Are you putting the “money cart” ahead of the “life horse”?

In this article, we return to a subject discussed previously in “Retirement planning: more than a financial exercise”, published in January 2013. Its essential premise was that many baby boomers could expect to live significantly longer lives than previous generations. Therefore, a satisfying retirement beginning in your early to mid-sixties not only requires a previously unprecedented focus on financial preparation but also serious consideration of what you are retiring to.

Increasingly, there is also pressure to redefine the concept of retirement. Among others, US retirement and financial planning coach, Mitch Anthony, in his book “The New Retirementality”, argues that the traditional notion of ceasing work in your early to mid-sixties and embarking on a life of leisure is outdated, given both financial and life expectancy realities.

But, more importantly, he observes that for many a successful traditional retirement is likely to result in a less than fulfilling, less than happy third phase of life. The apparent joys of being able to both finance and experience endless leisure are more the creation of finance and travel marketers than the reality for many retirees.

Anthony suggests that outdated ideas around retirement have resulted in us putting “the money cart ahead of the life horse”. He notes that:

“Millions are saving for what might be a 35 year journey with absolutely no idea where that journey may take them … a ticket to ride but no road map. While this may sound appealing, they may soon find themselves lost.”

He contrasts what he calls the “Old retirement” question i.e.

“How will you invest your money so you can retire comfortably?”

with what he considers should be the “New retirement” question i.e.

“How will you invest yourself and your time, as well as your money”.

Our next article looks at Anthony’s view of the “New retirement” in more detail. In the remainder of this article we examine some of the demographic and life expectancy trends that are demanding a rethink of retirement.

Most 65 year olds can expect to live to 85

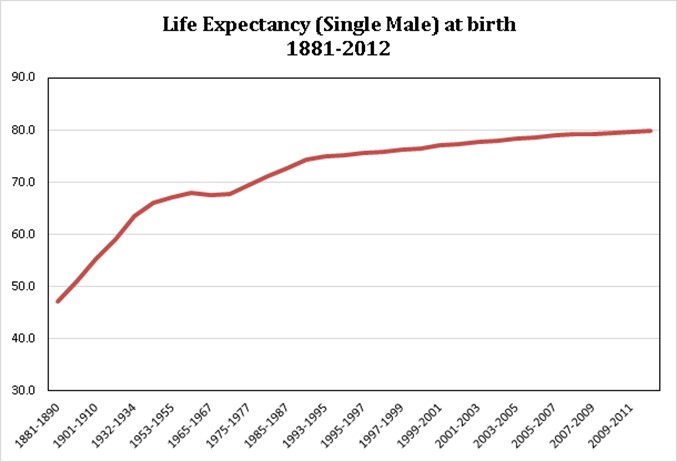

It is common knowledge that life expectancies have been on a long term upward trend in Australia, as illustrated in the chart below for the life expectancy at birth for a single male, over the period 1881-2012[1]:

Over the past 25 years (approximately a generation) to June 2011, life expectancy has increased about 7.2 years from 72.7 to 79.9. But the chart doesn’t reveal what has happened to life expectancies for those at the traditional retirement age of 65.

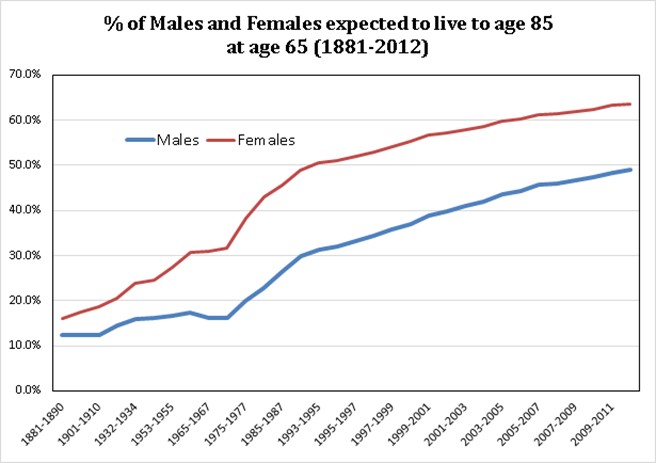

To capture this, the chart below shows the percentages of 65 year old males and females expected to live at least another 20 years (i.e.to 85) over the period 1881-2012:

It reveals that of those aged 65 in 2011, 49% of males and 64% of females were expected to live at least to age 85. The comparable figures for those aged 65 in 1986 (i.e. a generation ago) were 26% and 46% for males and females, respectively.

In terms of actual numbers of people, these percentages implied an expectancy of about 17,000 males and 32,000 females living at least another 20 years in 1986, compared with 50,000 males and 67,000 females in 2011.

Approximately, almost three times as many men and about twice as many women are expected to live at least 20 years beyond age 65 in 2011 compared with 1986. So, retirement at 65 in 2011 means that a 20 year plus retirement period will be a reality for many more people than it was a generation ago.

Managing the “money” and “life” risks of longer lives

How you view the risks of this massive demographic change depends on whether you take a “money” or “life” focus. Those with an eye on the “money” (including financial planners and most retirement commentators) are typically concerned about the implications of such things as:

- increased longevity;

- inflation;

- investment returns; and

- investment return volatility

for the increasing amount of wealth you must accumulate to support a traditional retirement. Our recent article, “The increasing cost of retirement”, discusses such issues.

However, Mitch Anthony’s observations from the US, and with a focus on “life”, indicate the major risks are what he terms the “Four D’s and the big B” i.e.:

- divorce;

- death;

- disability;

- drunkenness; and

- boredom.

No amount of money may be sufficient to offset the negative impact on a long retirement should these “life” risks materialise.

Anthony’s argument is that both “money” and “life” risks can be largely managed by recreating the concept of retirement. We will examine his viewpoint in our next article.

[1] N.B. The horizontal axis is not drawn to scale. Data points are selected based on availability of updates to life expectancy tables.