Asset allocation: a measure of your investment risk

Asset allocation: a measure of your investment risk

Our objective is to help clients become financially well organised and make smart financial choices so they have the best chance of enjoying the financial future they want. A key to achieving this objective is agreeing an appropriate investment risk exposure with each client and carefully managing that exposure over time. For us, this risk exposure is most appropriately measured by the client’s asset allocation.

This is the first in a series of four articles that explain our approach to asset allocation. Most people think they have a pretty good idea of what asset allocation is all about. Our experience suggests they don’t. While we start off pretty basically, we hope that by the final article you will agree that by viewing asset allocation in the lifelong context we advocate some conventional financial planning views are challenged and some smarter ways of thinking about personal finance issues emerge.

This article answers the questions “What is asset allocation?” and “Why is it important?”. The next three articles discuss, in turn:

- What is the right investment risk exposure for you i.e. your target asset allocation?;

- What is the appropriate way to measure your asset allocation? and

- How do you move from where you are now to your target asset allocation?

What is asset allocation?

At the highest level, your asset allocation is the division of your investment wealth between defensive assets and growth assets. Defensive assets are low risk, low expected return investments like cash and fixed interest. Growth assets are higher risk, higher expected return investments like domestic and international shares and property.

We view your asset allocation as the most fundamental measure of your investment risk exposure. The higher your allocation to defensive assets, the less variability there will be in the range of future wealth possibilities. But this lower variability comes at the expense of expected (but not guaranteed) lower investment returns. A 70% defensive/30% growth investment portfolio is expected to have considerably less variability but lower returns than a 30% defensive/70% growth portfolio.

Return differences between defensive assets are primarily driven by exposure to credit and maturity or term risk i.e. the better the credit risk (i.e. ability to repay) and the shorter the term to maturity (i.e. when repayment is due) the lower the expected return. Our view is that the purpose of holding defensive assets is to reliably reduce the overall volatility of your investment portfolio, rather than deliver high returns. We don’t actively encourage clients to pursue extra returns by opting for higher credit risk or long maturities as the premiums have not, in the past, justified the often considerable additional risk.

If higher returns are required, the growth asset classes of shares and property offer higher expected returns for their higher risk. Research suggests that the returns of share portfolios will be driven by what happens to the overall share market, plus their tilts to what are called the size factor (i.e. small versus large shares) and the price factor (value versus growth shares). For a more complete explanation of how investment returns are linked to well documented risk factors, see “Risk and return are related”.

We have purposely excluded investment offerings such as commodity funds, private equity funds and hedge funds from the above discussion of growth asset classes. They are not generally considered part of our asset class universe for a combination of reasons that include:

- an inadequate or unclear source of expected return for risk taken;

- high fees and expenses, that are not reliably linked to expected returns.

Why is asset allocation important?

On the assumption that your investment portfolio is well structured (i.e. low cost, highly diversified both across and within selected asset classes, tax aware), your mix between defensive and growth assets will be the primary driver of both:

- Your expected investment returns; and, more importantly;

- The variability in your investment wealth at any time in the future.

Research has shown that attempts to enhance investment returns through share selection (i.e. stock picking) or switching between asset classes based on forecasts of expected returns (i.e. market timing) have not added value and, on average, cannot.

To examine the link between asset allocation and future wealth possibilities, let’s consider the following 70% defensive/30% growth (“Defensive Portfolio”) and 30% defensive/70% growth (“Growth Portfolio”) portfolios:

Defensive and Growth Portfolios

US Based Data (December 1969 – December 2010)

| Defensive Portfolio Allocation (%) | Growth Portfolio Allocation (%) | |

| US Treasury Notes | 35 | 15 |

| US Long Term Government Bonds | 35 | 15 |

| Total Defensive | 70 | 30 |

| S&P 500 (i.e. Large US Shares) | 20 | 47 |

| MSCI EAFE (i.e. Large International Shares) | 10 | 23 |

| Total Growth | 30 | 70 |

| After inflation return (% p.a.) | 3.8 | 4.9 |

| Volatility(% p.a.) | 6.6 | 10.9 |

Over the period from December 1969-December 2010, the Defensive Portfolio returned 3.8% p.a. after inflation, with volatility of 6.6% p.a. This means that in any year there was a 68% chance that the actual return could vary by ±6.6% from the average i.e. between -2.8% and 10.4%. The Growth Portfolio returned 4.9% p.a., with volatility of 10.9%, suggesting a 68% chance that returns could vary between -6.0% and 15.8%.

With the benefit of hindsight, the Growth Portfolio provided the highest return, but the higher volatility suggests considerably wider variation in annual returns than for the Defensive Portfolio. If we assume that in future the portfolios have the same expected (but not guaranteed) returns as the historical returns and the same volatilities, we can simulate potential growth of wealth paths for any period based on an initial investment.

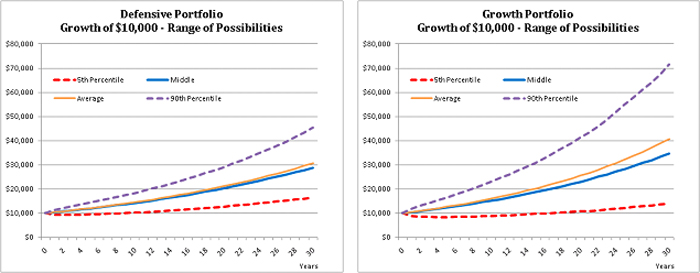

The charts below show the range of possible wealth accumulation for an initial $10,000 investment over a 30 year period for both the Defensive Portfolio and the Growth Portfolio, based on 10,000 simulations:

Features to note include:

- The range of possibilities for the Defensive Portfolio are considerably narrower than for the Growth Portfolio, reflecting the increased certainty that comes with lower volatility;

- The middle, average and 90th percentile for the Growth Portfolio are higher for than for the Defensive Portfolio, driven by the higher expected return; and

- For downside situations, represented by the 5th percentile, the Defensive Portfolio is less susceptible to the investment falling below its initial value and results in higher wealth after 30 years than for the Growth Portfolio.

Lower variability and downside protection come at the expense of foregoing potentially higher long term wealth.

But how do you choose the “right” asset allocation for you

Having briefly explained what asset allocation is and its importance, our next article will consider how to choose the right asset allocation for you. While the choice is a mixture of both art and science, we believe that the ability to adhere to a disciplined investment strategy is highly dependent on understanding the basis for the choice and then committing to it.

Our “Understanding Asset Allocation” series of articles is now available as a free eBook. Download here now.

1 Comment. Leave new

[…] our previous article, “Understanding asset allocation”, we focused on the questions “What is asset allocation?” and “Why is it important?”. In […]