It’s the easy decision to defer saving

In our last Blog article we examined the rationale for ensuring you don’t spend all of any salary increase, but save an increasing amount of a rising income. It’s advice we give particularly to young adults but is generally a critical practice for anyone trying to achieve financial independence.

In our last Blog article we examined the rationale for ensuring you don’t spend all of any salary increase, but save an increasing amount of a rising income. It’s advice we give particularly to young adults but is generally a critical practice for anyone trying to achieve financial independence.

In this article we look at another piece of related advice that we also encourage young adults to heed i.e. cultivate disciplined savings habits as early as possible. In summary, the more you save of your income early in a career the less you will need to save later. This advice incorporates both taking advantage of the benefit of compounding (i.e. accumulating) returns over long periods and the desirability of smoothing lifetime spending.

The concept of financial independence (i.e. being able to support a desired lifestyle from investment wealth, without reliance on earned income) is almost universally attractive. The logic that you generally need to be a disciplined saver over a long period to achieve financial independence isn’t hard to accept. But despite the concept and the logic, most people are inclined to spend too much and save too little relative to what is required to achieve financial independence by a desired age.

It’s not hard to see why. For a young person starting their career in their early 20’s, retirement isn’t on the radar. For what may be the first time in their life, they have regular cash coming in and lots to spend it on. Saving is something they’ll do later, but first they’re going to enjoy life.

In no time, they’re in their mid-30’s, perhaps looking to start a family. They’ve become used to a certain lifestyle and want to maintain it, despite additional expenses associated with children on the horizon. The idea of financial independence may be on the radar, but they feel there’s still plenty of time to start saving.

By mid-40’s, supporting a family and maintaining a lifestyle is consuming all available income and saving is out of the question. But once they’re over this hump, in their early to mid-50’s, they feel they will be able to make some real progress. However, for most, it’s too late. Even with the best will in the world, they simply can’t save enough to achieve financial independence by what they thought was a realistic mid-60’s.

The simple maths of savings deferral

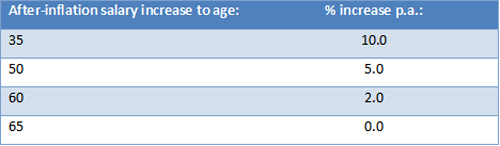

To illustrate why this is the case, we again compare the experience of the two twenty five year olds, Anne and Sue, we met in our last Blog article. They’re both on initial incomes of $50,000 p.a. Both enjoy successful careers, with average after-inflation increases in salary income as shown in the table below:

They both want to be financially independent at age 65, generating an inflation-adjusted income of $100,000 p.a. from their investment wealth. Using our “Rule of 25”, this suggests a target wealth accumulation of $2.5 million, in today’s dollars [1].

Sue understands the benefit of compounding investment returns and doesn’t want any abrupt changes in lifestyle to achieve her financial independence objective. She wants to save a constant proportion of her after-tax income. The chart below shows how much of both her pre and after-tax income she needs to save each year from now to age 65 to achieve her wealth target.

It reveals that Sue needs to save 27.3% of her after-tax income each year, an amount she believes is easily achievable.

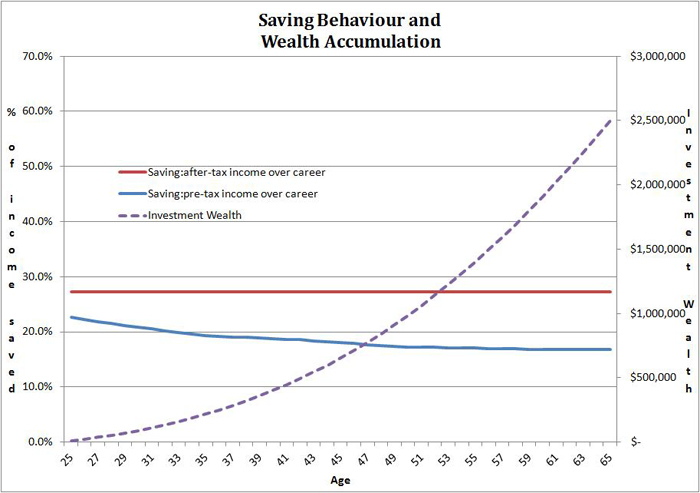

Anne, however, is enjoying life too much now. She knows she needs to save to eventually become financially independent but surely it can be put off for a while. And, certainly, for a five year deferral, she’s probably right, as revealed below:

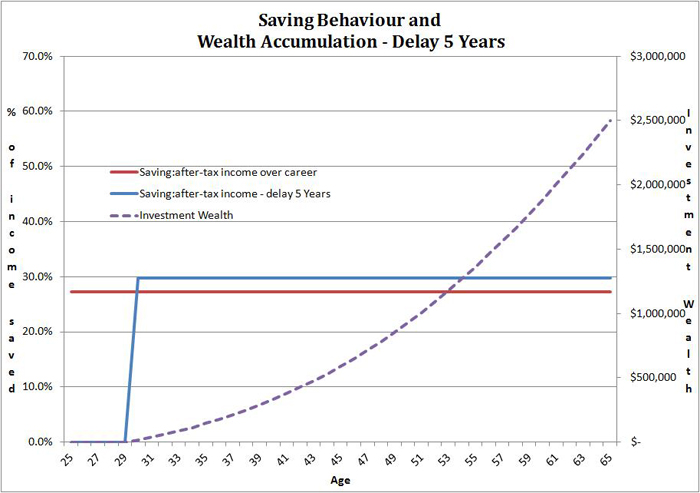

The saving requirement from her age 30 rises to 29.7% of after-tax income, not that much more than if she started at age 25. So Sue feels comfortable putting off saving a little longer. However, by her age 40 she is still spending all her income but is becoming a little more concerned about what she needs to do to reach her financial independence goal. The following chart shows that the saving requirement has now reached 39.6% of her after-tax income:

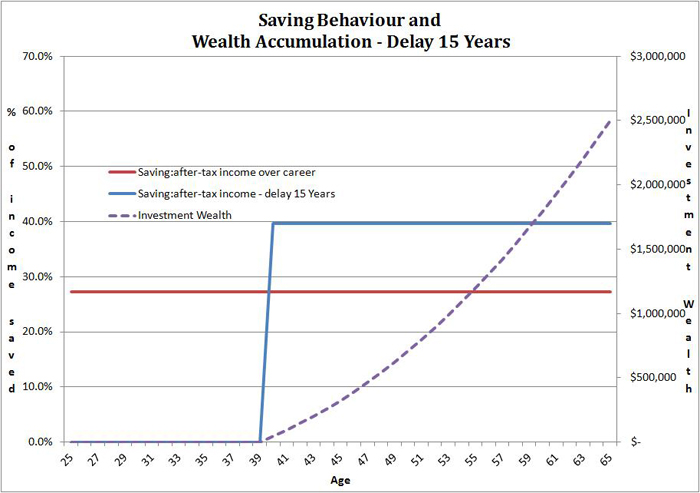

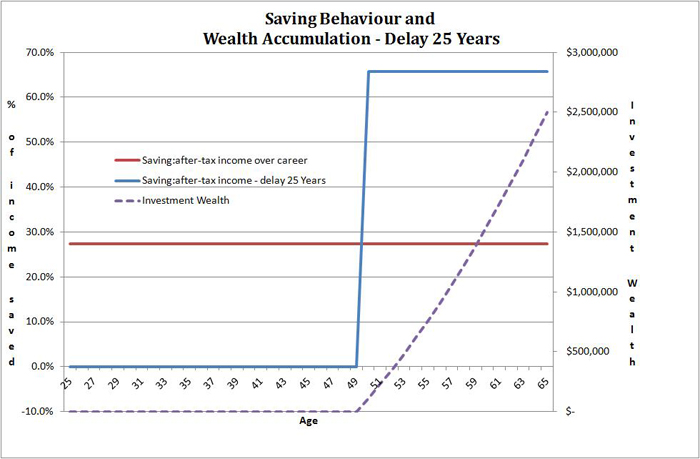

This is now getting serious and will take a fairly significant change in lifestyle to achieve. But, hey, spending demands will reduce beyond age 50 and there should be a lot more free cash around. But by age 50, there is still no saving and the saving task of 65.8% of after-tax income, as revealed below, is now so large that it is completely unrealistic.

Sue is simply not willing to change her lifestyle to the extent required. She must either be prepared to work longer or reduce her expectations of what a financially independent lifestyle looks like.

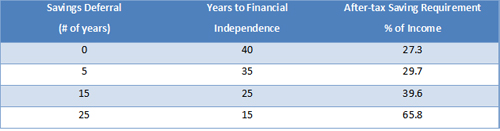

The table below summarises how the after-tax saving requirement increases with the length of savings deferral:

You can’t have your cake and eat it

The moral of the story is that there is an inevitability associated with the mathematics of finance. If you don’t begin saving enough early in a career, the task to reach a wealth target consistent with financial independence becomes increasingly more difficult, if not impossible.

Financial independence is unlikely to be achieved by accident. A decision to defer saving and spend more now is a decision to spend less and, perhaps, lead a significantly reduced lifestyle, in the future. It may not be what you really want!

[1.] In the following analysis, we assume a rate of return on savings to age 65 of 3% p.a., after-tax and after-inflation.