Risk perception and tolerance are often not aligned

People’s perception and understanding of investment risk sometimes vary wildly from their attitude to (or tolerance for) investment risk. As a result, they often make investment decisions that cause them considerable emotional, as well as financial, grief when things don’t go as expected.

People’s perception and understanding of investment risk sometimes vary wildly from their attitude to (or tolerance for) investment risk. As a result, they often make investment decisions that cause them considerable emotional, as well as financial, grief when things don’t go as expected.

For example, in the period leading up to the Global Financial Crisis many innately conservative investors borrowed to invest in the share market in the belief that the risk was relatively low and that, despite the possibility, market declines were usually short lived.

The precipitous falls that actually occurred caused obvious and considerable financial stress (e.g. investors with the Storm Financial group). But they also revealed that many investors, irrespective of the financial consequences, were not emotionally capable of dealing with the downside of the risk they had taken on.

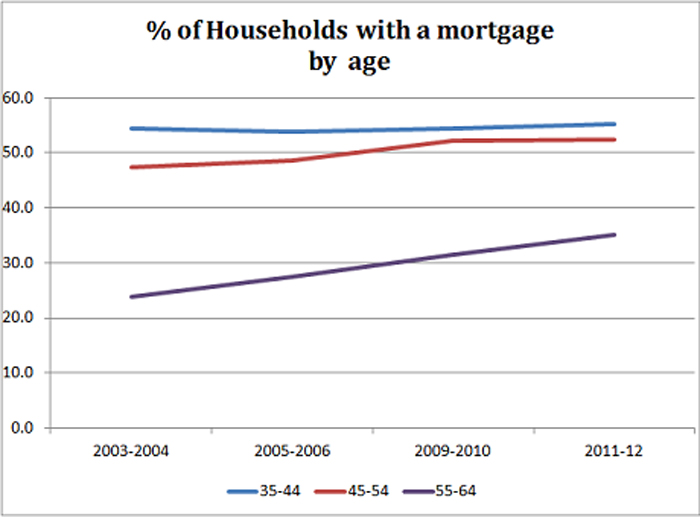

We are concerned there is a similar divergence between perception of and attitude to investment risk being exhibited by many of those baby boomers that are currently borrowing to invest in residential property. Despite being at a stage of life where we believe most should be eliminating debt, official data [1.] show that increasing numbers of 55-64 year old Australians are holding a mortgage, as revealed in the chart below:

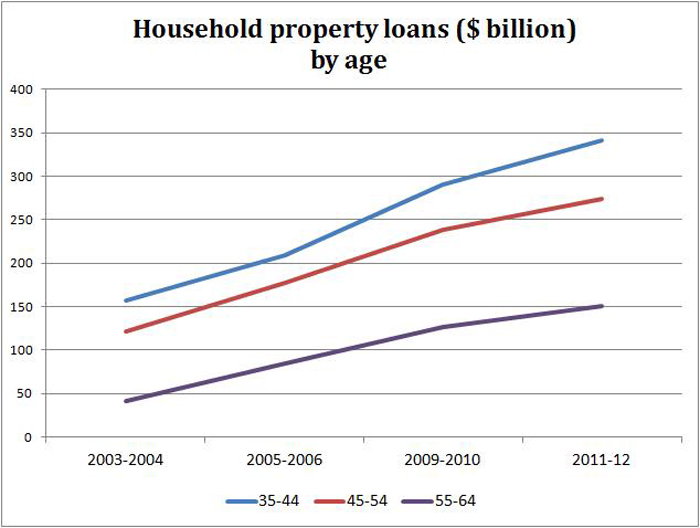

The following chart suggests that these 55-64 year olds have been significantly increasing their property related loans, both for owner occupied and investment property.

We suspect that when the comparable data to the above is released for 2013-14 it will show further increases in the property loan holdings of age “55-64 ” households and the percentage with a mortgage, given the large increase in loans for residential investment property recorded over the past 12 months.

So, 55-64 year old baby boomers are borrowing more to increase their already high exposure to direct property (60.6% of net worth in 2011-12). This reflects either a high appetite for investment risk and/or a poor understanding of the risks associated with property investment. Almost certainly, it is the latter.

A sound investment strategy takes account of downside risk

Direct residential property, like direct shares and managed share and property funds, is a growth asset i.e. it offers potentially higher returns than defensive assets but with higher risk of capital loss. While baby boomers have largely seen property values trend up, both domestic and international experience suggests that prices can fall quickly and savagely.

When determining what percentage of your investment portfolio you are comfortable holding in growth assets (regardless of type) as you approach retirement, we believe it is critical that you understand your downside risk tolerance i.e. what losses you are prepared to weather, both from a financial and emotional viewpoint.

A well structured investment strategy should enable you to handle virtually any market conditions. In developing the strategy, it needs to be appreciated that a partly debt funded growth asset portfolio adds to the risk already inherent in the growth assets. While debt will increase your returns if growth asset prices rise, it will magnify losses should prices fall.

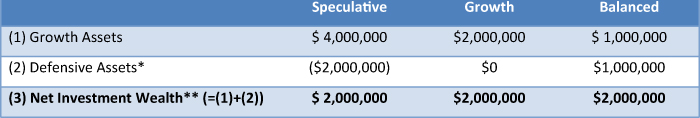

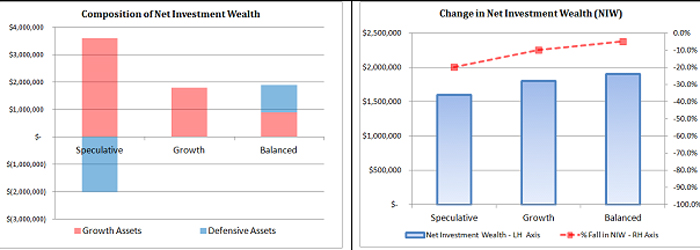

To illustrate the need to focus on downside risk, we examine the impact of market declines on three 60 year old baby boomers, each with net investment wealth of $2 million. However, their portfolios are structured very differently, classified as “Speculative”, “Growth” and “Balanced”, as revealed in the table below:

* Borrowings are shown as negative defensive assets

** Net investment wealth is investment assets less all borrowings

The following shows the initial portfolio composition and net investment wealth in chart form:

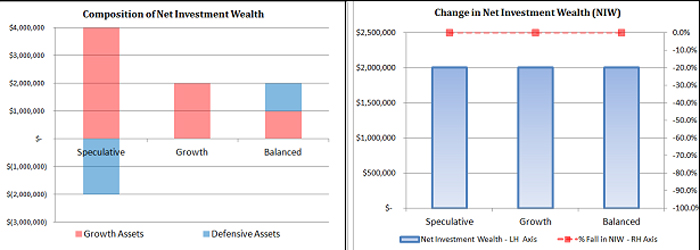

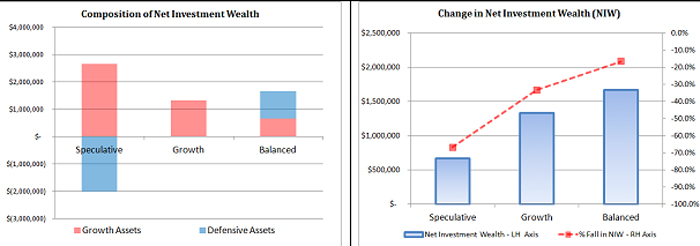

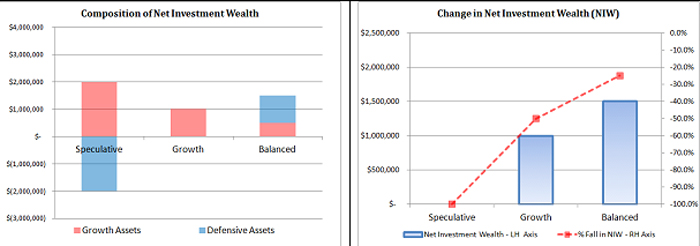

We next show how the portfolios and net investment wealth changes, based on 10%, 33% and 50% falls in growth asset values:

10% fall in growth asset values:

33% fall in growth asset values:

50% fall in growth asset values:

A 10% fall in growth assets results in a 20% decline in net investment wealth for the “Speculative” portfolio, but only a 5% fall for the “Balanced” portfolio. But far more alarming is the potentially catastrophic falls in net investment wealth experienced by the “Speculative” portfolio should growth assets decline by 33% or more.

Such falls in property prices are possible. If they occurred, they would massively dent the retirement savings of the many baby boomers who are borrowing to invest in residential property on the faulty premise that property always has and always will go up. We think that the massive, concentrated bets that are being taken are more akin to gambling than to prudent investment practice.

Test the alignment of your risk perception with your risk tolerance

Borrowing to purchase growth assets is always a high risk strategy. If the borrowing is undertaken at a time in life when future savings from earned income will be insufficient to repay the borrowing, the borrower is dependent on proceeds from the sale of the growth assets (or other assets) to repay at least part of the debt. Insufficient proceeds, due to price declines, may result in financial ruin in extreme cases (as for many Storm Financial clients in 2008).

If you’re a 55-64 year old baby boomer, we suggest you calculate how your net investment wealth would change if all growth assets (i.e. shares and property) fell by a third. Regardless of how confident you are that this would never happen, if its reality would seriously jeopardise your retirement plans and/or cause you significant emotional grief, our view is that you are holding too much investment risk. Your risk perception is not aligned with your risk tolerance.

[1] Latest available figures from Australian Bureau of Statistics. Sourced from 6554.0, “Household Wealth and Wealth Distribution, Australia, 2011-12” “Household Wealth and Wealth Distribution, Australia, 2009-10”, “Household Wealth and Wealth Distribution, Australia, 2005-06”and “Household Wealth and Wealth Distribution, Australia, 2003-04”