Two specific applications of the reverse mortgage are examined …

In last month’s article, “The Reverse Mortgage: an underutilised retirement planning tool?” we explained that a reverse mortgage is a potential solution for retirees who both wish to stay in the family home indefinitely and continue to enjoy a lifestyle beyond what their investment wealth is able to support.

Without access to a reverse mortgage, such retirees would be forced to either downsize to free up capital to live on and/or revise their lifestyle expectations downwards. Neither option may be particularly palatable.

In this article, we examine how a reverse mortgage would work in such a situation. We refer to it as the “Maintain lifestyle” scenario. We also discuss a scenario called “Bring forward inheritance” in which a reverse mortgage is utilised to provide assistance to adult children while retired/near retired parents are alive, rather than delay the children’s access to proceeds of the family home until the parents’ death.

“Maintain lifestyle” and “Bring forward inheritance”

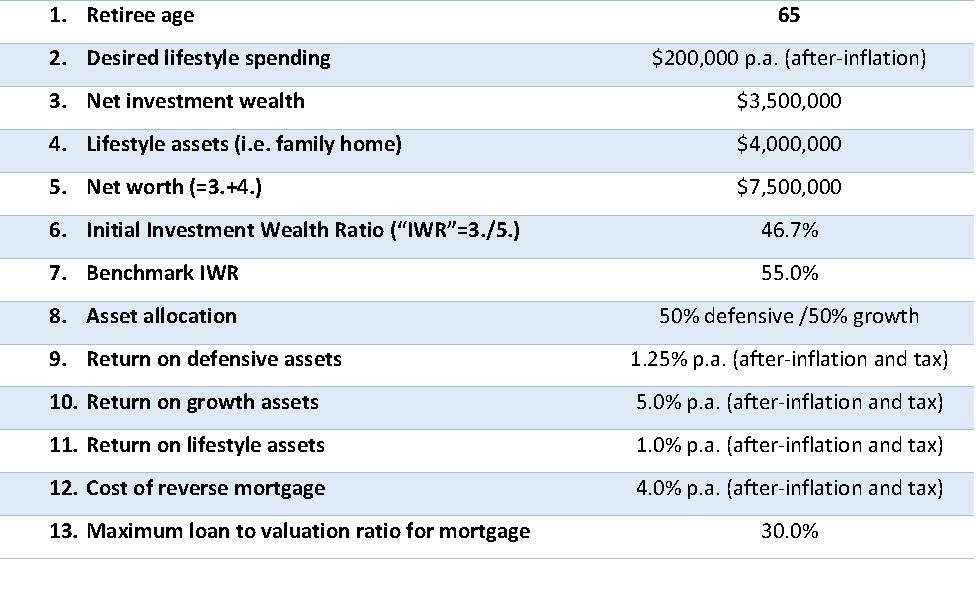

The table below provides key initial assumptions for the “Maintain lifestyle” scenario. The assumed investment returns are typical of those we use in our financial modelling, before we take account of investment return volatility.

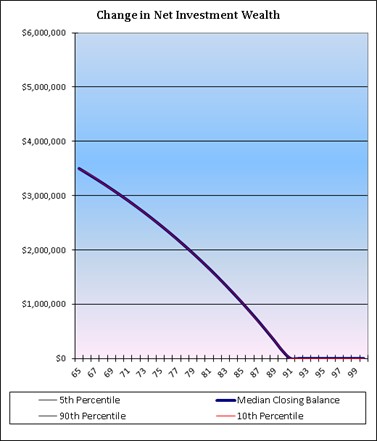

The chart below shows the projected path of net investment wealth to age 100, based on the above assumptions, but before access to a reverse mortgage.

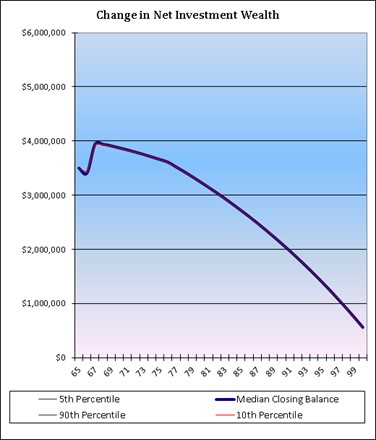

It reveals the retiree would “run out of money” by about age 91 and, at that time, be forced to sell the family home to maintain the desired lifestyle. However, a reverse mortgage would enable the retiree to continue to live in the home and maintain their desired lifestyle beyond age 100, as shown below.

The reverse mortgage modelling assumes the retiree initially borrows sufficient funds to restore the Investment Wealth Ratio (“IWR”) to our benchmark of 55% (calculated assuming the value of lifestyle assets reduce and investment assets increase by the amount borrowed), invests the proceeds based on their desired 50% defensive/50% growth asset allocation and continues to do this each year until the maximum loan to home value of 30% is reached.

The downside of not running out of investment wealth, of course, is that the retiree’s equity in their home is being continually eroded as the balance of the reverse mortgage rises. Although not shown above, for the illustrated scenario the reverse mortgage grows from zero at age 65 to a little over 63% of the value of the home at age 100.

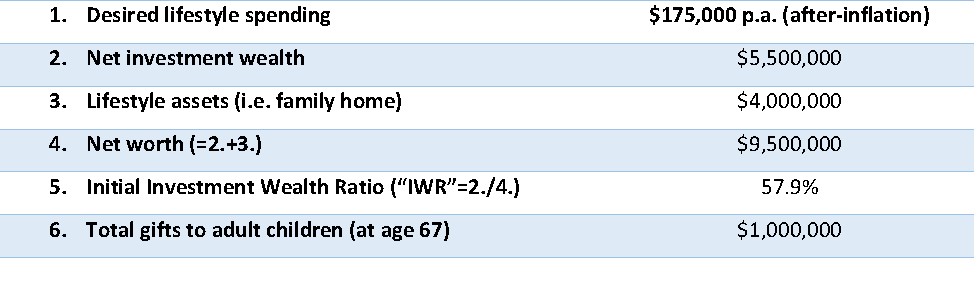

For our second scenario, “Bring inheritance forward”, the retiree couple is considered to have adequate investment assets to meet their desired ongoing lifestyle and be able to live in the family home as long as they want. However, they would also like to be able to assist their adult children to enter today’s expensive housing market.

A reverse mortgage provides a mechanism for effectively bringing forward the proceeds of the family home inheritance that the children would otherwise receive at some unknown time in the future. The borrowed funds are gifted to the children to enable them to afford a house now. Other than the changes shown in the table below, the assumptions for the analysis are the same as those for the “Maintain lifestyle” discussed above:

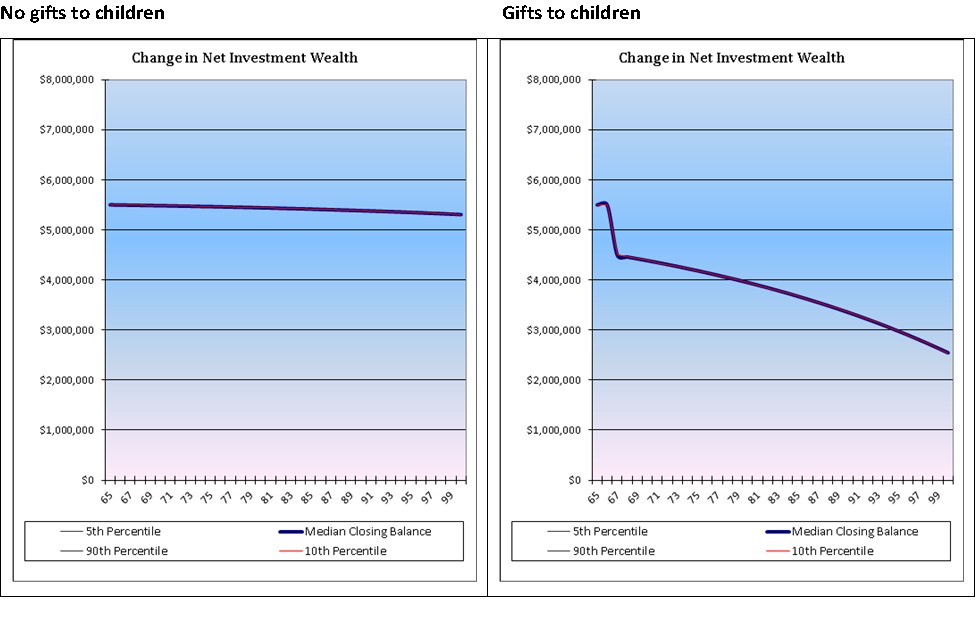

The charts immediately below show the net investment wealth projections, with and without gifts to children, and before consideration of a reverse mortgage.

If $1.0 million is provided to the children, net investment wealth declines considerably but remains positive to the parents’ age 100 suggesting the gift is affordable. But the analysis ignores the impact of investment return volatility.

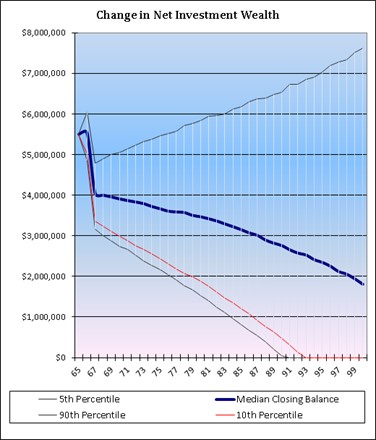

When we assume historically based after-inflation investment returns of 1.5% p.a. and 7% p.a. and typical investment return volatilities of 3% p.a. and 14% p.a. for defensive and growth asset returns, respectively, the investment wealth possibilities look very different. Using a technique called Monte Carlo analysis, we are able to simulate thousands of potential wealth paths, based on generating series of random investment returns using the assumed investment returns and volatilities.

The chart below reveals the wide range of investment wealth possibilities, based on the investment return and volatility assumptions:

It suggests that there is an approximately 14% chance that investment wealth will be totally eroded by the retiree’s age 95. This may be unacceptably high.

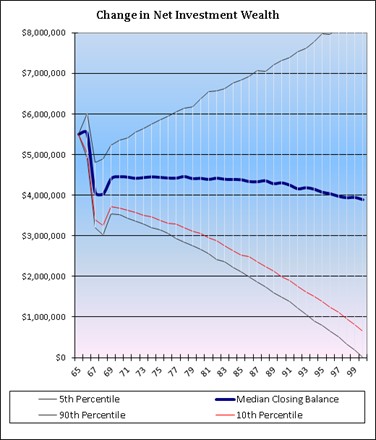

However, the chart below shows with access to a reverse mortgage, utilised as in the “Maintain lifestyle” scenario together with the additional assumption that outstanding mortgage balances are repaid in any year by the amount the IWR exceeds 55%, the risk of running out investment wealth is significantly reduced.

In fact, the risk of running out of investment wealth at age 95 is less than 2%, not significantly greater than the case when no gifts are provided and with no reverse mortgage. Of course, equity in the home is eroded and in very low return environments the loan balance may exceed the home value.

Reverse mortgages for those who see family home as a lifestyle asset

Reverse mortgages are most likely to appeal to those who see the family home as a store of wealth to enhance the family’s lifestyle rather than as an investment that is expected to increase wealth, at the expense of lifestyle.

The option to transfer ownership to the lender as the only source of repayment, when the borrower no longer needs the home, is extremely valuable. Given that Australians’ wealth is heavily concentrated in the family home and their generally inadequate financial preparation for retirement, it is not hard to see the reverse mortgage becoming a more popular retirement and estate planning tool in the future, despite its slow uptake to date.