You insure your car, don’t you?

Most people insure their motor vehicles, their homes and their home contents. These are valuable assets that, in the event of various catastrophes, they want to be able to replace or repair without significant financial loss.

But when it comes to what is many people’s most valuable asset – their ability to earn future income – they are woefully positioned to cope financially with catastrophe. Research completed in 2006 indicated that only 55% of Australian families had any life insurance, with an even lower 31% having income protection.

Even for those with some personal risk protection, the amount of cover is generally inadequate. There are numerous reasons for this unwillingness to adequately insure, including such “rationalisations” as:

- I’d prefer not to think about negative possibilities;

- I’m healthy, it won’t happen to me;

- I’m covered by my super, workers compensation, health insurance, “the government” etc;

- Insurance is just too expensive.

We help our clients achieve their version of financial independence. But no family can ever consider itself financially independent if the death or disability of a family member requires a significant adverse change in lifestyle expectations, due to inadequate financial resources.

The reality is that many families, particularly those with breadwinners early in their careers, just cannot afford not to purchase personal risk insurance. And sometimes lot’s of it, as we discuss in the case study below.

A life insurance case study

Let’s consider the hypothetical case of Mr John Professional. John is 35 years old and intends to work until age 65. He is the expected sole income earner in his family, also comprising his wife and two young children. The Professionals currently have no net investment wealth – all their current wealth is tied up in lifestyle assets (i.e. residence, cars etc).

Listed below are some other assumptions relevant to considering John’s life insurance requirements:

| Current income after-tax (in today’s dollars): | $300,000 p.a. |

| Growth in after-tax income (after-inflation): | 1.50% p.a. |

| Family lifestyle expenditure (in today’s dollars): | $200,000 p.a. |

| Retirement expenditure (in today’s dollars): | 75% of pre-retirement expenditure |

| Growth in expenditure (after-inflation): | 1% p.a. |

| Family expenditure if John dies: | 80% of Family lifestyle expenditure estimate |

| Investment return (After-tax and inflation): | 3% p.a. |

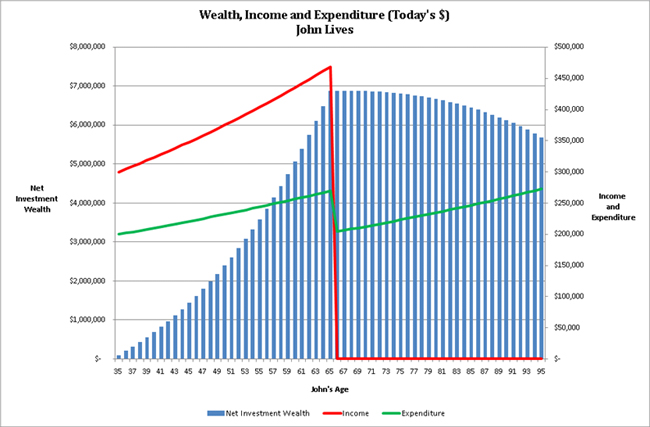

The following chart shows what happens to income, expenditure and investment wealth, assuming the Professionals’ lifestyle expectations are not affected by personal catastrophe.

It shows the Professionals will accumulate a peak investment wealth of about $6.9 million that is gradually run down to finance a desired lifestyle in retirement. Everything’s rosy. However, if John were to die tomorrow, a large future expenditure requirement would remain without the valuable asset of John’s income to support it.

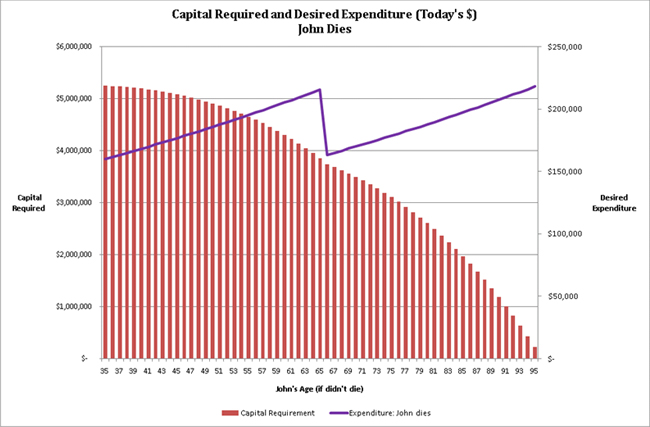

The chart below shows:

- Desired annual expenditure, if John dies; and

- the total capital sum required to fund the family’s spending in each future year. With no investment wealth, it is the amount of life insurance needed so the family can finance its lifestyle expectations.

An initial term life insurance requirement of $5.25 million is indicated! Often, the reaction to such analysis is first, disbelief with the amount and, second, “I can’t afford that”. But any lesser sum would require John’s family to make adjustments to their lifestyle expectations (out of financial necessity). And John can easily afford it, as we examine below.

What is the cost of life insurance?

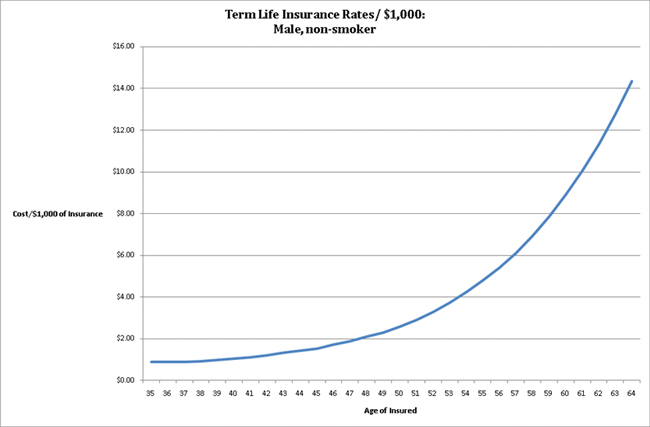

The table below shows the cost of insurance for a healthy, male non-smoker, at various ages as quoted by a prominent life insurance provider.

It shows insurance costs accelerate rapidly with age. For example, $5.25 million of life insurance, at age 55, would cost over $25,000 a year. And, if the insurance is held outside superannuation, this is the after-tax cost i.e. it consumes almost $47,000 of a top marginal tax rate payer’s pre-tax income!

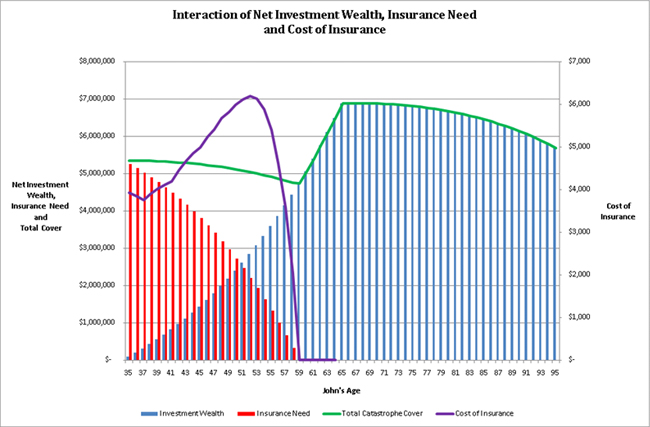

But this does not reflect John’s position. If all goes to plan, the insurance need declines with age as:

- Investment wealth increases; and

- Future expenditure requirements decline.

The chart below shows the interaction of insurance need and investment wealth. To about John’s age 59, the green line represents the capital sum required to meet the family’s lifestyle in the event of John’s death. It is met by a combination of insurance and increasing investment wealth. Initially, it can only be met by insurance but, by John’s age 59 and beyond, investment wealth alone is sufficient to meet the family’s expected requirements.

The purple line and right hand axis show the cost of meeting the declining insurance need. It rises to a peak of a little over $6,000 p.a. at John’s age 52 and then reduces rapidly as investment wealth overtakes insurance as the primary means to support desired lifestyle expenditure if John were to die.

Life insurance: the gamble you expect and want to lose

In fact, the lifetime cost of cover is about $82,000 or only 1.2% of the Professional’s projected peak investment wealth, assuming no catastrophe. It is easily affordable.

Insurance is a gamble that you both expect and want to lose. But for most people, it should not be a difficult decision to allocate 1.2% of expected investment wealth to avoid financial disaster for the family if the major breadwinner dies with no or inadequate insurance.

1 Comment. Leave new

good post , very informative with lots graphs which make it easy to understand , thanks mate