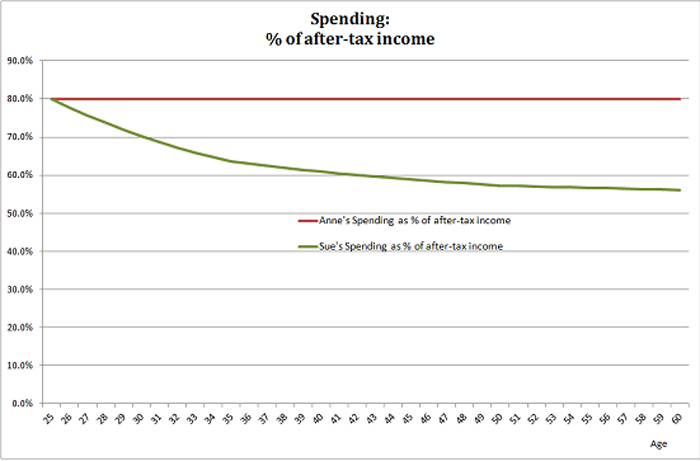

The ratio of spending to after-tax salary income for both Anne and Sue is charted below:

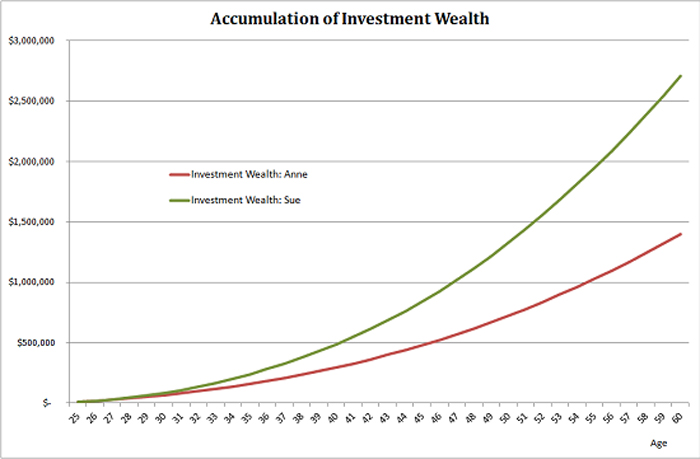

From age 42 onwards, Sue is spending less than 60% of after-tax salary income and, therefore, is saving twice as much each year as Anne. As a result, Sue is able to accumulate almost twice the investment wealth of Anne by age 60, as shown in the chart below:

Of course, to achieve this increased wealth, Sue has led a more frugal life than Anne. Anne may argue that she has led the more “enjoyable” life to age 60 and this certainly is the case if enjoyment is directly correlated with spending.

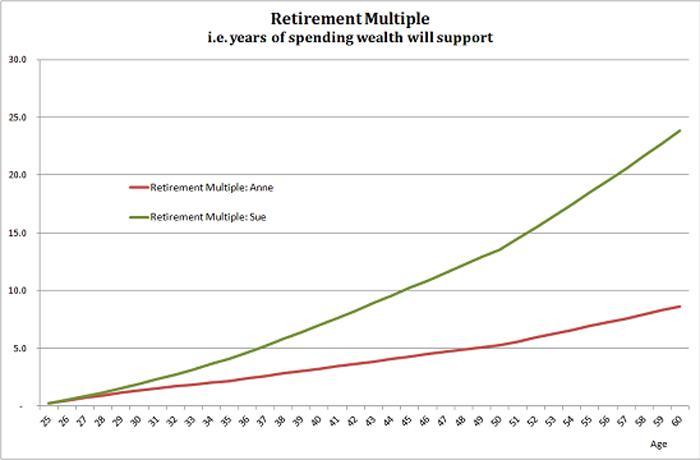

However, at age 60, Anne has no choice but to continue to work for the foreseeable future if she wishes to maintain her current lifestyle. This is revealed in the following chart which shows Anne and Sue’s retirement multiples i.e. the number of years of current spending that investment wealth will support.

Anne’s projected wealth at age 60 will only support about 9 years of retirement spending. For financial independence (i.e. to work by choice, rather than necessity), we prefer to see a retirement multiple above 25.

Anne must either be resigned to working virtually until she drops or be prepared to dramatically reduce her lifestyle in retirement. Using a retirement multiple of 25, Anne’s investment wealth of about $1.4 million at age 60 would support ongoing spending of about $56,000 p.a. This compares with her projected spending of almost $162,000 p.a. at age 60. Such an implied dramatic change in lifestyle isn’t something most people would voluntarily choose.

Sue, on the other hand, is projected to have a retirement multiple that is only a little under 25 by age 60. She is in a very strong position to make choices in the near future regarding whether and for how long she continues to work. Her age 60 spending of about $114,000 p.a. is likely to be sustainable.

Significant lifestyle adjustments aren’t consistent with “a good life”

Most people would like at some stage of their lives to be financially independent. However, this is likely to remain a pipe dream if spending rises in lockstep with increases in income over your career.

Waking up to this reality late in your working life will force some tough choices to be made – either you will have to work much longer than desired and/or wind back lifestyle expectations considerably.

There is simply no getting around the fact that the more you spend today, the less you will have tomorrow. The implication of this for your future lifestyle should never come as a surprise. Abrupt, forced reductions in spending or the late realisation that you will never be able to afford to voluntary retire aren’t consistent with our concept of a good life.

Our aim is to help clients get the maximum enjoyment out of their lifetime wealth. Ideally, this means that they will never be forced to make significant lifestyle adjustments because of a failure to understand the implications of their current, controllable behaviours.

While comprehensive financial planning considers many issues, ensuring that spending doesn’t rise in line with increases in income is invariably a critical success factor. Heeding this discipline is generally good practice both for young adults and anyone who wishes to take charge of their financial future.