Lowest home loan rates in 50 years …

“Lowest home loan rates in 50 years” scream the headlines. Best time to borrow and buy property claim the real estate agents. With an increased home savings grant for first home buyers, it’s easy to believe that there will never be a better time for existing renters to stop paying “dead money” and buy their own home.

And many baby boomers, who created a lot of their wealth by jumping into the residential market in the 1970’s and early 1980’s, are probably now encouraging their children to take the plunge because it worked well for them.

But while home loan interest rates are “low”, the question that should be asked is “Are they “cheap”?”

Home loan interest rates are low but not cheap …

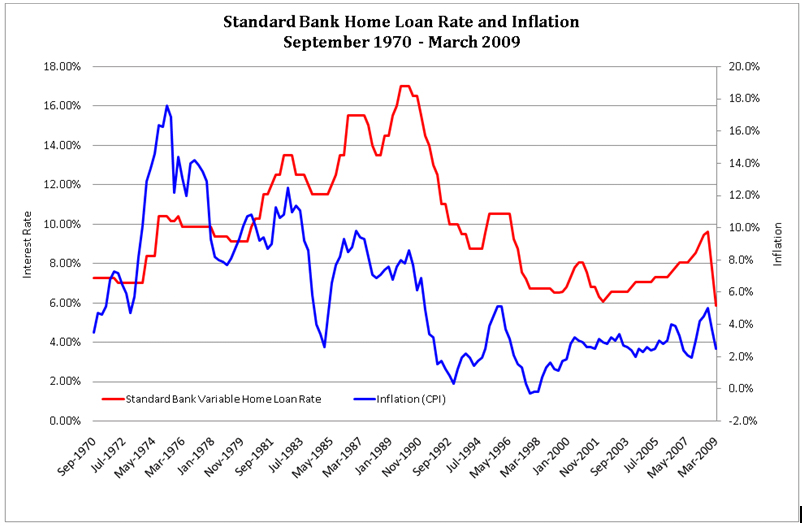

With regard to whether interest rates are historically low, the red line on the chart below of the standard bank variable home mortgage rate since 1970 certainly supports that claim. As at March 2009 the rate was lower than it had been at any time since September 1970.

But what borrowers should be concerned about is not the level of interest rates, but their relativity to the inflation rate. High inflation is good for borrowers because it erodes the real value of the amount owed. At an inflation rate of 6% p.a., the real (i.e. after inflation) value of an initial $100,000 borrowing reduces to $55,840 over 10 years, but to only $74,409 at an inflation rate of 3% p.a.

The blue line in the chart above shows that inflation was historically high during the 1970’s and early 1980’s and actually exceeded the home loan interest rate through much of the 1970’s. High inflation over long periods significantly reduced debt servicing pressures.

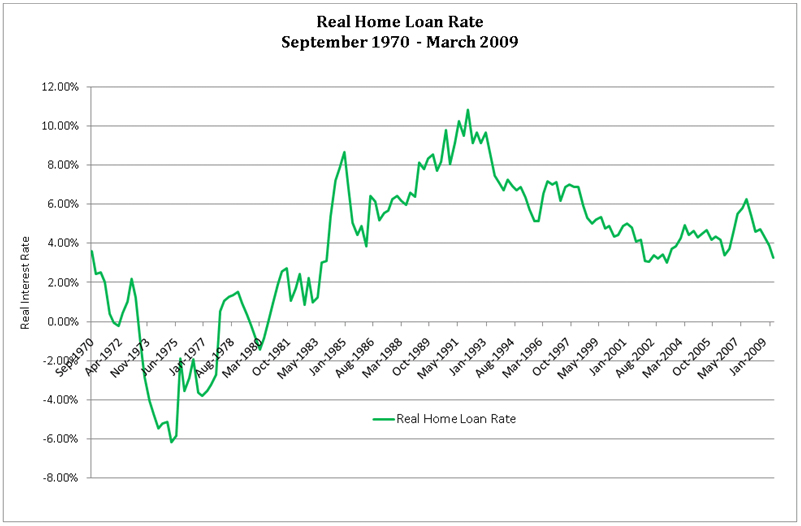

The real or after-inflation interest rate is a much better guide than the actual rate as to whether interest rates are “cheap”. The chart below provides a measure of the real interest rate by reducing the standard bank home loan interest rate shown above for inflation:

It reveals that while real home loan interest rates are now much lower than they were during the 1990’s, they are nowhere near as “cheap” as they were in the 1970’s and early 1980’s. And the difference in actual cost of a home loan now and when many baby boomers were buying their first homes is massive.

To illustrate this, the table below looks at annual and total payments, in today’s dollars, on a $100,000, 25 year principal and interest loan under three real interest rate scenarios i.e. 3% p.a. (representing now), 0% p.a. and minus 3% p.a. (representing the 1970’s):

Payments on a 25 Year P&I $100,000 loan

Real Interest Rate (% p.a.) | Annual Payments (Today’s $) | Total Loan Payments (Today’s $) |

3.0 | 5,743 | 143,570 |

0.0 | 4,000 | 100,000 |

-3.0 | 2,628 | 65,706 |

The servicing costs of a loan at 3.0% p.a. are more than twice those of a loan at minus 3.0 p.a.!

The message …

Home loan interest rates are not cheap, relative to inflation – they are about 1% p.a. below the average of the last 38 years, but much higher than the experience of the 1970’s and 1980’s.

Advice proffered by anybody who successfully entered the property market in the 1970’s and early 1980’s and is based on that experience should be ignored.

If you are going to borrow at today’s interest rates, don’t rely on a severe bout of inflation to help you manage your loan repayments. It is unlikely to happen. And even if it does, it is unlikely the Reserve Bank will allow real interest rates to go and remain negative for an extended period, as occurred in the 1970’s.

Make sure your loan to valuation ratio is not excessive and that you can continue to handle your repayments, even if real interest rates again rise to 6-7% p.a. for a number of years (as was the case through most of the 1990’s), from the current level of 2.5 – 3.0% p.a.

Half yearly updates of the charts in this article are provided in our “Resources” area.

2 Comments. Leave new

[…] major reason home purchase worked so well for baby boomers is that high inflation helped to ease mortgage pressure; […]

[…] interest rates were negative over Period 1, but substantially positive over Period 2. The implications for borrowers of these two vastly different real interest rate environments are not widely […]