It depends on your wealth accumulation “stage”

Nearly everyone who purchases an investment, be it shares or property, wants to see it immediately rise in value. And the more the better. It justifies the investment decision and makes the investor feel wealthier.

However, while it might make you feel good, it may not be in your best interests for investment markets to rise strongly. What you want to happen depends heavily on your wealth accumulation “stage”. This is assessed by comparing how much you expect to be able to commit to investment markets in the future (i.e. your projected surplus or future capital) with your current net investment wealth (your net worth less your lifestyle assets).

If most of your wealth accumulation is ahead of you, then rising investment markets mean that you will be buying into those markets at increasingly higher prices. Your money does not go as far.

On the other hand, someone who expects to add little to or is already living off their net investment wealth (e.g. a retiree) unambiguously wants investment values to rise. Falling markets mean a reduction in wealth, with little or no capacity to invest at lower prices. If this reduced wealth is drawn on to meet lifestyle needs, less is available to benefit from any subsequent rise in markets.

Below we try to clarify these concepts with some simple examples.

Return and investment patterns dramatically affect wealth

Let’s assume that over the next twenty five years, the Australian share market will return 6.6% p.a., after inflation. However, we also assume that there are two alternative patterns of returns that could produce this result, as shown in the table below:

| Time Period | Pattern A (High returns followed by low returns)% p.a. | Pattern B (Low returns followed by high returns)% p.a. |

| First 10 years | 18.0 | -2.5 |

| Next 5 years | 4.0 | 4.0 |

| Final 10 years | -2.5 | 18.0 |

First, the chart below shows the wealth accumulation experience of an investor under both return pattern scenarios, who begins with a sum of $1 million and neither adds to nor draws on his investment wealth.

The pattern of returns results in different accumulation paths but end wealth is the same.

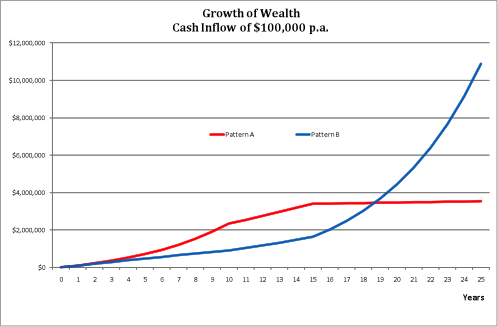

Next, consider the case of a young accumulator who has zero net investment wealth now but will commit $100,000 p.a. to share market investment over the next 25 years. The wealth accumulation paths under both scenarios are shown below:

The low initial, high final return pattern results in a much higher end wealth result. The accumulator is able to invest his future wealth in the first ten years at low prices and reap the rewards when returns are high for the final ten years.

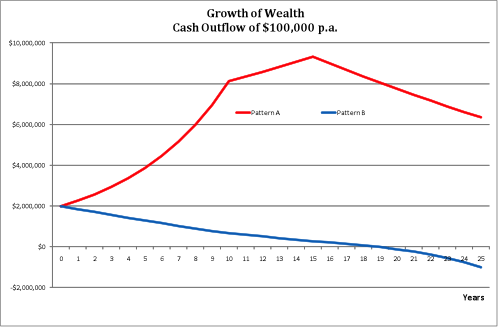

Contrast this with someone who starts with investment wealth of $2 million and draws down $100,000 p.a. to meet lifestyle needs. As the chart below reveals, a high initial, low final return pattern is preferred:

Under the low initial, high final return profile, negative returns and cash outflows result in declining wealth. By the time returns turn strongly positive in year 15, there is very little investment wealth remaining to benefit from the change in share market fortunes.

What are the lessons for your investment strategy?

The above analysis reveals some key insights that a personalised investment strategy should consider or allow for. They include:

- Even if you knew what investment market returns on average were going to be over a particular period, an infinite number of end wealth outcomes are still possible. They will depend on both the pattern of (within period) returns and your investment inflows and outflows;

- You need to understand your expected future cash flows and how you expect to add to and/or subtract from your investment wealth over your lifetime. You need to know the value of your “projected surplus capital”, if any, and how it compares with your current accumulated investment wealth. The answers are not necessarily related to age or “stage of life”;

- Your investment strategy should not be driven by short term investment returns. As we have seen above, provided there continues to be an adequate long term return for taking share market risk, early stage accumulators should welcome weak or falling share markets. The fact that many young do-it-yourself share investors abandon share markets following sustained weakness indicates a flawed or non-existent investment strategy; and

- The investment strategies of those either at the tail end of their wealth accumulation or in the drawdown stage need to be able to sustain long periods of low or negative returns. Should their investment wealth be allowed to fall too much, they risk the possibility of never being able to recover even if markets subsequently rise strongly.

To give yourself the best chance of achieving your financial and lifestyle objectives, your investment strategy needs to be designed around you and your expectations. Some counterintuitive approaches and ideas may be revealed. Such as an immediate increase in the value of your investments may not always be in your best long term interests.

Receive monthly notification of new articles by signing up to our Smart Decisions blog now.

2 Comments. Leave new

[…] low prices rarely go hand in hand. This creates an ongoing dilemma for wealth accumulators – do you want your investments to go up or down in the short […]

[…] sequence and size of returns – low investment returns immediately following retirement followed by high returns requires more additional capital to meet desired spending than a sequence of high returns followed by low returns; and […]