Interest rates are historically low …

With bank term deposit and other short term interest rates at historically low levels, many of those who rely on fixed interest to fund their lifestyles (retirees, in particular) feel under increasing pressure to examine higher yield alternatives. These usually come with significant additional, and often underappreciated, risk.

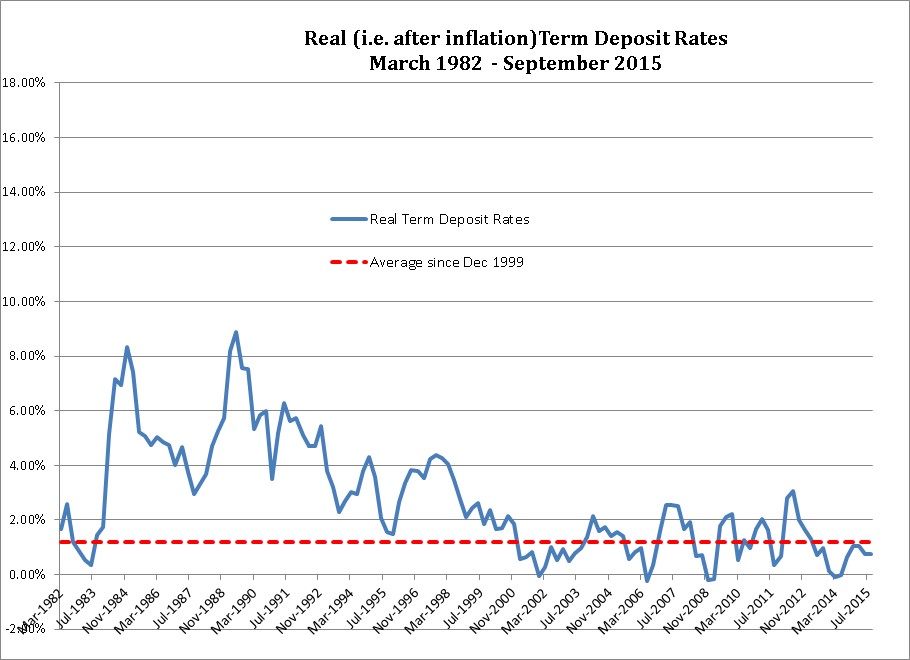

In a previous article, “Are you suffering from money illusion?”, published in October 2013, we warned against making investment decisions based purely on actual or nominal interest rates. We argued that it is critical to also consider both inflation and tax. Despite further falls in nominal interest rates since October 2013, after-inflation short term interest rates remain positive and are not significantly different from average levels experienced over the past 15 years.

The charts below update a couple of those provided in the previous article, to September 2015. The first shows historical 6 month term deposit rates, from March 1982, together with the average 6 month rate since 1999 (about 4% p.a.).

The above 5% p.a. rates experienced in 2007-08 and, briefly, in 2011 now look very attractive to retirees compared with the current historical low of 2.25% p.a.

The second chart below adjusts the actual interest rates for inflation, to reveal what we consider is a better starting point for making investment decisions. Tax also should be taken into account (and was in our previous article) but for simplicity we assume a zero tax environment in this article.

The chart shows that real term deposit rates have oscillated around an average of about 1.20% p.a. since 1999 and that the September 2015 level is only a little below that average. Why then are so many retirees now forsaking short term fixed interest investments for higher yielding, higher risk alternatives such as hybrid securities and high dividend paying shares?

We believe it is often because they are inappropriately fixated on meeting living expenses from investment income rather than from total returns after inflation and tax. The folly of this behavior is discussed more generally in “Should cash distributions drive investment decisions?”. In the rest of this article, we discuss how this mindset combined with “money illusion” may drive dubious decisions.

… but do current interest rates justify a change in investor behavior?

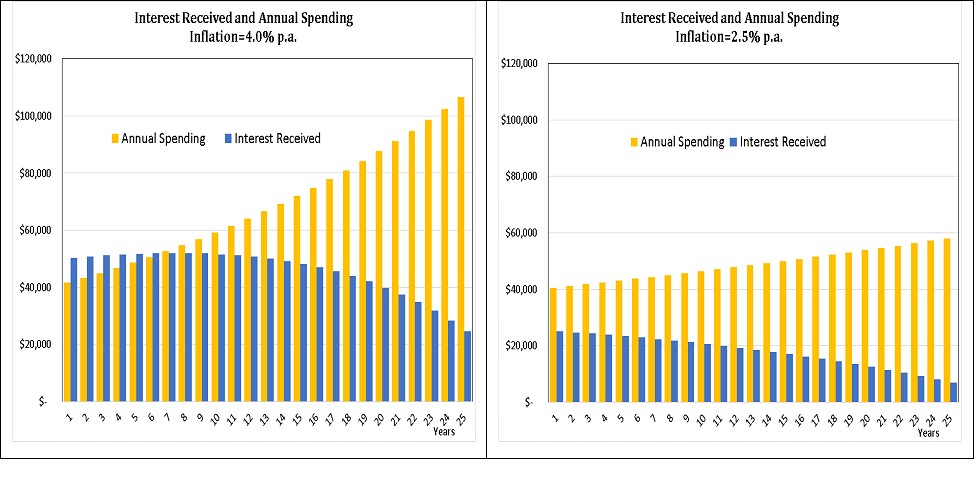

For our analysis, we consider a retiree that wishes to support a $40,000 p.a. lifestyle that grows with inflation for at least 25 years by investing an amount of $1 million in term deposits. The assumed after-inflation (real) interest rate for the 25 year period is 1.0% p.a. Two inflation environments of 4% p.a. and 1.5% p.a. are examined, implying alternative term deposit rates of 5% p.a. and 2.5% p.a. (i.e. real rate plus inflation).

The chart below compares actual annual spending and interest received on the (rolling) term deposit for the two inflation scenarios.

In the 4% p.a. inflation environment (i.e. 5% p.a. term deposit rate), interest received exceeds spending for the first six years. An income focused retiree would be comfortable with this position, as it is not necessary (at least for the first six years) to draw on capital to support spending.

However, in the 1.5% inflation environment (i.e. 2.5% p.a. term deposit rate), interest received is always less than spending, requiring regular reductions of capital. An income focused retiree would want to avoid this situation and may consider a more risky investment option.

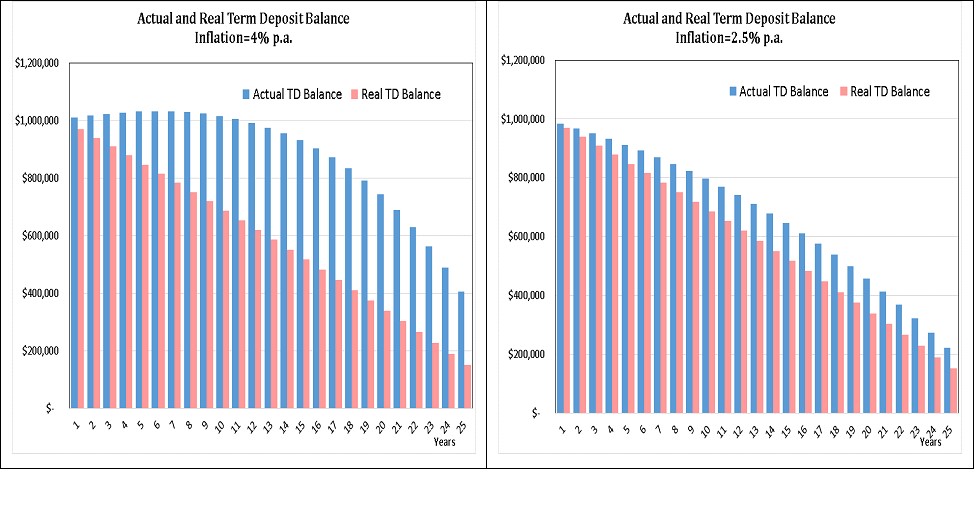

But an emphasis on actual or nominal amounts masks the reality that inflation is silently eroding the value of the invested capital, by 4% p.a. in the higher inflation environment and 1.5% p.a. in the lower inflation environment. The charts below show the actual and real (after-inflation) values of the term deposit balance for each inflation environment, assuming any surplus interest over spending is reinvested and any deficit requires drawing down on capital.

The charts reveal that while the actual (or nominal) balance of the term deposit varies, the movement in the real balances is the same regardless of inflation. It highlights the reality that higher inflation erodes capital just as surely as drawing down capital to fund a shortfall between interest received and spending.

For a given real interest rate, our retiree should not care what the actual term deposit rate is. With a high interest rate, capital will be eroded by high inflation. With a low interest rate, capital is eroded by low inflation and the need to meet the shortfall between interest received and spending.

But in terms of the real balance of the term deposit, there is no difference between the two alternatives. Therefore, it’s not logical to seek a higher risk option simply because inflation is lower!

The real short term interest rate environment hasn’t changed much so …

A single minded focus on investment income to meet living expenses can lead to poor investment decisions. In concert with “money illusion” (and, potentially, lack of tax awareness), the current environment may suggest rejection of low risk investments in favour of alternatives that aren’t fit for purpose.

But based on actual short term rates and inflation, we don’t see that the current real interest rate environment is significantly different to that which has prevailed over the past 15 years. Given this, perhaps a change in thinking rather than a change in investment behaviour is called for.