Portfolio construction: an art as much as a science.

Portfolio construction: an art as much as a science.

When designing investment portfolios for our clients we focus on the level of risk that’s suitable for their circumstances and tolerance levels. Unfortunately, there’s no scientific formula that spits out the ideal level of risk an investor should take. But through meaningful discussions and the use of tools such as risk tolerance assessments, portfolio analytics and Monte Carlo simulation techniques we can narrow the choice to allow an intelligent decision to be made.

We can’t overstate the importance of investing the time and effort into determining your investment risk policy. Because once determined it becomes the driver of future portfolio management decisions.

It’s important not to be inflexible when it comes to amending the policy, but we never amend it as a result of market movements. Amendments are only made when there are changes in the underlying drivers of the policy i.e. your circumstances and tolerance levels.

So, given this, how do we incorporate the movement of markets into the portfolio management process?

Rebalancing is a widely accepted investment discipline

Rebalancing a portfolio on a regular basis helps to bring it back into line with your desired (risk) targets. If, for example, Australian shares have outperformed International shares, their proportions within the portfolio will have shifted from the target proportions. Rebalancing aims to restore the portfolio to the desired target proportions by, in this case, selling some Australian shares and buying some International shares.

Our portfolios are built based on selected exposure to investment asset classes. The investments we recommend for our clients are chosen because of their disciplined delivery of exposure to each asset class. If an asset class underperforms, we don’t sack the investment manager that we’ve appointed to provide the exposure to that asset class. In most cases, the underperformance is an asset class issue, not a manager issue.

It’s highly improbable for an asset class to underperform indefinitely, unlike an individual investment that can go to $0. Accordingly, we’re much more comfortable buying an underperforming asset class than we would be buying an underperforming individual investment.

The ultimate aim of investing is to accumulate (and retain) as many units of exposure to an asset class as possible for its targeted allocation. Accumulation of asset class exposure is therefore best done when its price is (relatively) low i.e. after underperformance. The rebalancing process assists with achieving this aim.

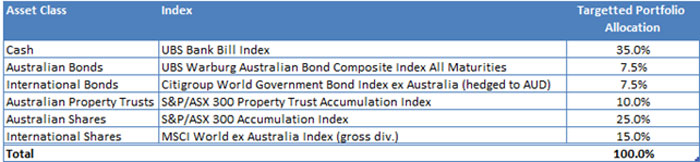

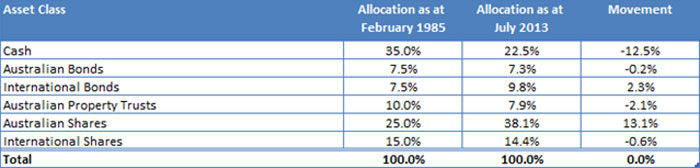

To illustrate the potential benefits of rebalancing, we constructed a portfolio using the following allocations:

We then tracked the changes of the portfolio from the earliest data we had (February 1985) to today (July 2013). The table below shows how the portfolio allocations would have changed due solely to the effect of market movements.

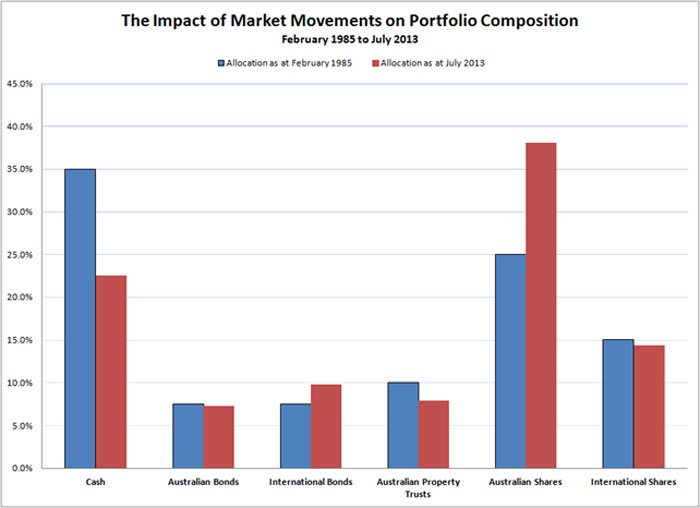

This comparison between the starting and ending allocations is shown graphically in the chart below.

Without any form of rebalancing, the portfolio shifted significantly from the original target allocations set in 1985. By July 2013 you would be holding a very different risk exposure to the one you originally selected.

A better way to manage the portfolio’s investment risk policy over time is to rebalance the portfolio to the original targets on a regular basis.

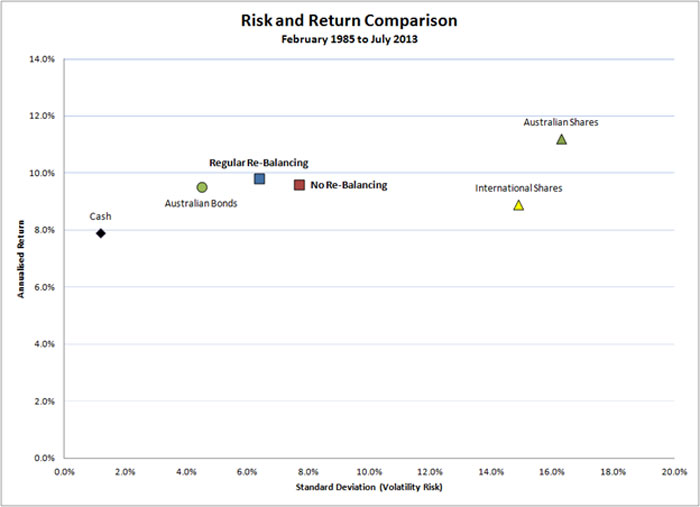

The difference between a regularly rebalanced portfolio and a portfolio that is not rebalanced is reflected in the charts below. (Note: this is based on historical data over the noted period). The rebalanced portfolio is re-weighted to the target allocations on a quarterly basis. The other portfolio is not rebalanced at all. When viewed from the perspective of a risk and return map, the portfolios plot as shown below:

The portfolio that was rebalanced regularly showed a lower risk (as measured by standard deviation) and a higher return – the equivalent of nirvana in investment land.

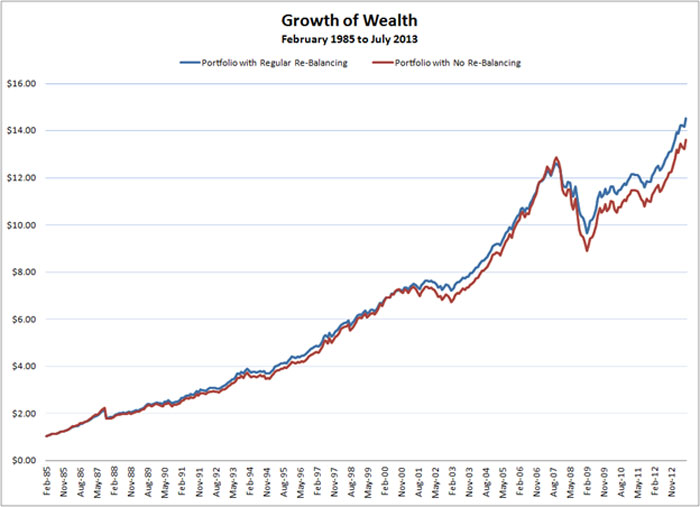

The chart below shows the growth of $1.00 invested in each portfolio since 1985. You would have ended up with 7% more capital (and less volatility) with the regularly rebalanced portfolio:

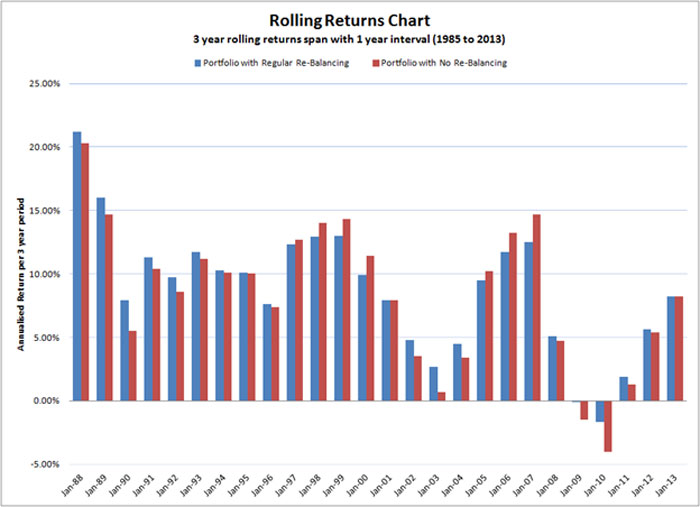

In fact, over the 26 (rolling) three year periods since 1985, the non-rebalanced portfolio only out performed on 7 occasions (as revealed below):

The benefits of rebalancing – small changes add up over time

Rebalancing is a relative risk tool. It focuses purely on the relative movement between asset classes and is not affected by the absolute movements. By itself, it will not save you from a financial crisis – the mechanism to address that issue is your investment risk policy. But it will help to curtail the damage and place you in a better relative (risk adjusted) position than if you had not rebalanced.

While it’s a fairly mechanical process, there are additional issues that need to be considered such as transaction costs and cashflow. But, inherently, it’s a contrarian approach that requires you to increase exposure to the poorest performer and decrease exposure to the best performer. This is, for most, an emotionally difficult thing to do. Yet, the disciplined nature of the process is one of its key advantages, as it helps to negate the emotional influence on investment decision making.

The majority of investors do not rebalance their portfolios, despite the evidence of its benefits. The toughest part of the rebalancing process is being prepared to commit to an investment risk policy. Most investors seem to prefer flexibility (over commitment), which invariably works against them in the long run.