Are you an intelligent risk taker?

Are you an intelligent risk taker?

Most investors accept the notion that risk and return are related and that those who are prepared to take on more risk will ultimately get rewarded for their risk taking. As we’ve seen with the implosion of some investments during the GFC, increased risk taking does not always guarantee higher returns, it simply exposes you to the opportunity for higher returns.

In this article we have attempted to assess the odds of success for investment risk taking. We have looked at this over varying time periods to see how the odds of success change over investment time horizons. It provides some illuminating insights.

How often is investment risk rewarded?

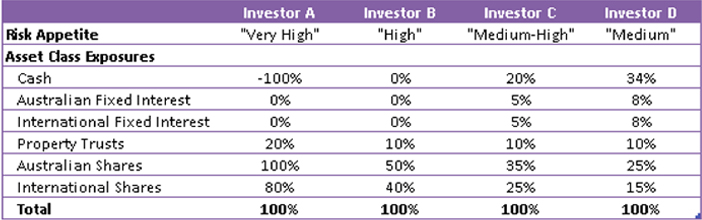

In this assessment, we have compared the outcomes of four investors. Each investor holds a diversified portfolio which varies according to their risk appetite. Their exposures are shown in the table below:

Each Portfolio is re-balanced on a semi-annual basis to maintain its risk exposure over time.

What do we expect to see when higher risk pays off?

Firstly, we would expect to see the higher risk investors out performing the lower risk investors for the given time period. Secondly, we would expect to see the order of the performance in accordance with risk exposure. In other words, the ranking of performance would be Investor A, then B, then C and finally D.

What do we expect to see when higher risk is not considered to have paid off?

We would expect to see lower risk investors out performing higher risk investors and the ranking of performance would be D, C, B and then A.

Example

| Portfolio Risk | “Risk Taking is Rewarded” √ | “Risk Taking is NOT Rewarded” X | “Risk Taking = Inconclusive” ? |

| “Very High” (Investor A) | 12.0% p.a. (1) | 2.0% p.a. (4) | 7.5% p.a. (1) |

| “High” (Investor B) | 11.0% p.a. (2) | 4.0% p.a. (3) | 6.9% p.a. (3) |

| “Medium-High” (Investor C) | 10.5% p.a.(3) | 6.0% p.a. (2) | 7.3% p.a. (2) |

| “Medium” (Investor D) | 10.0% p.a. (4) | 8.0% p.a. (1) | 6.7% p.a. (4) |

Note that Investor A may have achieved a positive return for a period, yet that period may be deemed to have been “unsuccessful” in terms of risk being rewarded. In other words, Investor A would have been better off taking less risk even though they did not experience negative returns.

This was the criteria upon which we assessed whether risk paid off or not. We calculated the monthly returns of each portfolio using market data since February 1985 (the earliest available data). We then compared the portfolio returns (for a given investment period) to find out how many times “risk taking was rewarded” compared to when “risk taking was not rewarded”.

For example, there were 299 rolling one year periods between February 1985 and December 2010. Of these 299 periods, risk taking was rewarded 169 times but was not rewarded 120 times. There were 10 periods where it was inconclusive. In other words, a higher risk portfolio may have out performed a lower risk portfolio but the ranking of the portfolios was not consistent with our criteria. For example, the order may have been Investor A, C, B then D.

Based on this one year investment period, we concluded that risk taking was rewarded 1.4 times more than risk aversion (i.e. 169 ÷ 120). Note: we ignored the 10 periods that were inconclusive.

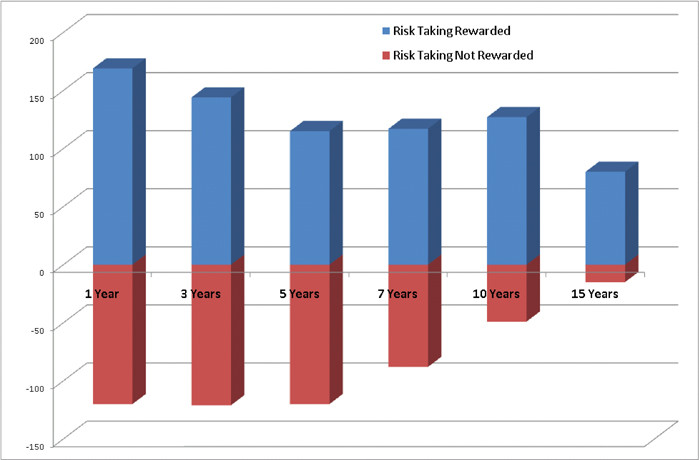

We assessed the data over a number of different investment horizons and found the following:

Notice the change in the “Odds of Success” as the Investment Time Horizon increases.

This relationship is shown graphically in the chart below:

For shorter time horizons (even those out to 7 years) the “Odds of Success” for risk taking were modest (not more than 1.4:1). However, for holding periods of 10 years plus, the odds improve significantly. For example, if your holding period was 15 years, your chances of out performing your risk averse neighbour increase to around 5:1. Not bad odds if you have the patience to withstand the inevitable financial storms through that 15 year period.

Increasing your odds of investment success

This assessment makes no statement about the absolute benefits for risk taking. It is assessing the chances of you being better off than your risk averse neighbour. It indicates that risk takers are rewarded over time relative to their risk averse neighbours. However, the wait may be a long one.

Does it indicate that we should all take on more risk? No, not if your time frame is short or your risk tolerance is such that you will be unable to weather the almost inevitable downturns along the way.

What about timing your risk exposure to match the markets? Given that the odds of success during the first 7 years are almost even, you are going to find that your risk averse neighbour is often better off than you in the short term. This is often the reason behind investor behaviour that obsesses in the costly pursuit of “fiddling” with their risk exposure to improve their chances of success.

The most important ingredient to any good investment strategy is patience and discipline. While increased investment risk does not always translate into investment success, bringing patience and discipline to the table has proven to be the most reliable way to increase your odds of success.