Investing in government bonds is attracting a lot of attention

Herding or “running with the pack” is one of a number of well documented psychological biases that inhibit our ability to make rational investment decisions that are not in our objective long term interest. And so are “hindsight bias”, “prediction addiction” and “overconfidence”.

We may currently be seeing them all interact on a global scale in the fixed interest or bond markets. An article in “The New York Times” of 21 August 2010 reported that a “staggering” $33.12 billion had been withdrawn from domestic equity funds in the first seven months of 2010, with many investors now “choosing investments they deem safer, like bonds”.

“The Economist” of 19 August, 2010 observed that falling US bond yields had delivered “bumper returns to investors” and inflows of $191 billion to bond funds. The same article also noted that “Some go so far as to call the market a bond bubble”.

And, in Australia, similar themes were echoed in “Bonds deliver dazzling rewards”, highlighting the recent attractive returns of fixed interest funds and suggesting that:

“those who learnt the lesson of the financial crisis and added more defensive assets to their portfolios saw the bond index rise by 3.6 per cent in the [June 2010] quarter.”

So, it appears that the smart money has moved and is moving into bonds. The “herd” has learned from the recent past and is now pouring into “safe” investments. And, as usual, there is no shortage of “experts” to put the case that either bond prices can rise further (i.e. yields fall) or that there is a “bond bubble” just waiting to burst.

Bond returns have been outstanding

There is no doubt. Bond funds have spectacularly outperformed shares over the past three years, as shown in the chart below which compares well recognised bond indices with Australian and international share benchmarks.

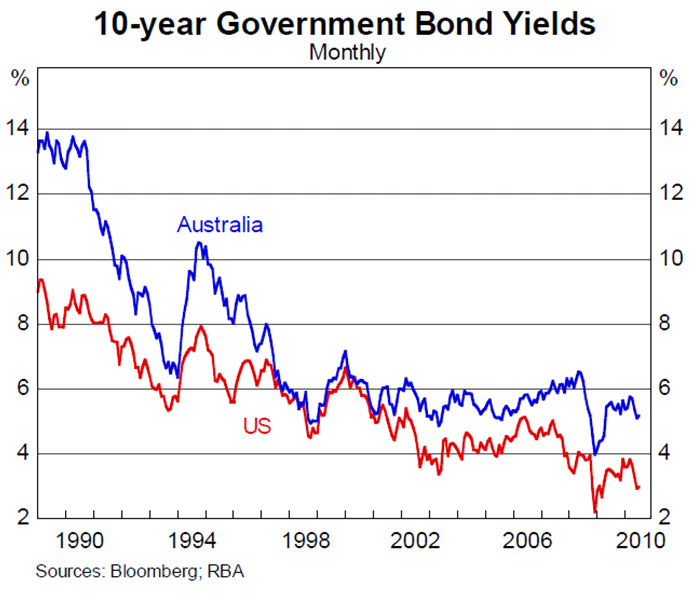

And, as shown below for US and Australian 10 year bond yields, this performance was driven by the fall in long term bond yields to their lowest levels in 20 years (excluding the bottom of the global financial crisis).

It is worth noting that the recent falls in government bond yields and stellar performance of bond funds occurred at a time when government borrowings have increased significantly. As government deficits have risen in response to the global financial crisis, the supply of bonds has increased dramatically.

Many “experts” confidently predicted that this situation would lead to higher interest rates (and falls in bond prices), with government borrowing crowding out private sector borrowing. To date, these experts have been way off the mark. But recent forecasting failures have not cured them of their “prediction addiction”. Rather than consider that, perhaps, they know less than they thought they did, they now warn of the lemming-like behaviour of bond investors and a “bond bubble”.

Should you be investing in government bonds?

So, is it too late to hop on the bond bandwagon? Have bond markets gone too far or will fears of worsening recession and deflation drive yields even lower? What should an investor do?

In summary, we don’t know what bond yields are going to do next. We take the view that bond markets very efficiently reflect the market’s “best guess” of appropriate values and that the shape of the bond yield curve embodies the market’s “best guess” of future bond yields.

Only with the benefit of hindsight will we be able to confidently say that the current bond market was a “bubble”, driven by the irrational herd instincts and flight to safety of investors, or an appropriate reflection of their correct expectation that economic conditions could continue to worsen.

We don’t think it makes sense for smart long term investors to try to outguess the market. Rather, they should understand that the primary purpose of holding defensive assets, like government bonds and managed bond funds, is to reduce overall portfolio volatility rather than to enhance returns. We think you should hold government bonds and other high credit quality fixed interest investments for the stability and financial security they offer, rather than because you’re “aiming to shoot the lights out”.

So, the important decision is not so much whether bond yields will go up or down, but what percentage of your investment portfolio should be held in defensive assets i.e. the asset allocation decision. The decision should be made after consideration of:

- Your attitude to risk;

- Your need for risk; and

- Your capacity for risk.

Once the decision is made and implemented, should you find that you become overweight in defensive assets due to favourable movements in government bond yields and/or falls in growth asset values, it may be appropriate to reduce your defensive holding. But this would reflect disciplined rebalancing of your portfolio, rather than a view that there was a bond market “bubble”.