Super reforms will hit the “wealthy”

Super reforms will hit the “wealthy”

On 5 April 2013, the Minister for Financial Services and Superannuation announced a number of proposed changes to superannuation. This followed a period of intense speculation regarding what changes were being contemplated by the Government and widespread concerns that the benefits of saving for retirement in the super environment could be significantly eroded.

The major proposed reform, and the focus of this article, is that from 1 July 2014 the tax exemption for earnings on superannuation assets supporting pension income streams will be capped at $100,000 p.a. (adjusted for inflation). The Minister observed that:

“For superannuation assets earning a rate of return of 5 per cent, this reform will only affect individuals with more than $2 million in assets supporting an income stream.”

While justified as necessary to ensure the superannuation system was “fair” and “sustainable”, the proposal was criticised as a form of class welfare as it was clearly aimed at “the wealthy”, as measured by the size of superannuation balances.

In this article, we examine what implementation of the reform will mean for those with superannuation balances of $2 million and above. In summary, they will continue to be far better off than they were prior to the “Simple Super” reforms that were introduced in July 2007. Superannuation will remain a tax effective investment environment, but a little less generous than previously.

But how much worse off will the wealthy be?

Our analysis compares three pension regimes:

- Pre-2007, when earnings on funds supporting pensions were tax exempt but the pensions themselves were taxed as ordinary income. A rebate of 15% was provided on pension income derived from balances up to the lump sum reasonable benefit limit (“RBL”) – in 2014 dollars, this would equate to about $917,000. Pension income earned from balances in excess of the RBL didn’t receive any tax concessions;

- Post-2007 – for those aged over 60, earnings on both funds supporting pensions and pension income were tax exempt (and remain so for pension income, under the proposed reforms); and

- Proposed change – earnings on funds supporting pensions in excess of $100,000 are taxed at 15% [1.]. This is an additional tax at the fund level, rather than on pension income.

We initially examine how a 60 year old retiree, beginning with total investment wealth held as a $2 million pension balance, would fare under each regime, assuming:

- Income and growth returns, both 4% p.a., on the fund balance;

- Inflation of 3% p.a.;

- Minimum and/or most efficient pension withdrawals [2.];

- Constant real expenditure equal to 4% of the initial pension fund balance i.e. $80,000 a year; and

- Drawdown of the residual pension fund balance at age 90.

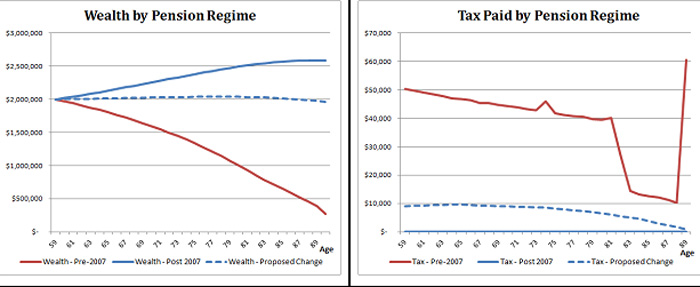

The charts below detail the change in wealth and tax paid, in today’s dollars, under each regime:

The first obvious feature to note is how much better off our retiree is under both the Post-2007 and Proposed Change regimes, compared with the Pre-2007 regime – the “Simple Super” reforms were very generous. At age 90, the illustrated benefit is over $2 million and reflects the much higher and ongoing tax paid on pension income in the Pre-2007 regime.

The analysis tends to support the Minister’s contention that those with balances below $2 million will be little affected by the proposed change. In the example above, there is a relatively small amount of tax paid, mostly on the capital gain on withdrawal of the total pension balance at age 90. Under current arrangements, there would be no tax payable on such a withdrawal.

However, the Minister’s conclusion is highly dependent on how the return on funds is distributed between income and growth. If, for example, rather than 4% p.a. income and growth, the return comprised 8% p.a. income only [3.], the Proposed Change regime projected wealth falls well below the Post – 2007 regime projection, as shown in the chart below.

The deterioration reflects the drag of regular tax payments. But the Proposed Change scenario remains superior to the Pre – 2007 scenario.

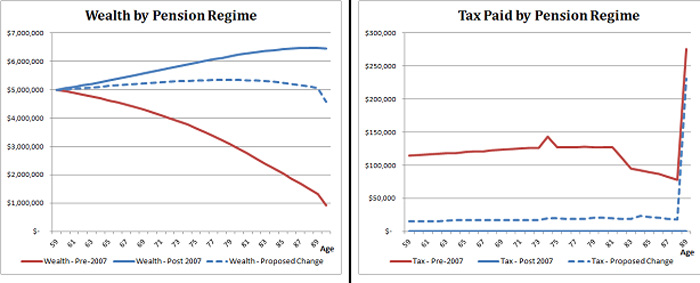

Finally, we compare the regimes based on a considerably higher $5 million initial pension balance, maintaining our other original assumptions. The results are shown in the charts below:

The excess income return (i.e. over $100,000 p.a.) on the larger balance results in ongoing tax payments in the Proposed Change scenario and a considerably lower projection than for the Post-2007 case. But the retiree remains in a much better position than would be the case if the Pre-2007 arrangements had remained in place.

Reforms don’t appear to justify abandoning super

If implemented, the proposed super change will make super a little less generous than it currently is, from a tax viewpoint. It will also lead to more complexity and a flurry of “clever strategies”, some almost certainly counterproductive, designed to minimise taxable income.

However, in our view, the proposed reform will not undermine the appeal of superannuation as a very attractive investment environment. Compared to the alternatives currently available, it does not justify abandoning superannuation.

[1.] It is assumed that the 1/3rd capital gains discount will continue to apply. In this article we have assumed all capital gains are taxable. The proposed reform provides some relief on assets held prior to the 1 July 2014 start date.

[2.] In practice, in the pre-2007 regime superannuation may not have been the most tax effective environment to hold balances supporting allocated pensions in excess of the lump sum RBL. Therefore, the examples provided may not be consistent with strategies actually implemented for this period.

[3.] This could occur for portfolios that are traded frequently and realise all earnings (both income and capital) each year. Such actively managed portfolios would also miss the benefit of the capital gains tax discount.