Making financial decisions based on what others are doing can be dangerous

My children and many of their friends are now at the age where they are making very important decisions regarding starting families and meeting housing needs. These decisions, of course, have a strong emotional element. But they also generally have massive financial implications that, once made, lock in commitments that will extend for many years into the future.

Entering into such commitments, without detailed consideration of your “best guess” capability to both meet them and continue to be able to enjoy a desired lifestyle, sets up a high likelihood of serious, unanticipated financial pain later in life. Anecdotes suggest that many young adults who borrowed to purchase in the Sydney housing market over the past three to four years are already finding this out.

A focus on the “here and now” and peer comparison when making financial decisions is fraught with danger. Young adults often wrongly presume because their friends are buying houses and starting families, they can and should do the same.

But young adults aren’t alone in basing their financial behavior on what people “like them” are doing. Often, for example, highly paid professionals (e.g. lawyers, accountants, doctors) in their early fifties are leading financially unsustainable lifestyles because they are too busy to look forward a few years and are comforted by their colleagues’ similar financial behaviors.

We encourage clients to make financial decisions based on their lifestyle objectives and financial expectations, rather than their life-stage or what friends or colleagues are doing. Particularly for those who are some years off intended retirement, a key metric we focus on is their expected “future capital” or “future savings”. This is calculated as expected accumulated savings, to a nominated retirement age, from after-tax employment (or business) earnings less lifestyle spending, including purchase of lifestyle assets (e.g. house purchase).

When added to current net investment wealth (“NIW”), future capital (“FC”) provides an estimate of investment wealth available to fund lifestyle when no longer working. We call this estimate Projected Lifetime Investment Wealth (“PLIW”). If you don’t have some reasonable expectation of what this number is and its adequacy in terms of financing a desired retirement lifestyle, you are setting yourself up for future financial surprises that may not be welcome.

A “back of the envelope” alternative to calculating future capital

However, the calculation of future capital is not a trivial exercise. It requires a detailed “best guess” of future earnings potential and desired lifestyle. For a 35 year old looking to retire at age 65, it’s a look forward for thirty years, a period of time over which things can change dramatically. And, as discussed in our previous article, this “visioning” is not something that most people naturally do.

An alternative simple, but potentially revealing, approach is to attempt to examine the long term implications of significant financial decisions in terms of more easily understood current dollar amounts. Let’s first consider an example of a 35-year old couple looking to purchase a $2 million residence, with a $500,000 deposit i.e. a financing requirement of $1.5 million. Their only investment wealth is $200,000, held as superannuation.

Using our “Rule of 25”, the couple can make an estimate of their required investment wealth at retirement by multiplying their desired level of retirement spending by 25. Based on current spending of $110,000 p.a. (with no children), they might estimate retirement spending of $125,000 p.a. at age 65, implying an investment wealth need of $3.125 million.

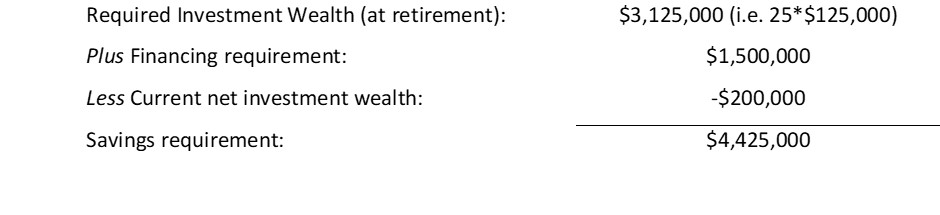

Assuming a 0% p.a. after-inflation[1], after tax return on investment (and cost of any borrowing), these basic assumptions imply a need to save $4.425 million over the next 30 years, for the couple to own their residence outright and accumulate $3.125 million of investment wealth. The simple calculation is shown below:

Accumulated savings of $4.425 million imply average savings of $147,500 p.a. over 30 years. Allowing for the additional costs of intended children, pre-retirement spending of $140,000 p.a. would be a reasonable starting point. Together the savings and spending requirement suggest an average after-tax household income of about $287,500 p.a. (or about $450,000 – $500,000 pre-tax income) for thirty years for the couple’s expectations to reasonably hold together.

The couple can then assess this “ball park” required average $450,000-$500,000 p.a. of pre-tax household income against both their current and expected future household income. While the conservative investment return assumption inflates the income requirement calculation, if there is a big discrepancy it should trigger a need to examine both the decision to purchase the proposed residence and/or lifestyle expectations in much more depth.

In a similar manner, let’s consider the situation of a 52-year old, high income, professional household with one income earner. Assume current investment wealth is $2 million, with a desire to spend $300,000 p.a. in retirement, from age 65. Again, using the “Rule of 25”, a retirement investment wealth need of $7.5 million is implied.

Based on a 0% p.a. after-inflation, after tax return on investment, accumulated savings of $5.5 million or $423,077 p.a., are indicated. If current spending is $350,000 p.a., after-tax income must average $773,077 p.a. (or about $1.4 million p.a. pre-tax) over the next 13 years for retirement plans to be achieved. This income requirement should be compared with current and expected income to judge whether adjustments to expectations may need to be made.

Some simple calculations could uncover major flaws in financial decision making

Some simple “back of the envelope” calculations will often highlight that basing your financial decisions on what those you consider most like you are doing is fraught with peril. Their circumstances may be very different and/or they may have you heading over the same financial cliff that they are.

In our view, there is no substitute for a detailed consideration of your financial future in order to make better financial decisions. However, application of the “Rule of 25” to give you a ball park retirement investment wealth requirement and some simple arithmetic mean there is no excuse for making current financial decisions without heed to your longer-term lifestyle expectations.

[1] 0% p.a. is a conservative assumption, but not an unrealistic one. It effectively assumes all investments are held as low risk defensive assets.