Most investors should hold a combination of defensive and growth assets

Most investors should hold a combination of defensive and growth assets

In our last article, we explained why we don’t think that the past five years of poor share market investment performance provides sufficient evidence that the investment world has changed i.e. we don’t yet believe there has been a paradigm shift.

We also suggested that while cash (as a proxy for defensive assets) helps to provide some short term downside protection for an investment portfolio, over the long term (i.e. greater than 20 years) shares (as a proxy for growth assets) are more likely to ensure portfolio value is maintained, in real terms, with significant potential upside.

But, as we explained, most retirees don’t have the luxury of waiting 20 years or more to see if a 100% share portfolio that has dropped significantly in the first few years of retirement will eventually recover all its real losses. And, except for accumulators with very high risk tolerance, few investors have “the stomach” to hold an all share investment portfolio through markets like those experienced over the past five years.

For most investors, the decision is not just cash or just shares, but some combination of both that reflects their appetite for risk, capacity for risk and need to take risk (i.e. as guided by their lifestyle objectives). In this article, we use the same analysis as the previous article to examine the (primarily downside) characteristics of the following three portfolios, comprising combinations of both cash and shares:

- 75% cash/25% shares (the “75/25” portfolio);

- 50% cash/50% shares (the “50/50” portfolio); and

- 25% cash/75% shares (the “25/75” portfolio).

The cash and shares combinations behave differently

The table below provides the same statistical information for the portfolios, as previously provided for US shares and cash, for the 86 year period from July 1926 – June 2012:

| Investment | Compound Annual Return (After-inflation) % | Annual Average Return (After-inflation) % | Volatility % |

| Shares | 6.7 | 8.3 | 19.3 |

| Cash | 0.5 | 0.5 | 1.8 |

| 75/25 | 2.3 | 2.4 | 5.1 |

| 50/50 | 4.0 | 4.4 | 9.7 |

| 25/75 | 5.4 | 6.4 | 14.5 |

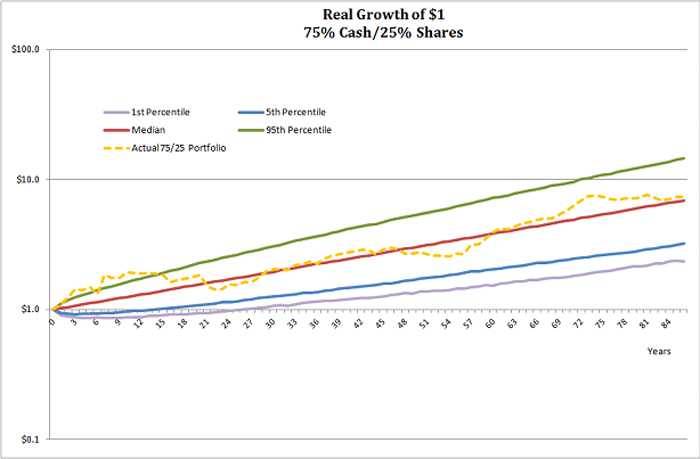

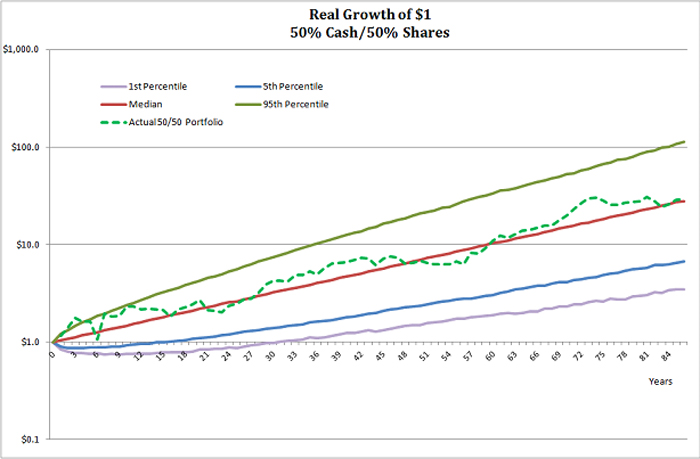

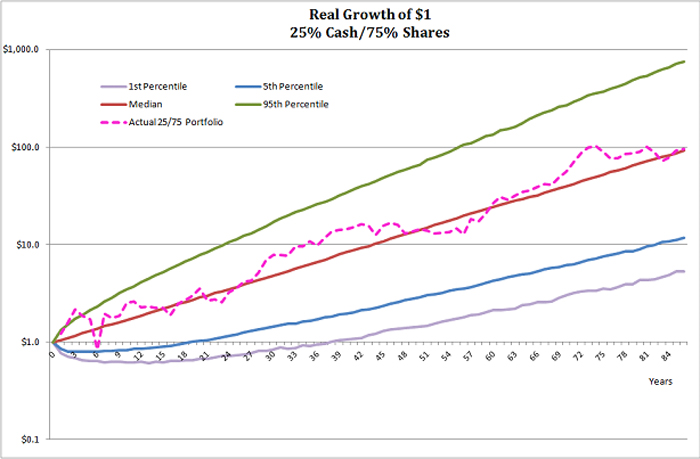

We again use this information to simulate thousands of possible future returns and paths for the growth of a $1, using Monte Carlo analysis. The charts below show the results of 5,000 such simulations for a $1 investment in each of the combination portfolios for 86 years, compared with the actual experience from June 1926 to June 2012. Please note when comparing the charts that the Y-axis is scaled on a logarithmic basis and the scale varies between the charts.

These charts should be compared with the 100% shares and 100% cash charts provided in our previous article. The table below shows the time it takes to be 95% and 99% confident of a positive real return for each of the combination portfolios. The comparison with shares and cash is also provided:

| Investment Portfolio | Years to be 95% Confident of Positive Real Return | Years to be 99% Confident of Positive Real Return |

| 75/25 | 14 | 27 |

| 50/50 | 16 | 31 |

| 25/75 | 19 | 38 |

| Shares | 21 | 40 |

| Cash | 42 | >86 |

A key take-away is that adding 25% shares to an all cash portfolio significantly reduces the time required to be confident of a positive real return. While 100% cash requires the longest time, a 75% cash/25% share portfolio results in the shortest time! As share exposure increases beyond 25%, the years to be confident of a positive real return rises but, as the charts reveal, so does the potential upside.

However, for those drawing on investment wealth to fund their lifestyles, the more critical statistic may be the maximum potential loss of capital. Regular drawings on capital in a declining market could mean that insufficient wealth can be preserved to benefit from market recovery.

Maximum wealth reduction is shown below for each portfolio combination, together with 100% shares and 100% cash:

| Investment | 5th Percentile of Simulations | 1st Percentile of Simulations | ||

Maximum Wealth Reduction (%): | In Year: | Maximum Wealth Reduction (%): | In Year: | |

| 75/25 | 8 | 3 | 14 | 8 |

| 50/50 | 13 | 3 | 25 | 7 |

| 25/75 | 20 | 5 | 39 | 13 |

| Shares | 28 | 5 | 50 | 12 |

| Cash | 5 | 10 | 9 | 17 |

While a 100% cash portfolio most effectively limits downside, the 75/25 portfolio also does a pretty good job. But, as demonstrated above, with much better prospects of a long term positive return.

Your target asset allocation is your most important investment decision

There is no combination of investments that will simultaneously minimise your downside and maximise your upside, under all conditions. Choosing an appropriate asset allocation requires compromise and an acceptance that you can’t have your cake and eat it too.

The more important it is to protect your downside, the less risk and potential upside you can expose yourself to. While a “safe”, heavily defensive, option may feel appropriate now, it must be understood that it will most likely come at the expense of a reduced lifestyle in the future (when compared to more risk tolerant investors).

While choosing your target asset allocation – primarily your mix of defensive and growth investments – is as much art as science, there is a combination that is best for you. Its choice is the most important decision an investor needs to make.

Your target asset allocation should be selected based on the best available assumptions regarding your attitude to risk and your expected future cash flows. It then should serve as a guide for all your subsequent individual investment decisions.

As such, it definitely shouldn’t be influenced by current market conditions or how you’re feeling at the time. And, if in any doubt regarding your ability to determine what’s best for you, seek expert help.