The “big picture”: Matching your lifetime financial assets and liabilities

Most people don’t really grasp what we regard as the primary purpose of personal financial planning. As a result, they often fail to identify some long term issues that should significantly influence their current decision making.

Personal financial planning is often viewed as having three increasing levels of complexity or sophistication. They are:

- Financial planning as investment advice – those without experience of financial planning usually associate it primarily with providing advice on investments. Some planners, while paying lip service to the more sophisticated levels of financial planning, also see their key role as advising on and managing investments;

- Financial planning as technical advice – while also providing investment advice, planners provide advice of a more technical nature in areas such as superannuation, taxation, insurance and estate planning; and

- Financial planning as strategic advice – more generally known as comprehensive or lifestyle planning, detailed long term cash flow analysis examines the consistency of a client’s lifestyle objectives with their current and projected financial resources. Relevant investment and technical advice is also provided to increase the chances that any gap between the client’s current and desired position is closed with no more investment risk than is necessary.

Successful implementation of the strategic advice approach usually implies the need for the financial planner to also act as a “money coach” to help clients avoid behaviours that may feel emotionally appropriate but are objectively likely to be inconsistent with achievement of their objectives. Some planners go even beyond this level, seeking to ensure that clients stay committed to their objectives by attempting to align those objectives with revealed deep seated values.

We are definitely in the “Financial planning as strategic advice” camp but often feel that with increasing complexity the “big picture” purpose of personal financial planning can easily be lost. That “big picture” is, in our view, to help you achieve a desirable match between your financial assets and liabilities over your lifetime.

While simple to state, the reality of many moving parts means success can never be guaranteed. However, some “back of the envelope” calculations based on this high level view of personal financial planning can often reveal some key potential issues, particularly for those early in their careers. The rest of this article provides an illustration.

Is there a gap between your lifetime financial assets and financial liabilities?

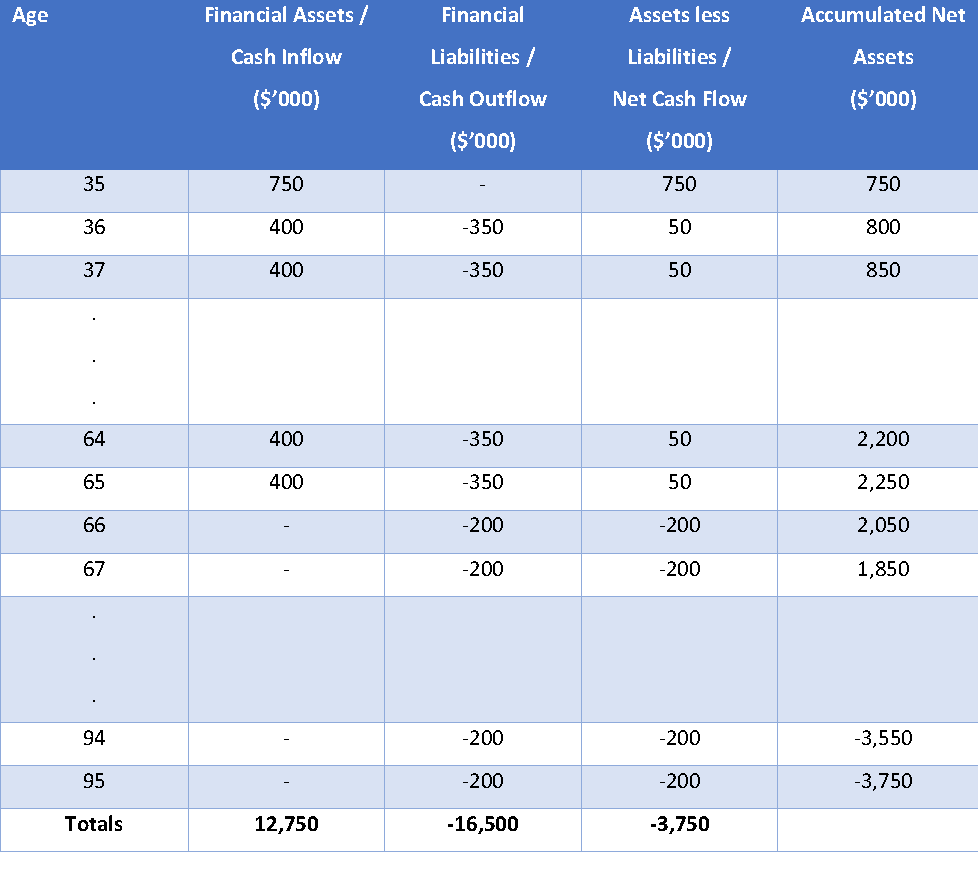

While the example discussed below is fairly unrealistic, the messages drawn remain generally valid. We assume a household, the Martins, with a 35 year old major breadwinner. The Martins currently have assets of $0.75 million and no liabilities. They rent a property that meets their projected lifestyle needs for $60,000 p.a. They have an intended retirement date of age 65 and want to be able to finance a 30 year retirement to age 95.

Their projected lifetime financial assets comprise current net financial assets plus:

- their expected household earnings to age 65 – we assume $400,000 p.a., growing with inflation;

- access to either employer sponsored defined benefit and/or age pensions – we assume zero; and

- any inheritances/windfalls received – we assume zero.

Projected lifetime financial liabilities consist of any existing debts, plus:

- taxes on earned and pension income – we assume $150,000 p.a., growing with inflation, to age 65;

- desired lifestyle spending – including rent of $60,000 p.a., we assume $200,000 p.a., also growing with inflation, to age 95; and

- any desired estate – we assume zero.

The table below details these projections and provides total projected financial assets and liabilities (all in after-inflation or real dollars):

Based purely on an assessment of their current circumstances, the Martins appear to be doing nicely – at age 35, they have accumulated $0.75 million, live a nice lifestyle and are still able to save $50,000 p.a., after rent. However, the above simple high level analysis reveals a major potential long term issue that should be addressed immediately i.e. lifetime financial liabilities exceed lifetime financial assets by $3.75 million!

While a well-considered investment strategy and sound technical advice can be expected to assist to close the identified asset-liability gap, the high level view isolates what should be obvious, but often isn’t: the Martins’ work and lifestyle expectations are the primary determinants of their projected financial future.

To at least partially close the gap, and to reduce the reliance on any appropriate technical strategies and uncertain investment returns, the Martins must either increase their financial assets and/or decrease their financial liabilities. The alternatives include:

- looking at ways to earn more, including investing in the acquisition of new skills (i.e. investing in your human capital);

- working longer;

- spending less; and/or

- buying or renting less expensive accommodation.

The asset-liability framework reveals potential changes only you can make

The “big picture” asset and liability matching approach often reveals potential financial planning issues that may not otherwise reveal themselves until well into the future. It provides a simple, yet powerful, framework to understand and consider what changes should be made immediately to reduce the probability of having to make unpalatable adjustments “down the track”.

It also highlights what should be obvious: that your objectives and behaviours are key determinants of the whether your desired financial future is achievable. While sound technical advice and a disciplined investment strategy, that is effectively implemented, are also essential ingredients for “success”, they are unlikely to be able to reliably compensate for objectives and financial behaviours that imply a large, unfavourable mismatch of your long term financial assets and financial liabilities.