Our investment philosophy relies on capitalism continuing to work

A key tenet of our investment philosophy is that it’s extremely difficult to reliably predict short term (i.e. out to five years) movements in share markets. Markets are very effective in distilling all that is currently known about individual companies, their markets and the relevant economic and political environment to determine “fair” values both for the companies that make up a share market and for the market itself.

Now “fair” doesn’t necessarily mean correct. But it does mean that it should not be an easy task to reliably outperform a share market index by identifying and buying “undervalued” companies (and, perhaps, selling “overvalued” companies) or by entering or exiting that market based on views of its future direction. There is a mountain of robust academic research to support this view of “fair’.

Another central tenet of our investment philosophy is that for capitalism to continue to work, over extended periods well-structured risk should be rewarded. This view suggests that patient share market investors should anticipate and most of the time receive a reward in excess of a risk free rate (e.g. in Australia, the RBA cash target rate) for the system to continue to work. Investors would refuse to commit funds to the share market if the long term expectation was that the prospects for business profits implied share market returns less than those available by keeping your money in the bank (or under a mattress).

Our philosophy leads us to the conclusion that while we don’t know what share market returns will do in the short term (i.e. for periods less than about 10 years), in the long term we expect (but can’t guarantee) positive, after-inflation returns in excess of holding funds in bank deposits, from well diversified exposures to Australian and international share markets.

In the rest of this article, we examine US market experience since 1926 to assess the historical reasonableness of our viewpoint.

Excess returns are less certain in the short term than the long term

In the following analysis, we use the S&P500 index as the proxy for the US share market and the US one month Treasury Bill (“T-Bill) rate as the proxy for the risk free interest rate. Both the S&P500 index and the T-Bill rate are adjusted for inflation.

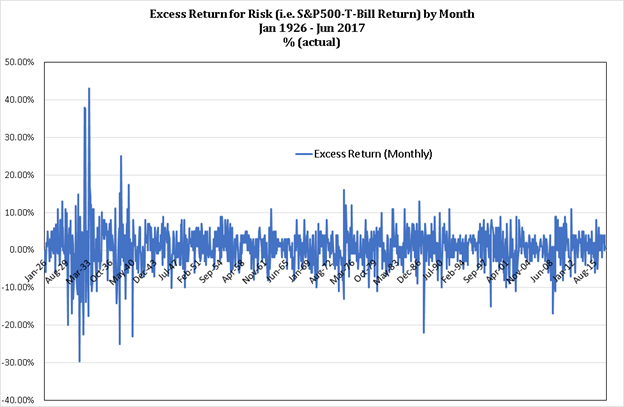

The first chart below shows the excess return for risk (i.e. difference between the share market and risk free return) on a monthly basis for the period January 1926 – June 2017:

The excess returns for risk are all over the place, varying from a largest positive return of about 44% to a largest negative of -30%. While it isn’t readily apparent, the excess returns were mostly positive (i.e. 64% of the months) but forecasting a month out appears fraught with uncertainty.

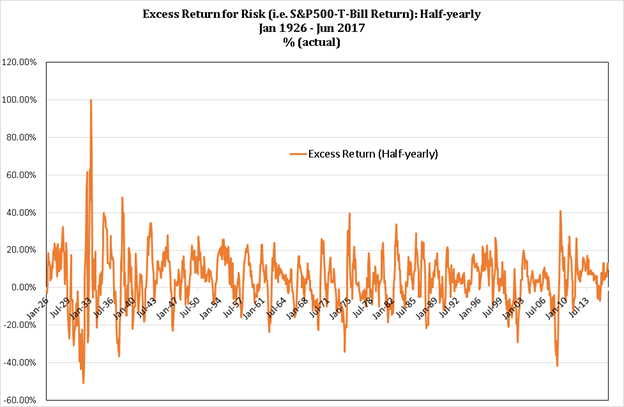

How do things look when we take a six monthly view – are the excess returns more reliable. The following chart provides the data:

While it is now more readily apparent that the number of positive excess returns exceeds the negative returns, the percentage of positive returns hasn’t increased greatly – from 64% to 68.4%. Forecasting certainty hasn’t changed much.

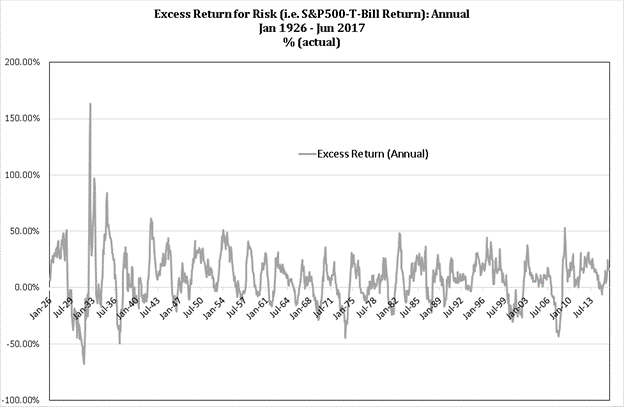

On an annual basis (see below), there is still a lot of variability in excess returns, with positive excess returns recorded 70.7% of the times but with no apparent pattern with regard to when the direction of the returns change (i.e. from positive to negative and vice versa).

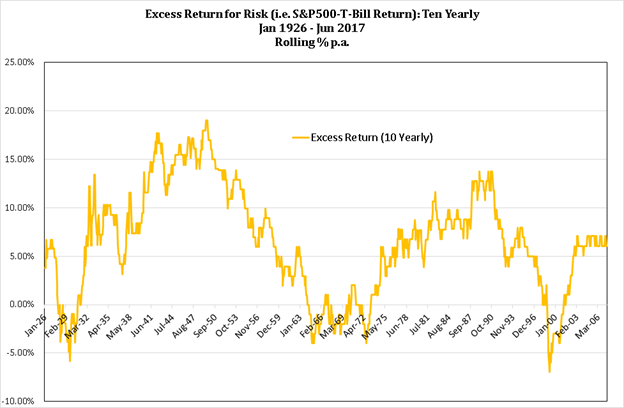

However, as shown in the chart below, with ten year holding periods, the percentage of positive excess returns rises significantly to 86.1% with risk taking usually well rewarded. But even with this time horizon, investors who entered the US share market around March 1999 experienced a negative 7% excess return over a ten year period that encompassed both the “Tech Stock Crash” and the “Global Financial Crisis”.

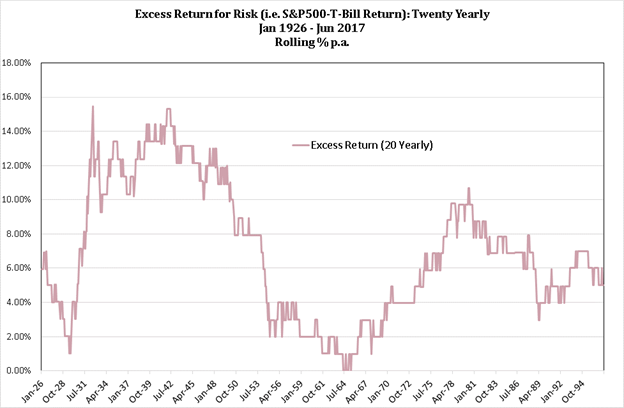

Finally, when the risk taking horizon is extended to 20 years, the chart below reveals that all excess returns were positive. With the benefit of hindsight, patient investors were always better off taking share market risk rather than the risk free alternative.

Of course, some of those investors received little additional return for the rollercoaster ride they endured, while others were generously compensated (e.g. most recently, those who commenced their twenty year investment periods in the late 1970s/early 1980s).

Increased certainty of returns requires an extended investment horizon or no risk, at all

History supports our approach to investing. Unless you have some special abilities (which you probably wouldn’t want to share with others), with a well-diversified share portfolio and a 12 month investment horizon, you have about a 70% chance of earning an excess return. In other words, you should expect to lose (relatively) about 30% of the time.

As your investment horizon extends, your chances of earning an excess return increase. We generally consider that you have no business holding share market exposures unless you have a minimum horizon of at least 10 years. Even then, history suggests you will be worse off (compared with holding bank deposits) about 14% of the time.

If this level of losses isn’t tolerable, your unpalatable options are:

- extend your investment horizon even further; or

- invest everything at the risk free rate.

Investing everything at the risk free rate implies foregoing the expected excess returns that share markets have delivered to patient investors and, correspondingly, the potential need to accumulate considerably more investment wealth to fund a given desired lifestyle.