Uncertainty is the only certainty there is

Uncertainty is the only certainty there is

Whether we like it or not, the real world rarely behaves in ways we expect. Our progress towards a goal is unlikely to occur in a nice linear path. Inevitably, we encounter detours and short cuts along the way, and we may experience feelings of devastation and euphoria depending on our progress relative to our expectations.

Investing is an example of the ongoing dilemma faced when reconciling our outcomes with our expectations. Given the inevitable need to invest our savings, how do we cope with the volatility and unpredictability of markets?

The “smart money” agrees that investment forecasts are useless

Finance professors around the world have been studying market behaviour for decades and have come up with many theories for the movement of investment markets. Most ascribe to the view that asset price movements are essentially random, dictated by the reaction of investors to new information. Given that new information cannot be known in advance, the subsequent movement in prices is purely random in reaction to the news that appears.

This approach assumes that there is no link between past and future prices. To highlight this concept, consider a coin toss, the outcome of which is purely random. If the first three tosses of a coin turned up “heads”, what is the chance that the next toss would be “heads”? The odds of tossing four “heads” in a row is very small (= 63/1000), yet there is still a 50% chance that the next toss will produce a “head”. Even though we expect a fairly even distribution of “heads” and “tails” over a large number of tosses, the outcome of past tosses gives no information about the outcome of the next toss. In other words, it is random.

Others have suggested that there is some structure to markets (i.e. that they are not truly random), where future prices depend on past price movements, but in a highly non-linear way. While they purport to show, using fractal geometry, that there is some structure beneath the apparent chaos, they acknowledge that the patterns generated are essentially unpredictable.

Professors in Behavioural Science have studied the irrationality of market participants. This is a step away from traditional economics which assumes that market equilibrium occurs as a result of the rational behaviour of its participants. While some believe this creates the opportunity to profit from the irrational, the professors themselves conclude that their studies make it no easier to profit from or predict the future movement in market prices.

The over riding conclusion from those involved in the pursuit of unlocking the secret to the movement in market prices is that they are unpredictable. Why is it then that finance professionals take it upon themselves to ignore this research? Perhaps, as investors we are addicted to knowing the future, and they are simply attempting to meet our need.

Are the Finance professors too far removed from reality … caught up in their complex formulas and theories? Perhaps, yet if you asked the most experienced of investors you tend to get an affirmation of their conclusions. Warren Buffett, perhaps the most seasoned and successful of investors, says this about the market’s predictability:

“We’ve long felt that the only value of stock forecasters is to make fortune tellers look good. Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.”

Given the weight of evidence from academics and knowledge from experienced practitioners, it seems naïve to continue to seek to predict the unpredictable.

Living with investment market uncertainty

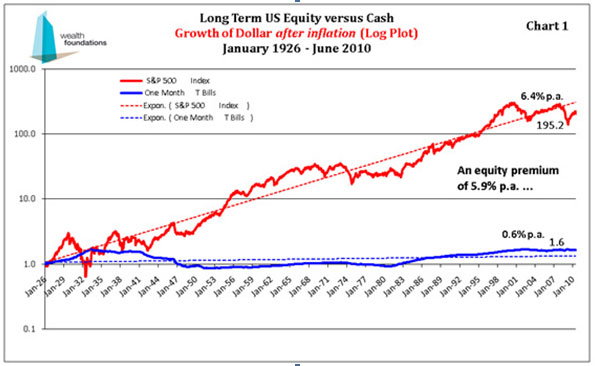

While investment markets are unpredictable, we know historically their path has been upward sloping, as revealed in the chart below showing the growth of the US share market since 1926.

The short term is always volatile, and sometimes painfully so. But, the long term offers rewards for risk takers.

The reality is that most people sit on the side lines when they are most uncertain. Whether you feel uncertain or not will not change the uncertainty surrounding future market movements. If you accept that investment markets are always uncertain in the short term, you should be prepared to act regardless of your own feelings. Perversely, most of the best buying opportunities occur when investors feel most uncertain and fearful about the future (and vice versa).

Smart strategies that work in an unpredictable world aim to reduce the impact of luck and focus on improving your odds of success. There is no element of prediction in these strategies and they are almost bound to be at odds with current media hype or crowd behaviour.

They involve a “buy low, sell high” methodology, lots of diversification, a sound capital management policy (driven by your long term projected cash flows), and a regular and systematic investment plan. They provide the constancy and consistency to deal with the volatility and uncertainty of the market.

These strategies alone are of little use unless you bring the right temperament to the table. Anyone who has studied and experienced the wonders of compound interest will know that it only reveals itself after you have shown the persistence and patience to allow it to work. It does not reveal its power in the short term.

To really get the most from these strategies, you need to let go of the desire to predict. Continuing to seek and react to market forecasts inevitably leads to “double guessing”, which almost certainly reduces the effectiveness of the strategies and undermines your chances of success.