Do you mean don’t put all your eggs in one basket?

The principle, “Diversification is key”, is similar to the old adage that urges you not to put all your “eggs in one basket”. But it goes further.

Formally, it encourages investors to:

“Invest in broad based asset portfolios of every asset class where risk is rewarded over the long term in a strong and reliable manner.”

The original underpinning research for the benefits of diversification was published in 1952 by Professor Harry Markowitz, in a paper called “Portfolio Selection”. In 1990, Professor Markowitz won The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel (i.e. Nobel Prize in Economics) “for … pioneering work in the theory of financial economics”.

The market doesn’t reward concentration risk...

At the time Markowitz wrote his groundbreaking paper, conventional wisdom was that successful sharemarket investing involved selecting a handful of rigorously researched shares in the hope of maximising returns. Markowitz showed that such an approach carried significant risk that could easily be avoided by broad diversification i.e. holding many shares and other asset classes. Concentration or diversifiable risk would be unrewarded or “uncompensated”.

The subsequent development of the efficient market theory (see “Markets work”) also implied that a concentrated portfolio was only likely to outperform the market through luck or increased undiversifiable risk – considerable underperformance was also a distinct possibility.

To understand the concept of uncompensated risk and the benefits of diversification, a very simple (and, admittedly, unrealistic) example is instructive. Assume you are considering buying a fictitious “oil” share. Its price has fluctuated dramatically with the price of oil but trended upwards over time. You expect it to continue to do so in the future. However, given the past and expected future volatility of the share, you expect a higher return from this share than from shares that have had shown more stability.

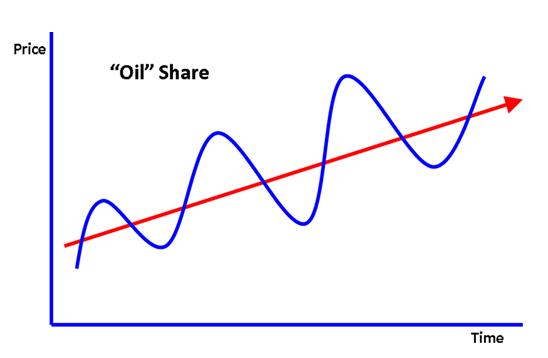

The chart below illustrates the actual and expected behaviour of the “oil” share:

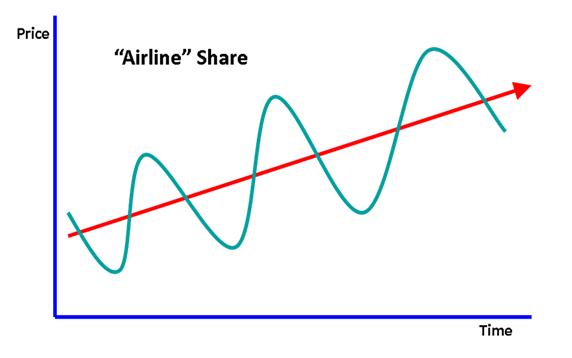

At the same time, as an alternative to buying the “oil” share, you are also considering buying a fictitious “airline” share. Its price has also fluctuated with the price of oil, but in exactly the opposite way to the “oil” share. Its long run return has been similar to that of the “oil” share and you expect the future returns of both shares to be similar. Again, because of the anticipated continued volatility of the “airline” share, you expect to earn more than you would from a less volatile share. The chart below illustrates the “airline” share:

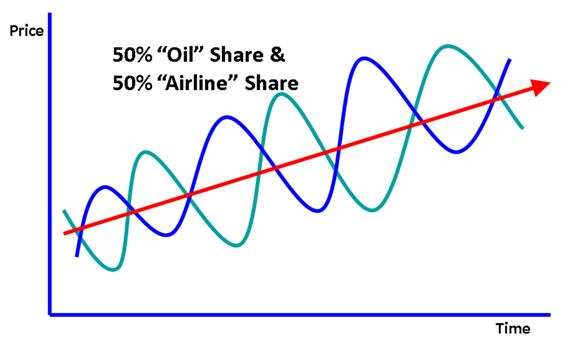

However, rather than buying one or the other shares, if you invested 50% of your funds in each share, the expected profile of your “portfolio” would change dramatically, as illustrated below:

The past and expected future price volatility of the individual shares would offset and be completely eliminated in the portfolio, yet past and expected future returns would be unchanged. By diversifying – spreading your holdings across the two shares, rather than holding one or the other – all price volatility is eliminated, without affecting return.

Markowitz’s insight relevant to our fictitious example is that you cannot expect the market to reward you for the concentrated or single share risk if you can eliminate it totally by diversifying i.e. holding both shares. The more general and important proposition is that concentration risk, or risk that can be diversified away, will not, on average, be rewarded – it is often called uncompensated risk and, in our view, is never worth taking.

What’s “correlation” and why should I care?

Now the example provided above is unrealistic. Volatility was totally eliminated because the prices of the two hypothetical shares moved in exactly the opposite direction to each other. They were perfectly inversely related and are said to have a correlation of -1 (see below). Such pure diversification does not exist either within an asset class (e.g. Australian shares) or across asset classes. However, effective diversification does not rely on such ideal circumstances.

Correlation is a measure of the relationship between two variables (i.e. things that change in value, such as the prices of shares). A correlation of -1 indicates that the two variables move exactly opposite to each other i.e. as one variable goes up, the other goes down by the same amount. At the other extreme, a correlation of +1 means that the two variables move exactly in tandem with each other i.e. as one variable goes up, the other also goes up by exactly the same amount. In between, a correlation of 0 indicates that there is no relationship between the two variables.

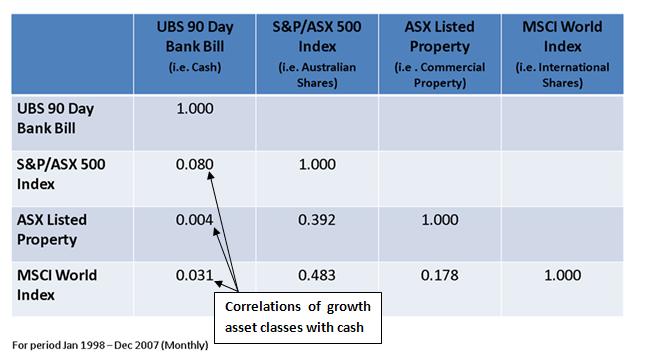

The table below shows the correlations between indexes (or benchmarks) of the major asset classes, over the period 1998-2007.

It shows that the relationship between the defensive asset class of cash and the growth asset classes of Australian shares, property and international shares is very close to zero i.e. no relationship. This implies that introducing cash to an all growth portfolio will significantly reduce overall portfolio volatility.

While the correlation coefficients indicate there are positive relationships between each of the growth asset classes, they are significantly less than one. Therefore, combining the individual growth asset classes in a growth portfolio provides the opportunity to reduce volatility compared to only investing in one growth asset class, without necessarily reducing expected return.

Markowitz showed that when adding an additional investment to an existing portfolio, the resultant volatility of the new portfolio would not be an average of the components’ volatility, but something less. How much less depends on the correlation between the components – the lower the correlation, the lower the resultant volatility and the greater the diversification benefit. This concept is discussed further below, with reference to the benefits of investing in international shares.

Invest in international shares to reduce risk...

Many people think that the argument for investing in international shares rests on a view that over the long term international shares will outperform Australian shares. But if global markets work like we believe they do (see “Markets work”), nobody even knows what tomorrow’s prices will be – share prices everywhere already reflect everything known about every share.

We believe the starting premise should be that “the market” considers that Australian and international shares will provide similar expected returns (after adjustment for risk). Otherwise, global capital would flow virtually instantaneously to the markets expected to do better and away from the ones expected to underperform.

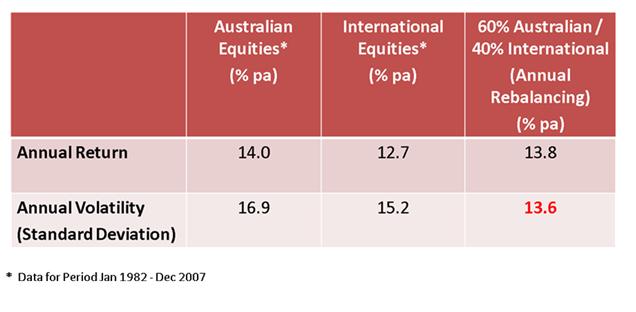

The argument for investing in international shares depends entirely on diversification, as the table below will be used to illustrate:

The table shows that had you invested 100% of your share allocation in a portfolio of Australian shares that reflected the Australian sharemarket index, you would have received a return of 14.0% p.a. for the period from 1982-2007. The annualised volatility of the portfolio, as measured by its standard deviation (a statistical concept that measures the extent of variation of returns about the average return), was 16.9% – lower is better.

Alternatively, had you invested 100% of your share allocation in a portfolio of shares that reflected the index of international shares, you would have received a return of 12.7% p.a., with a volatility of 15.2%.

The final column of the table shows the outcome if, instead of choosing either Australian or international shares, a diversified portfolio of 60% Australian shares and 40% international shares was selected and rebalanced annually. The resulting return of 13.8% p.a. is essentially a weighted average of the returns of Australian shares and international shares.

However, the volatility of the diversified portfolio is not a weighted average, but significantly less than an all Australian share portfolio (20% reduction in volatility) or an all international share portfolio (11% reduction in volatility). The volatility reduction reflects the fact that over the period Australian share returns and international share returns were not perfectly correlated with each other – i.e. they moved differently.

As discussed above, it is impossible to know what future returns on Australian and international shares will be – a “best guess” is that they will essentially be the same. But what can be said is that a diversified portfolio of Australian and international shares is highly likely to have lower volatility than an all Australian share portfolio or an all international share portfolio. A decision to hold a 100% Australian share portfolio and not to invest in international shares is more likely than not a decision to take on additional risk (as measured by volatility) with no expected return!

Diversification is the only free lunch in finance...

If you believe, as we do, that markets effectively price shares and other investments (i.e. “markets work”) then choosing to hold poorly diversified investment portfolios is a choice to take risk that has no expected return. It is a choice to forego what has been referred to as “the only free lunch in finance”. Yet anyone who thinks they can “beat the market” must take some amount of this unrewarded risk. We don’t think it is a smart decision.

The practical investment messages that come from the “diversification is key” principle include: