“Living for today” has future consequences

“Living for today” has future consequences

We often hear people say that they don’t plan too much for the future. They’d rather live for today, as they argue you don’t know what’s going to happen tomorrow. And many of these people spend today as if there isn’t going to be a tomorrow.

Also, it’s not unusual for parents of Gen Y children, who are in their late 20’s or even early thirties, still living at home or travelling the world, saving very little, to suggest that times are different now. They are unconcerned that their adult children aren’t settling down and focusing on their desired futures, because that’s the “new normal”.

Unfortunately, while such attitudes may be helpful to rationalise current behaviour, they do nothing to change the inescapable truth that by not saving today you have made the choice to reduce the amount you will be able to consume or spend in the future. The “live for today” proponents usually don’t make this connection. They have an implied view that current behaviour has no impact on future possibilities.

But this is unrealistic. Over our lifetimes we will all generate a fixed (but unknown) amount of wealth. This can be consumed in any way we see fit but it only takes simple arithmetic to understand that the more we consume now, the less will be available later in life.

In our view, the essence of financial planning is to help clients make good decisions regarding how they spread their spending or consumption of finite wealth over their lifetimes. Rather than a focus on the immediate, we encourage clients to examine the long term possibilities and seek to arrange their lifetime spending in a way that gives them the greatest satisfaction. This article examines the impact of current spending on future spending more formally.

Lifetime wealth takes account of future income and spending

To decide how you may like to spread consumption of your lifetime wealth, it is necessary to make an estimate of that wealth. A first step is to calculate the value of your current net worth: your assets less your liabilities. If you exclude your home and other lifestyle assets from this figure [1], you have a measure of your net investment wealth or financial capital.

For illustrative purposes, we’ll assume the Green household has negative current net investment wealth of $400,000, made up of financial assets of $100,000 and borrowings (for their home) of $500,000. But this is not a measure of the household’s lifetime investment wealth. It ignores the significant value of both expected future income (an asset) and spending (a liability).

The sole income earner in the Green household, Roger, is aged 35 and currently earns $300,000 p.a. after-tax. He expects his income to grow by 1% p.a. above inflation, to his retirement age of 65. This implies lifetime future income of $10.84 million. So, projected gross lifetime investment wealth is net investment wealth plus projected lifetime future income or $10.44 million. Assuming no other inflows (e.g. an inheritance), this is the fixed amount available to be consumed over the Green’s lifetime.

The Green household lives well today and is currently spending 85% of after-tax income (i.e. spending $255,000 and saving $45,000). They would like to see spending grow at a rate of at least 1% p.a. above inflation to retirement.

From retirement, they expect to spend 70% of the previous year’s income, growing at 1% p.a. above inflation until death at age 85. Their desired estate consists only of their lifestyle assets i.e. they want to consume all financial wealth. How realistic are the Green’s expectations.

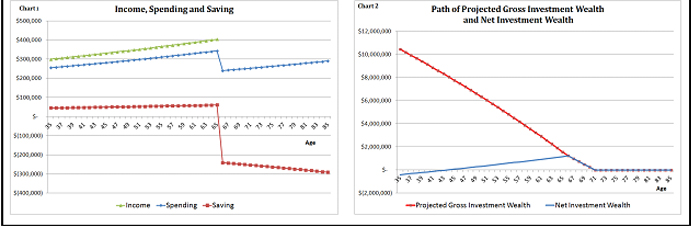

The charts below reveal they are unachievable. Chart 1 shows expected income, desired spending and implied saving. Chart 2 shows how projected gross investment wealth declines as it is either consumed or saved and converted to net investment wealth [2]. At age 65 (i.e. retirement), projected lifetime future income is zero and Projected gross investment wealth and Net investment wealth are equal. By age 72, all financial wealth has been consumed. Spending plans fall well short of expectations.

Green household: Initial expectations

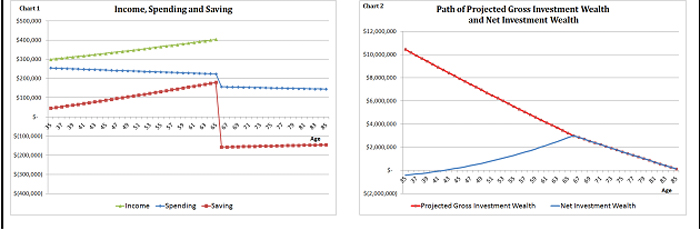

The Greens are currently spending too much. The chart below shows how they must (smoothly) reduce future spending if they wish to continue to spend $255,000 this year and ensure projected gross investment wealth lasts to age 85. Significantly lower future spending is required.

Green household: Realistic expectations

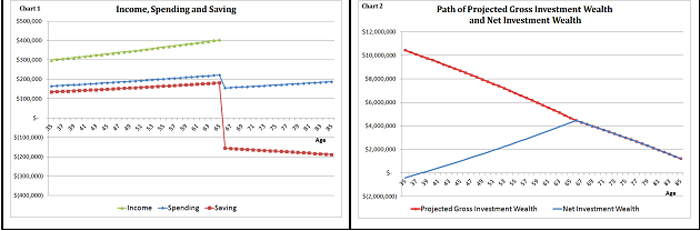

Next, we compare the relatively spendthrift Greens with the frugal Browns, whose situation is exactly the same except that they only spend $165,000 p.a. (and save $135,000) in the first year.

Brown household: Initial expectations

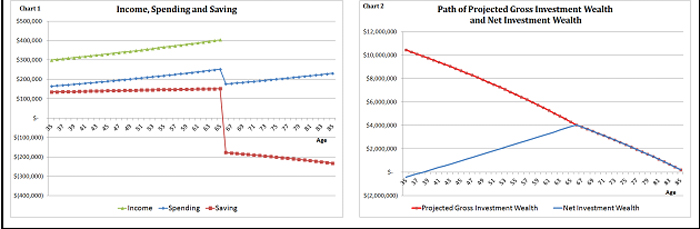

The Browns are saving too much and will not consume all their net investment wealth by age 85. Because they are consuming less now, they are able to enjoy a standard of living over the rest of their lives above their initial expectations and a more prosperous retirement than the Greens, as revealed below:

Brown household: Realistic expectations

A lifetime view of wealth may change how you live today

While the future isn’t as certain (or as simple) as that suggested in the above Green and Brown illustrations, the key message remains intact: how you choose to live now will affect how you are able to live in the future.

You can choose to put your head in the sand and say “I’ll enjoy myself now and let the future look after itself” or you can invest the time to think about what your lifetime wealth might be and how you are going to get the most enjoyment out of it.

Perhaps one positive result of such an exercise may be that it reveals you can live a better lifestyle now, without jeopardising the future you hope for.

[1] We usually exclude lifestyle assets from financial wealth. The assumption is that these assets will never be sold to support a desired lifestyle.

[2]For simplicity, the calculations assume:

- a 0% p.a. after-inflation interest rate for borrowings;

- a 0% p.a. after-inflation return on investments; and

- no age pension.

1 Comment. Leave new

The job of financial planners to shape realistic expectations & ensure people are not just living for today is crucial. Thanks for highlighting this and providing some good examples and charts.