The “New retirement” is not defined by age

In our previous article, “Re-thinking retirement (Part 1)”, we introduced the view shared by Mitch Anthony, author of “The New Retirementality”, and a growing chorus of ageing experts that the traditional concept of retirement is outdated. It is considered too focused on “money” issues, rather than the potentially more important “life” concerns i.e. what does a happy, fulfilling retirement mean to you.

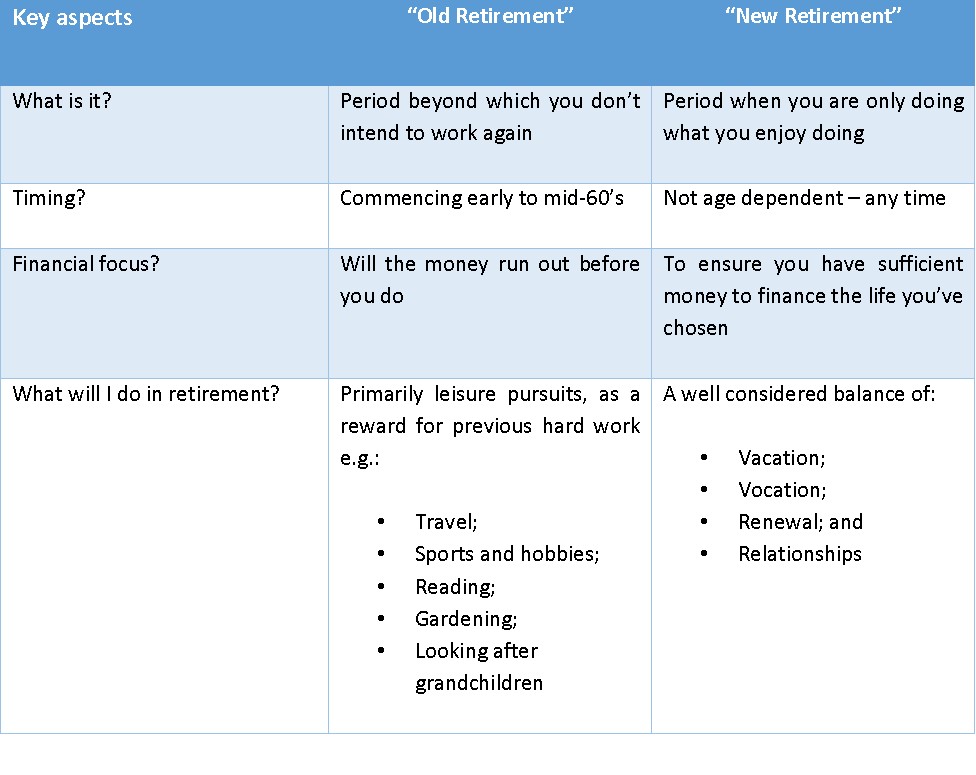

Anthony argues that the “New Retirement”, unlike the “Old Retirement”, should not be age related and necessarily associated with stopping work. Rather, it should be the time when you have put yourself in a position to be able to only do what you want to do. The “money” is a facilitator for a new retirement, rather than an end in itself. As Anthony puts it:

“…it’s not about the money. It’s about doing what you love, doing what you want. It’s about balancing vocation and vacation. It’s about balancing enrichment and relationships.”

The table below contrasts traditional retirement, the “Old Retirement”, with Anthony’s “New Retirement”:

The rest of the article explores aspects of Anthony’s “New Retirement” in more detail.

“Work” is likely to be a component of a successful retirement

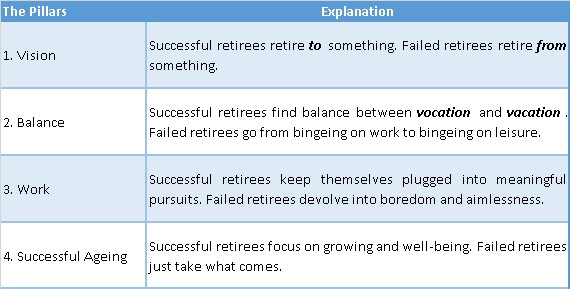

Based on both an increasing body of research and his own observation, Anthony suggest there are “four pillars” that need to be addressed in order to increase the chances of enjoying a “successful” retirement. These pillars are Vision, Balance, Work and Successful Ageing. The table below provides further explanation of the pillars and contrasts “success” and “failure” in their implementation”:

“Work” is an important element of this new view of retirement. While work is what a lot of potential retirees are looking to escape from, it does provide a number of benefits that are often critical components of a successful retirement. These may include challenge, connectivity, creativity, competition, learning, status, relevance and last, but not least, monetary compensation.

But Anthony is not referring to work that you hate doing. In fact, he redefines “work” for the new retirement as:

“An engagement that brings value to others and meaning to me.”

It is something you want to do and does not necessarily require monetary compensation to qualify i.e. it includes appropriate volunteer activities. Anthony observes that if you are doing “work” that you love and you’re also getting paid for, you’re getting a “play cheque”, rather than a “pay cheque”.

As noted in the first table above, a successful new retirement is considered to require achieving a balance of activities across the following four dimensions i.e.:

- Vacation (i.e. Play) – includes leisure, travel and hobbies;

- Vocation (i.e. Work) – helping others, both paid and unpaid;

- Renewal – looking after your physical and mental well being; and

- Relationships – devoting time to family and friends.

While the chosen balance will be different for everybody and is never set in stone, too much emphasis in one area is of potential concern.

Couples will usually find that the emphasis each partner places on the dimensions varies and, sometimes, significantly. It’s worth understanding these differences before heading in to retirement, so that they can be embraced and supported, rather than become a potential source of conflict and resentment down the track.

Diagnostic tools can help plan your “New retirement”

Anthony has developed a number of diagnostic tools to help people plan for their version of a new retirement. In particular, the “Your Life Profile” personalises the “Four Pillars” concepts of Vision, Balance, Work and Successful Ageing. The “My Retirementality Profile” examines your desired balance between Vacation, Vocation, Renewal and Relationships.

While we want our clients to be financially “successful”, and seek to make a meaningful contribution to that success, our ultimate aim is for them to have rewarding lives. A potential disconnect between being financially ready and emotionally ready for retirement is therefore of concern to us. The “New Retirementality” philosophy and accompanying tools will assist clients of any age more deeply explore the retirements they want.