Income yields are down, but should you worry?

The last few years have seen a fairly dramatic drop in the income yields obtained from typical balanced (i.e. roughly equal defensive and growth investments) investment portfolios. Reduced interest rates, lower rental yields on property and flat to declining dividend yields on shares mean that many retirees are no longer able to meet living expenses solely from the cash distributions (i.e. the income yield) generated by their portfolios.

There is often a reluctance to sell investments (i.e. draw down capital) to maintain desired spending. Rather, the apparent solution to the shortfall is often seen as higher yielding investments (e.g. higher risk fixed interest securities, including hybrids, high dividend paying shares and other structured products), with there being no shortage of financial product manufacturers happy to respond. However, yield enhancement always comes at the expense of a combination of increased credit risk, reduced diversification and/or increased taxation.

In our view, a focus on income yield results in less than optimal investment behavior. We explain to clients that it is the expected after-tax and inflation total return (i.e. both income and growth) from their portfolios that will determine whether they are able to finance their desired lifestyle. They should construct their investment portfolios to provide them with the highest expected after-tax and inflation total return, subject to the amount of risk they are willing to bear.

The rest of this article examines in some detail the potential tax inefficiency of yield enhancement, revealing that even when investment risk issues are ignored, it may have deleterious consequences for investment wealth. Unless investments are held in a zero tax environment (e.g. the pension phase of superannuation), the benefit of short term cash flow gains is offset by the cost of higher than necessary tax payments.

Unnecessary tax payments are detrimental to your long-term wealth

For purposes of our analysis, we assume a retired couple looking to finance a 30-year retirement, spending $100,000 p.a., growing with a 2.5% p.a. inflation rate, from a $2 million portfolio. The couple has a choice of three investments:

- A fixed interest investment, paying 9% p.a. in income and with no growth, representing an extreme approach to income enhancement;

- A fully franked, high dividend paying, Australian share portfolio paying a 4.5% p.a. cash dividend (i.e. grossed up yield of 6.43% p.a.) and growth of 2.57% p.a., implying a total pre-tax yield of 9% p.a. This typifies the growth portfolios of many self-managed super fund investors; and

- A high growth portfolio, paying zero dividend and with growth of 9% p.a.

The three investment alternatives all have a 9% p.a. pre-tax return. For illustrative purposes, a tax rate of 30% is assumed on regular income, with a 50% discount applying to capital gains. The cost base, for calculation of capital gains tax, is equal to the initial value of the portfolio. Investment risk considerations are ignored.

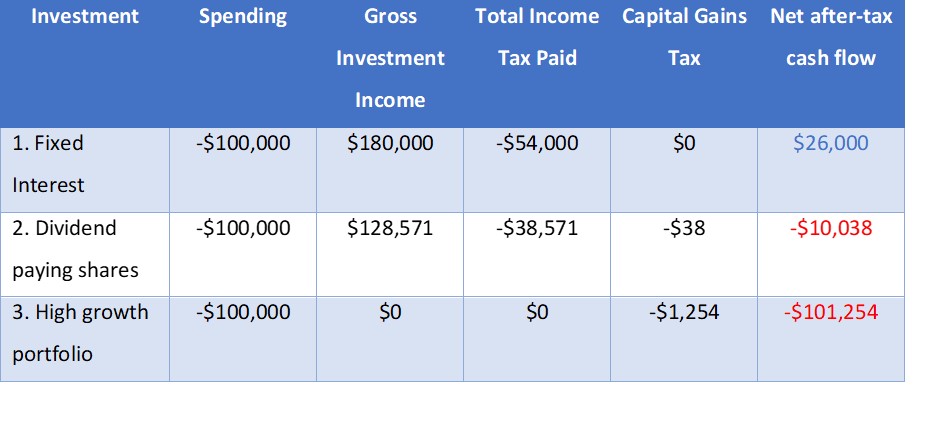

The first-year cash flows for each investment are shown below:

After paying income tax, there is a cash flow surplus with the fixed interest investment, a small shortfall with the dividend paying shares and a $100,000 shortfall for the high growth portfolio. Cash flow surpluses after income tax are reinvested in the relevant investment. Cash flow shortfalls are met by selling sufficient investments to both meet the shortfall and any resulting capital gains tax.

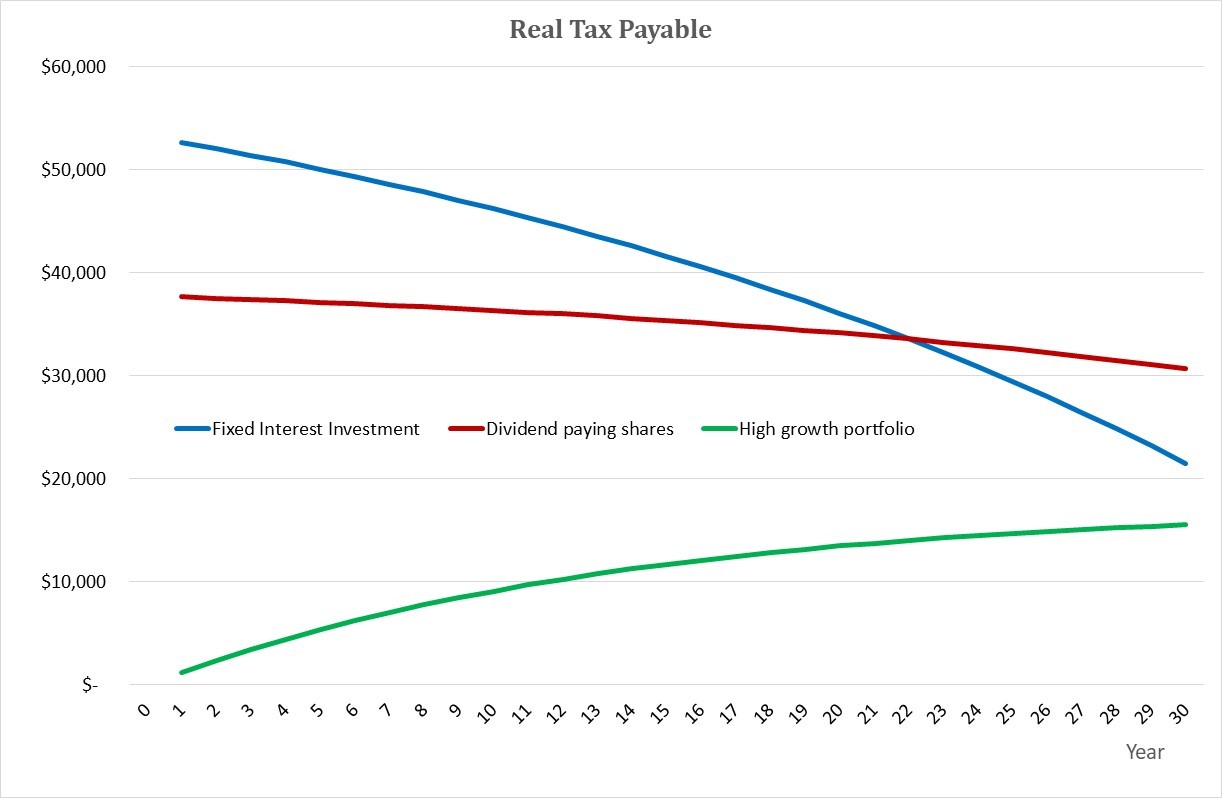

It can be easily seen that investing focused on generating sufficient income to meet spending comes at the cost of considerably higher tax payments. Real (I.e. after-inflation) tax payments for the 30-year period for each investment are charted below:

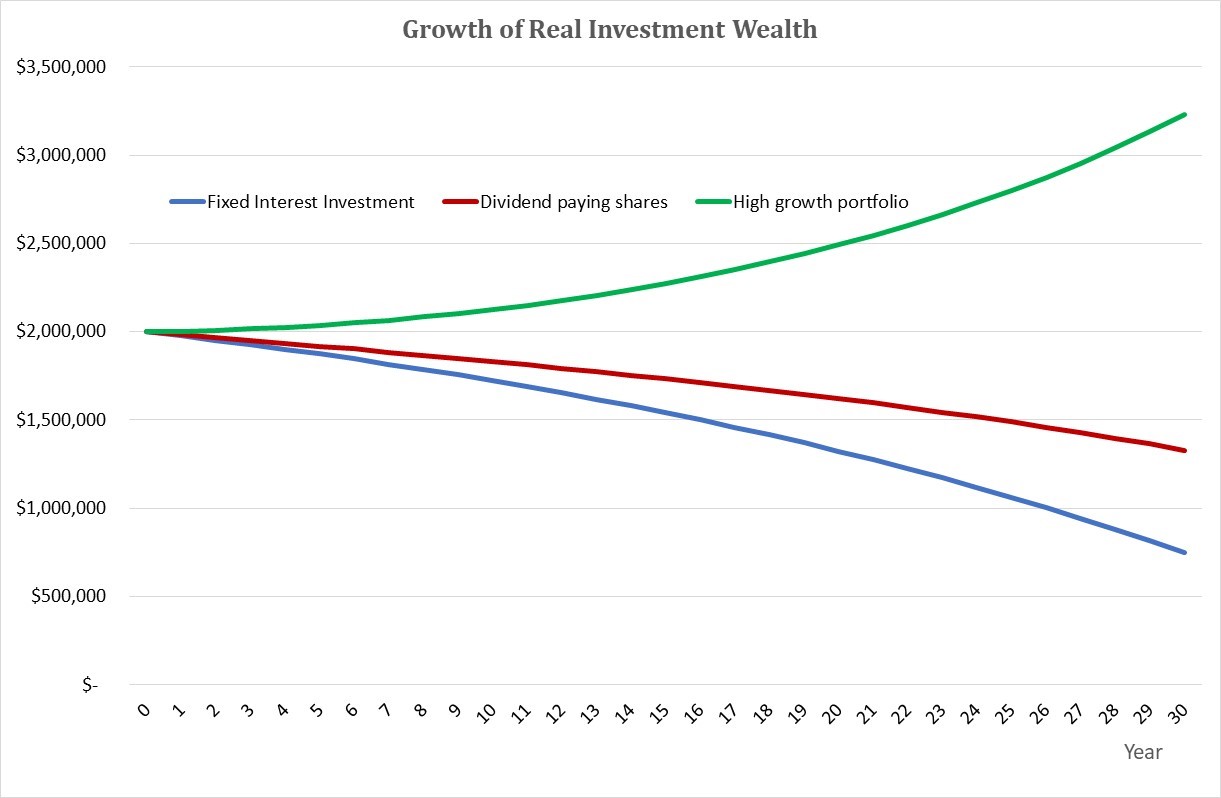

The cost of the high tax expense, associated with the fixed interest investment, to long term real investment wealth is evident in the chart below:

For this scenario, the cost of an income focus is considerable. Now while lower tax structures (e.g. superannuation) will reduce the tax drag, as both wealth and desired spending increase, and superannuation’s share of total investment wealth holdings reduces, tax concerns generally favour selling assets rather than chasing income yield to finance cash flow deficits.

Your investment portfolio’s income yield is a low order priority

One of our investment mantras is that taxation issues should not take precedence over maintaining an appropriate risk exposure e.g. you shouldn’t continue to hold an overly large exposure to a single investment because sell down would result in crystallising capital gains and incurring capital gains tax.

However, we do rank tax concerns over income returns. Cash flow should be met from your total, appropriately structured, investment portfolio as tax efficiently as possible.

If the income distributions generated from this portfolio are insufficient to meet your desired spending, the solution is tax-aware asset sales rather than the addition of investments based purely on their expected income yield. Such investments inevitably come with additional risk (usually, not well understood) and tax concerns that are likely to reduce your chances of achieving your desired financial future.