Our clients respond to an online “Client experience” survey

In late February-early March 2017, a representative group of our clients was asked to participate in a confidential on-line “Client Experience” survey. The survey aimed to help us, among other things, better understand:

• what our clients look for in their relationship with us;

• how they measure the value of our service;

• their greatest personal finance fears; and

• how they felt we were doing.

We were pleased with the 70% response rate we received and thank those clients who participated.

The same survey was simultaneously offered to clients of other financial advisers that choose to use the services of global fund manager, Dimensional Funds Advisors, both in Australia and internationally. The results provide us with the opportunity to compare our clients’ feedback with that of almost 19,000 other respondents.

Unfortunately, we don’t know the response rate to the global survey. However, the high response rate from our clients and the large numbers that responded to the international survey provide a high level of confidence that the findings are robust.

In summary, the good news is that for both us and other financial advisors that participated in the survey there appears to a strong alignment with what is offered and what clients value and a generally high level of client satisfaction. The findings could not be further from the jaundiced view of financial planning that pervades the mainstream financial media and public opinion. The bad news is that not enough people are aware that a better personal financial advice alternative exists.

To provide some flavour of the feedback received, the remainder of this article compares our clients’ aggregate responses with those of all participants in the international survey to four key questions.

An executive summary of the “Client Experience” feedback

The first question we examine is:

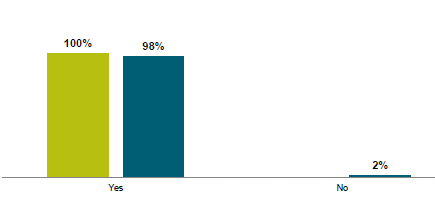

Would you recommend your advisor to friends, family members, or colleagues?

In the chart below (as for all the charts), Wealth Foundations clients’ responses are shaded green while those of all participants are shaded blue.

The results, both for us and all the financial advisers involved, are very gratifying and set an extremely high bar to maintain. But, hopefully, they provide clients with some comfort when considering future referrals to us that they are not “going out on a limb”.

The next chart is in response to the following question:

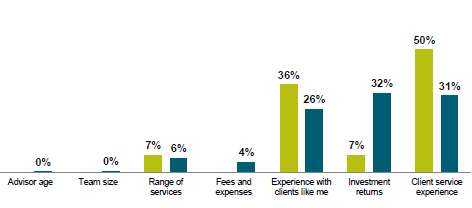

From the following, choose the attribute you consider most important in your advisor relationship:

Our clients put a much higher weight on “experience with clients like me” and “client service experience”, rather than “investment returns”. It is consistent with an understanding that investment returns are the outcome of a disciplined investment strategy, rather than an input that can be directly controlled.

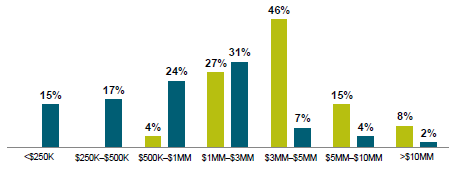

With reference to the high weighting given to “experience with clients like me”, it appears that our client base has higher funds under management than the average international survey respondent, as suggested by the chart below:

The third question we examine is:

How do you primarily measure the value received from your advisor?

The responses are charted below:

Consistent with the previous question, our clients are focused on what we consider to be core objectives of our service i.e. “progress towards my goals” and “sense of security, peace of mind”, rather than “investment returns”. This alignment with what we believe we can reliably offer and what clients value is reassuring.

The final chart examines the responses to the following survey question:

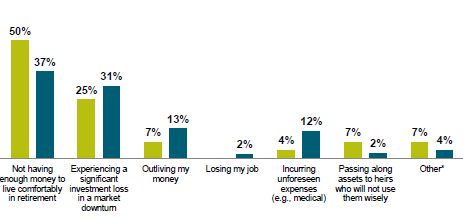

My greatest fear about my personal finances is:

Our clients are significantly more concerned about “not having enough money to live comfortably in retirement” than the international average. While this may simply reflect the reality that the future is inherently uncertain, we aim to build resilience in our clients’ financial plans to allow for both an adverse external environment and changes over time in what is perceived as “living comfortably in retirement”.

The survey also provided us with more detailed and helpful feedback on what aspects of our service were regarded as most important by our clients and their satisfaction with those services. Some areas for potential improvement have been identified.

Responses to questions regarding “Advisor Communication” were also revealing. For example, based on external “expert” advice, we have been considering moving some of our communications to a video or audio format and away from our current written/presentation style. The responses from our clients, mirrored closely by the international survey, indicated that this may not have been well received. The preference for video/audio is currently very low, particularly as the age of respondents increased.

Survey suggests an “easy” fix to woes of financial planning industry

In summary, we were pleased with, but are definitely not complacent about, the feedback received from the “Client Experience” survey and, again, thank our clients for taking the time to participate. But we were also particularly heartened by the overwhelmingly positive feedback received by other financial advisers whose clients participated in the survey.

A distinguishing feature of most (if not all) of these advisers is that their personal financial advice isn’t conflicted by any formal alignment (e.g. through ownership or incentive arrangements) with financial product manufacturers. Perhaps, our regulators should be shown the survey results in the hope they realise that no amount of additional regulation, disclosure or education will more effectively “clean-up” the generally poor perceived performance of the financial planning industry than legislating the separation of the provision of personal financial advice from financial product manufacture.

We won’t be holding our breath!