Pdf Version – Property Investing – Listed or Unlisted

The Government’s plan to provide a rescue package to help the ailing commercial property sector has sent shivers down the spines of many investors. The package is driven by the fear of property trusts being unable to refinance their short term debt. Most notably, the probability of refinance by foreign lenders, who are coping with their own problems at home, is considered to be quite low.

The Government’s plan to provide a rescue package to help the ailing commercial property sector has sent shivers down the spines of many investors. The package is driven by the fear of property trusts being unable to refinance their short term debt. Most notably, the probability of refinance by foreign lenders, who are coping with their own problems at home, is considered to be quite low.

The implications of not being able to obtain funding (i.e. re-financing) are that property assets may have to be sold in a short period of time. This is likely to result in ‘fire sale’ prices for those forced to sell. The concern for those not forced to sell is that these sales are likely to drive down the valuations of all properties which may trigger covenant breaches on existing loans that are not due for re-finance. It may also have an impact of the value of residential property as both commercial and residential property markets, while different, are based on the valuation of land. This would then affect the banks and the wider community.

But would this be such a dilemma if the properties were valued at their current market sale price?

It seems that the current dilemma is an issue that has arisen as a result of property managers being reluctant to value their properties at or near actual market values. Surely, if they were valued at close to market value the prospect of a quick sale would not be such a current issue. It would certainly cause a fair bit of pain to re-value these assets but it would allow investors and lenders a far more transparent view of the situation.

The lack of sales is quite evident. Sales of commercial property (i.e. office, retail and industrial) totalled $16.5 billion in 2007 compared to only $5 billion for the equivalent period last year.[1] This seems to highlight the fear property managers have of selling their assets to provide liquidity. It also highlights their reliance on bank funding as their only alternative.

A number of unlisted property trusts have frozen investor redemptions on the basis that selling properties now would not generate proceeds that reflect the ‘fair’ value of the properties they

hold. Their solution is to stick with their ‘fair’ valuations in the hope that things improve within the next few months to enable sales to occur at prices that are closer to their book values. It basically confirms that they believe their own valuations are optimistic.

But what about the listed property sector?

The value of these property trusts is driven by the market price of their units. This is driven by market sentiment about the sector and each participant. It is not based exclusively on the book value of their property assets.

This has been the worst performing sector of the market over the past year. The question is will it get worse given the dire expectations for commercial property?

Well, the short answer is that it could. However, it seems that the listed property trust sector, while on the surface being a much poorer recent performer than unlisted commercial property and residential property, has taken a lot more of the downside on the chin. The market sentiment, which takes into account the current re-financing risks, is already being factored into the prices of the listed sector. Those securities that have been unable, or considered unlikely, to obtain refinance have already been severely downgraded by the market.

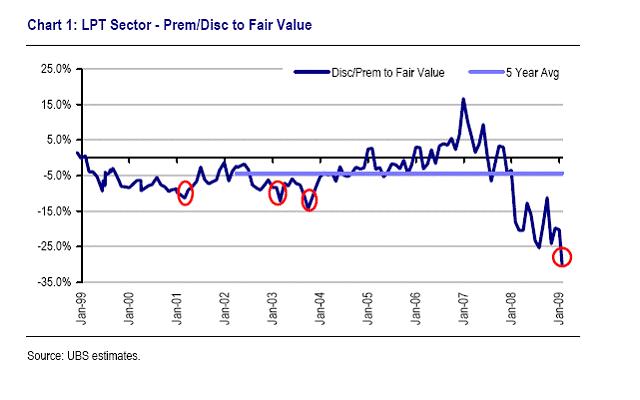

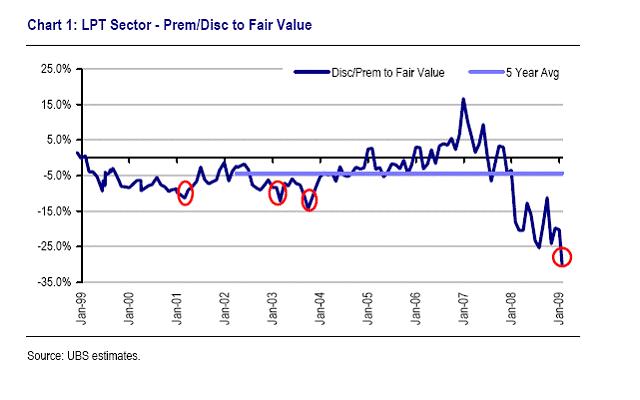

The table below is a telling one. It shows the comparison of the book value of property assets for the listed property trust sector compared to their market value.

A premium indicates that the market’s value of the pool of property assets is greater than the book valuation of these assets. A discount indicates that the market’s valuation is lower than the book values.

Currently, the market is valuing the sector at a 30% discount to the book value of its assets. This compares to the 5- year average of a 5% discount.

However, the unlisted trust sector is still valuing itself based on book value, with valuations of some properties as much as two or three years old. The concern is that funding problems will force asset sales in thin markets, exposing the yawning gap between book value and market reality.

So, should you still be investing in property?

We believe there is still a place for property in an investor’s portfolio. We make the following observations:

1. Property provides a good addition to any growth portfolio. It’s correlation to other asset classes is relatively low and it therefore continues to add diversification benefits;

2. Broad diversification within the property sector is preferred to a concentrated exposure;

3. Listed Property exposure provides more liquidity than unlisted exposure and/or direct property exposure. The listed mechanism provides investors with the opportunity to buy and sell partial exposures and provides a transparent price at all times. This considerably improves an investor’s ability to manage their risk exposure. It does however come with a higher degree of price volatility. As stated in previous articles, this is more a factor of the frequency of valuation rather than a difference in the underlying assets;

4. Based on the above discussion, it would appear that on a relative basis listed property has more upside potential than unlisted and direct property exposures. This does not imply that we are forecasting the listed property sector to have bottomed (although with time that may prove to be the case), it is simply better placed on a relative basis. For those with both listed and unlisted/direct exposure and a concern about an over weighting in the property sector, reducing your unlisted and/or direct exposure first is considered a more prudent option.

Summary

The listed property sector has experienced a significant and severe shakeout over the past 12-15 months. Whether this will continue is anyone’s guess. The current market for listed property securities (and all listed securities) reflects investor expectation of the future. For prices to fall further, those already negative expectations would have to worsen.

The fortunes of unlisted and direct property sectors are equally difficult to predict. However, it appears that they have not adjusted to market realities evidenced by the performance of the listed sector. On a relative basis, the listed sector appears to have more upside and far more flexibility than the unlisted and direct sectors.

[1] According to David Rees, Research Director at Jones Lang La Salle. Note: the figures were for the 9 months to September.

2 Comments. Leave new

http://www.theaustralian.news.com.au/business/story/0,28124,25810583-36418,00.html

This article “Two listed trusts write down assets worth $500m” | The Australian, discusses two listed property funds that dramatically devalued their property holding values. Their listed price however remained essentially unchanged. It highlights that fact that listed “market” prices reflect current expectations (even before they are formally reported). Unlisted structures have no pricing mechanism for reflecting this information. Their price is determined by their own asset valuations, which (as highlighted in this article) can be subject to gross mis-pricing via over (under) valuation. The listed structure is a far more transparent structure.

A recent article in the Money section of SMH yesterday (see http://www.smh.com.au/news/business/money/investment/playing-the-weighting-game/2009/08/17/1250362027592.html) seems to confirm the ideas and concepts you highlighted in your Januray article. As they stated – “there are not great dissimilarities between the two and that, ultimately, unlisted and listed property markets will produce similar performances over rolling 10-year periods.” It would seem foolish to think otherwise.