You don’t need to feel or forecast for a good investment experience

In our previous article, we warned of the dangers of letting both your emotions and predictions/forecasts influence investment decisions. Often, your feelings will provide exactly the wrong guide to appropriate action.

But if you aren’t to rely on feelings and/or forecasts, how do you make investment decisions. One approach, that we favour, is to determine an appropriate risk exposure or asset allocation for you, based on:

- Your attitude for risk;

- Your need for risk; and

- Your capacity for risk.

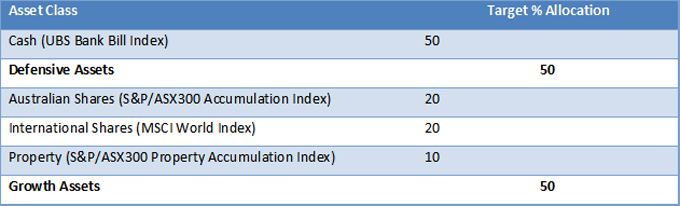

At the highest level, this first requires choosing a target mix of defensive (i.e. cash, fixed interest) and growth assets (i.e. domestic and international shares, property). For example, a retiree may choose a 50% defensive/50% growth allocation, that is then built using the various asset classes. For purposes of this article, we assume the retiree’s portfolio (the “Diversified 50/50” Portfolio) is structured as follows:

Each quarter, the portfolio is reviewed and rebalanced to the target allocations. This is done mechanically, regardless of current investment market conditions and pundits’ forecasts.

An alternative approach is to use one of the countless variations of trend following or market timing systems. Based on historical performance, a decision making system is constructed to provide signals regarding when to enter the share market (and exit cash) or vice versa. The aim is to have you out of shares when they are trending strongly downward and fully invested when they are trending strongly upward.

For illustrative purposes, we examine a system (the “Market Timing” Portfolio) that has the following rules:

- Whenever the return on Australian shares falls below zero for the previous three months, hold all investments in cash; and

- Whenever the return on Australian shares is above zero for the previous three months, hold all investments as shares.

Again, the signals are acted upon, regardless of feelings and forecasts.

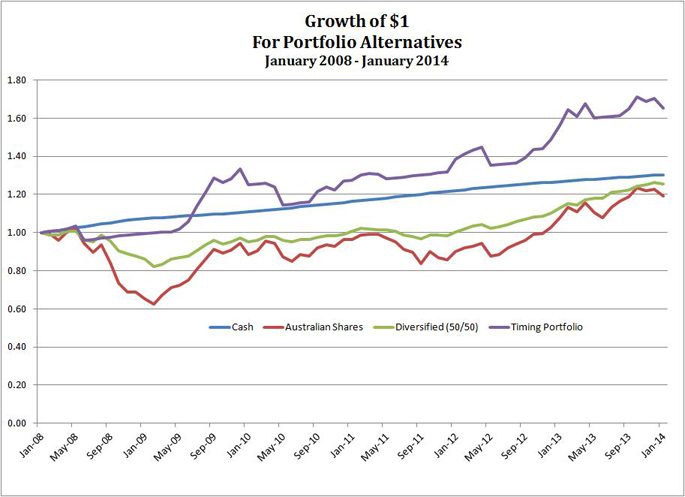

The chart below shows the experience for both approaches, as well as that for cash and Australian shares, for the period examined in our previous article i.e. January 2008 – January 2014:

Based on this, it’s tempting to conclude that market timing is a pretty good way to go. And while the diversified approach was a lot less volatile than shares, all cash was a better alternative than both for the entire period.

Market timing has high transaction costs and requires high involvement

But such conclusions don’t take account of some practicalities of implementing the market timing approach and may not hold across all time periods.

Looking at practicalities first, to achieve the charted market timing result required fifteen switches from cash to shares or vice versa over the six year period. Transaction costs must be borne on the total amount invested, for each switch. In addition, because cash needs to be available at short notice to invest in shares, it won’t earn best available interest rates.

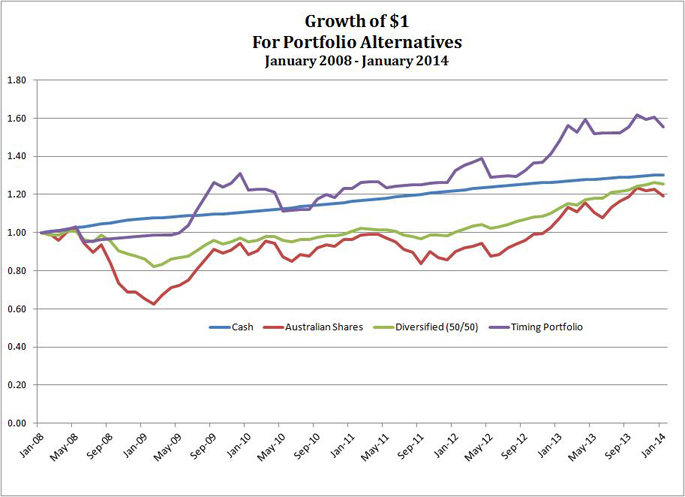

To allow for these realities, we have assumed each switch attracts transaction costs of 0.25% on the total investment amount and that cash earns 1% p.a. less than the bank bill rate. The adjusted chart below reveals that these “frictions” reduce the benefit of the approach.

<

Also, unless the portfolio is being managed in a tax free environment (e.g. the over 60, pension stage of superannuation), tax will place a further handbrake on the strategy. Because of the frequent switching of the portfolio, most gains will be taxed at the relevant regular income tax rate rather than deferred indefinitely or, at least, eligible for the concessional treatment provided for capital gains on assets held more than 12 months.

The approach also requires diligent monitoring of the share market and the discipline to react quickly and in accord with each signal. This is harder than it may appear as the required action may not always sit well with our feelings.

Like most market timing systems, our simple system’s effectiveness relies on the share market trending for extended periods, either up or down. Should the market oscillate, with little trend, transaction costs can weigh heavily.

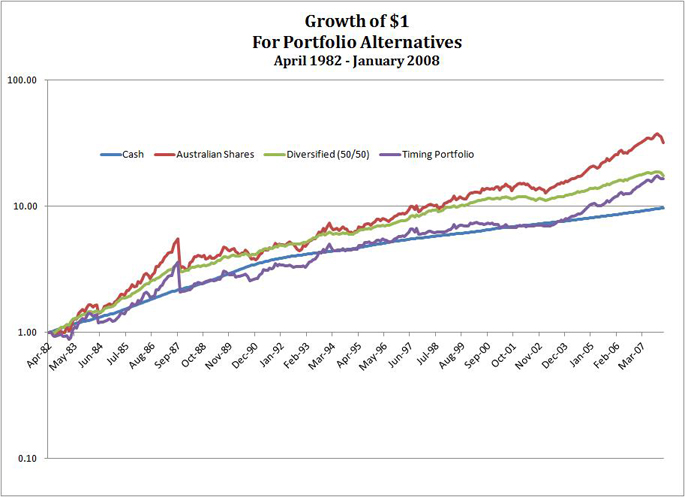

Market behavior over the January 2008 – January 2014 period may have been atypically favourable to the system. Longer run data, charted logarithmically (i.e. proportionality preserved) below, for the period April 1982 – January 2008, doesn’t show such a positive picture:

<

For all the constant monitoring and switching, the timing portfolio underperformed (even before taxes are taken into account) the diversified portfolio, but with much more volatility. It significantly underperformed an all Australian share portfolio.

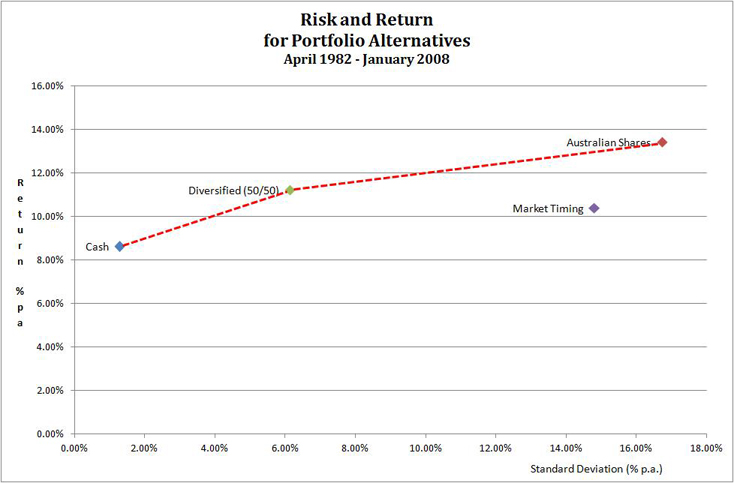

The following chart examines the trade-off between risk (as measured by standard deviation) and return for the portfolio alternatives:

In the parlance of financial economics, the market timing portfolio looks very inefficient and sits well below the efficient frontier, represented by the red dashed line.

No feeling, no forecasting investing will set you “free”

While we believe an investment strategy based on managing to a target risk exposure is both theoretically and practically superior to any sort of market timing approach, the benefit of both is that strict implementation provides no place for either:

- what you feel about the current state of the world; or

- what you, or anybody else, thinks about the future.

For most people, giving up the need to refer to feelings or forecasts when making investment decisions is almost like giving up an addiction. Once “clean”, however, it’s like having a load lifted off your shoulders. Investment can take its rightful place in your life – a means to an end, rather than a constant source of anxiety and, for many, a sense of inadequacy.