Self managed super funds now a mass market product

Self managed super funds (“SMSFs”) have been getting a lot of attention lately. All the major banks and fund management institutions have developed self managed super fund capabilities and are actively promoting their expertise in this area. The focus appears to be all about getting more control of your super, typified by this AMP advertisement.

This has coincided with, or perhaps was partly driven by, a relatively recent relaxation of regulations allowing SMSFs to borrow under restricted arrangements to purchase investments, including residential property. An “opportunity” that may prove too good to refuse for the typical Australian D-I-Y investor has been provided to take control of their super, gear it up and purchase their most loved investment.

While the major institutions have shown a little restraint in promoting this capability, various property development companies and real estate agents certainly haven’t. Teaming up with super fund administrators/accountants, solicitors and mortgage brokers, they aggressively offer to put the whole package of loan, SMSF and property together for a “modest” fee. In a moribund property market, it provided a glimmer of hope. In a hot property market, it’s potentially irresistible to a predisposed audience.

So irresistible, in fact, that the financial regulator, ASIC, has repeatedly warned about the need to be appropriately licensed to advise SMSFs on purchasing residential property. And the Reserve Bank, in the minutes of its Monetary Policy Meeting of 3 September 2013 and with reference to management of household finances, noted:

“Property gearing in self-managed superannuation funds was one area identified where households could be starting to take some risk with their finances; members noted that this development would be closely monitored by Bank staff in the period ahead.”

SMSF servicing is a growth “industry”

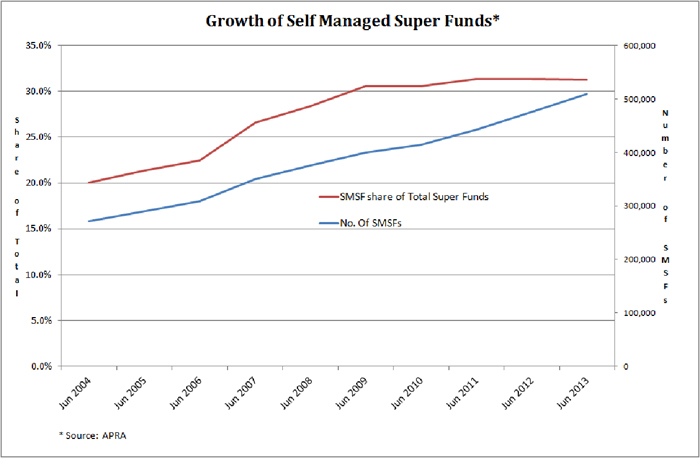

But the apparent love affair with SMSFs goes back longer than the banks’ recent promotion of their expertise in the area or the opportunity for a fund to borrow and invest in residential property. As the chart below shows, the total number of SMSFs has grown steadily since 2004 (at 7.2% p.a.) to a little over 509,000 at June 2013. Interestingly, however, the SMSF share of total superannuation funds has remained fairly flat since June 2009:

The servicing of SMSFs is now a sizeable sub industry within the finance sector, with various administrators, accountants and financial planners touting themselves as specialists. SMSF courses and qualifications have been developed to educate, demonstrate expertise and create differentiation.

Based on an assumed administration cost of $4,000 p.a. per fund and planning/investment advisory fees of 0.50% p.a. of total SMSF funds (at June 2013), SMSFs generate a potential $10 billion p.a. in revenue for service providers. Clearly, there is a lot of vested interest in seeing the past growth continue and for maintaining a certain cachet around having a SMSF.

But positioning a business as a SMSF specialist or expert brings to mind the famous Abraham Maslow quotation:

“If you only have a hammer, you tend to see every problem as a nail.”

The possibility of inappropriately selling SMSFs because it suits the service provider’s interests rather than that of clients is real.

This issue is of sufficient concern to ASIC that on 16 September 2013 it released a consultation paper (No. 216) indicating its intention to impose disclosure requirements on AFS licensees who give personal advice on establishing or switching to an SMSF (from another superannuation arrangement). They include the need to:

- warn clients that SMSFs don’t have access to compensation arrangements in the event of fraud or theft; and

- explain other matters that may influence the client’s decision (e.g. costs, trustee obligations) to set up a SMSF.

While more than half of our clients have a SMSF (either recommended by us or in place when they first became clients), we don’t promote ourselves as SMSF experts. Rather, we want to be seen as experts in helping clients achieve their chosen financial planning objectives. These objectives typically include:

- To be financially well organised

- To create a Financial Plan that will give you a clear grasp of your present financial situation and help you make the most effective use of your resources to achieve your goals and objectives.

- General Lifestyle

- To define you and your family’s version of a desirable lifestyle and achieve it as soon as possible.

- Financial independence

- To achieve Financial Independence no later than age …………….

- Lifestyle Protection

- To ensure that adequate provision is made for the financial consequences for the family of the death or disablement of you or your partner.

- Income Tax Planning / Current Cash Flow Management

- To minimise your income tax liability, produce an analysis of your personal expenditure planning assumptions and to ensure that your cash inflows are sufficient to cover your desired cash outflows.

- Investment Planning / Future Cash Flow Management

- To estimate future cash flow on realistic assumptions and to develop an investment strategy that will enable you to invest your capital and surplus income in accordance with risk/reward, flexibility and accessibility standards with which you are comfortable.

- Estate Planning

- To reduce the tax liability likely to arise on the death of yourself and your partner and to ensure that your estate is distributed to your beneficiaries as intended.

- Wealth Management

- To decide how to effectively use cash flow that will result in an accumulation of wealth that is considerably beyond any perceived lifetime financial requirements of your family.

Based on these objectives and relevant analysis, clients decide on a case by case basis whether a SMSF is an appropriate structure for them to accumulate wealth. There is no preconceived judgement.

SMSFs aren’t for everybody

Despite the hype, the reality is that SMSFs definitely aren’t for everybody. This is the case regardless of wealth. Unfortunately, in the wrong hands they provide an opportunity for significant financial harm.

If anybody suggests you should have a SMSF you should ask whose well considered financial objectives are being best served by this advice. If yours are not well understood by the adviser and the merits of the advice can’t be clearly demonstrated, perhaps it is not in your best interests to take “more control of your super” at this time.